[ad_1]

dulezidar

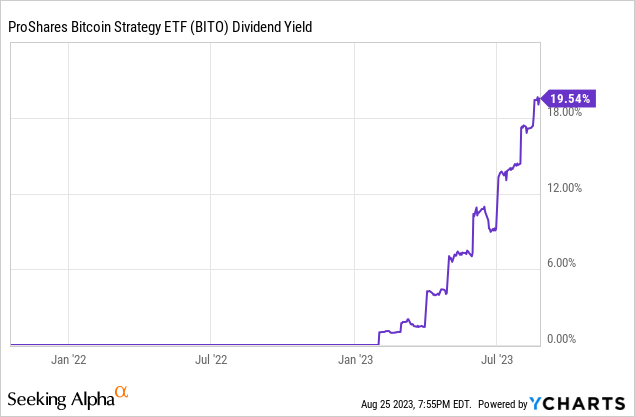

ProShares Bitcoin Technique ETF (NYSEARCA:BITO) is without doubt one of the first Bitcoin primarily based ETFs, and it was launched in late 2021. The fund would not immediately make investments into Bitcoin, however somewhat make investments into Bitcoin futures contracts and roll them each month. The fund’s purpose is to trace the worth of Bitcoin futures as carefully as potential. This yr, traders “awoke” to a shock. The fund all of the sudden began paying dividends. Not solely was it paying dividends, however it was yielding nicely into double digits. This made individuals surprise the place these dividends are coming from and if they will deal with this fund as an revenue play. I will attempt to clarify what is going on on on this article.

The fund trades Bitcoin future contracts, which is a bit completely different than holding Bitcoin outright. Why? As a result of you should purchase and maintain Bitcoin eternally in the event you select, and also you may by no means should roll your place until you wish to add to your place or scale back your place. If you happen to purchased a place of 1 Bitcoin, that 1 Bitcoin is mainly yours to carry eternally. Futures contracts do not work like that as a result of they’ve expirations. It’s a must to purchase a contract that comes with an expiration date and when that date arrives you must settle this contract. Bear in mind, futures usually are not like choices the place you may select to train them or not. Shopping for a futures contract really provides you an obligation to settle your place both with money or by taking ship of products (on this case Bitcoin).

When the expiration time comes, BITO rolls its futures contracts to a later date, and the fund intends on doing this eternally. This creates a “drawback” for the fund, although, and that is the place the wealthy dividends come from. Generally when Bitcoin value is rising, rolling these futures contracts end in reserving a revenue for the fund. Based on Funding Firm Act of 1940, all mutual funds and ETFs that ebook a revenue in a given yr should both distribute all these earnings to traders (in dividends) inside that yr or face steep taxes. So this is the reason BITO all of the sudden began to pay these dividends and the fund’s yield jumped from 0% to twenty% in a matter of months.

As a matter of reality, the fund’s newest month-to-month distribution got here at $0.3849 which provides us an annualized yield of 35%.

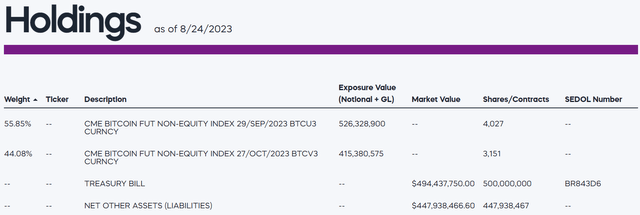

I’ve really seen some feedback on message boards claiming that BITO sells lined calls on Bitcoin, however this isn’t true. The fund would not do such factor. Once you have a look at the fund’s present holdings, all you see are two units of futures contracts expiring in September and October (plus some treasury payments it holds as collateral). As a matter of reality, as of writing of this text (8/25) there aren’t any Bitcoin primarily based lined name funds within the US. There are a couple of in Canada, however most American brokerages haven’t got them. I think we’ll see some in a couple of years, however we merely haven’t any proper now. Technically, one cannot promote lined calls on Bitcoin itself, however one can promote lined calls on Bitcoin futures.

BITO holdings (ProShares)

Now you may assume that the fund has a wealthy dividend yield, so this should be a fantastic revenue play, however that is in all probability not true. First, the fund can solely ebook a revenue so long as the worth of Bitcoin is rising. In any other case, the fund has no approach of reserving a revenue. Once you purchase this fund for dividends, you might be mainly making an assumption that the worth will rise eternally, and in actuality it could or could not rise. The sustainability of the dividend funds can be in query eternally as they are going to rely on value appreciation of Bitcoin. At that time, you may as nicely purchase a big Bitcoin place and begin promoting small chunks of it for revenue.

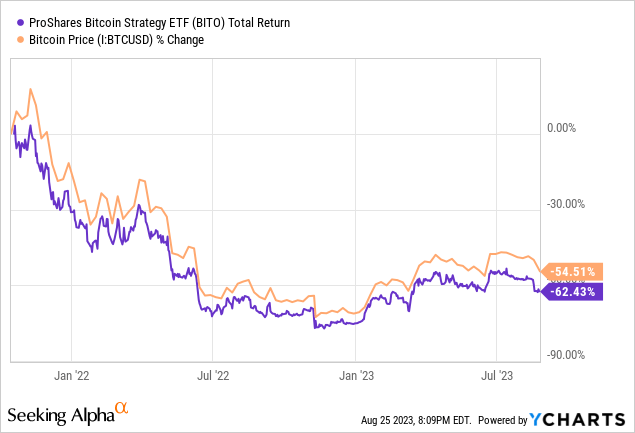

The second drawback is that this fund can be in fixed decay as a consequence of having to roll these futures contracts. These of you who’re aware of buying and selling choices and futures contracts know that rolling a contract from one month to the subsequent has prices due to time decay and implied volatility. Some funds even earn a living from this phenomenon by shorting sure futures contracts (for instance, SVOL shorts VIX futures each month) and benefit from this. For this reason this fund will virtually actually underperform the efficiency of Bitcoin. Since its inception, the fund’s whole return is down -62.4% as in comparison with Bitcoin, which is down -54.5% throughout the identical interval. That is another excuse BITO won’t be a sustainable dividend play.

This fund is extra appropriate for brief time period buying and selling. For instance, if anticipate Bitcoin to leap within the subsequent month or two, you should purchase a place and promote it after it reaches your value goal. Holding this fund in the long run may end in underperformance. In case your purpose is to purchase and maintain Bitcoin in the long term, you may as nicely simply purchase and maintain Bitcoin as a substitute of paying for time decay plus an ETF payment for BITO.

One of many greatest points with Bitcoin is that it is inconceivable to calculate a good valuation for it. The asset has no revenue, no money circulation, no dividends, and it is simply one thing that trades primarily based on what individuals assume it’s value which appears to alter wildly from daily, hour to hour and even minute to minute (to not point out 24/7). That is additionally true for valuable metals similar to gold, and I normally avoid issues that I am unable to worth correctly. Nonetheless, I purchased a small place in Bitcoin as a speculative place simply in case it rises considerably and this makes up lower than 1% of my whole portfolio worth, so I would not lose sleep over it even when it dropped to zero. I’m not saying traders ought to keep away from Bitcoin altogether, but when they have to put money into Bitcoin, it will be smart to both hold it as a small share of your portfolio or hedge your portfolio by some means.

[ad_2]

Source link