[ad_1]

Jabil’s Silicon Valley Manufacturing Facility.

Sundry Images

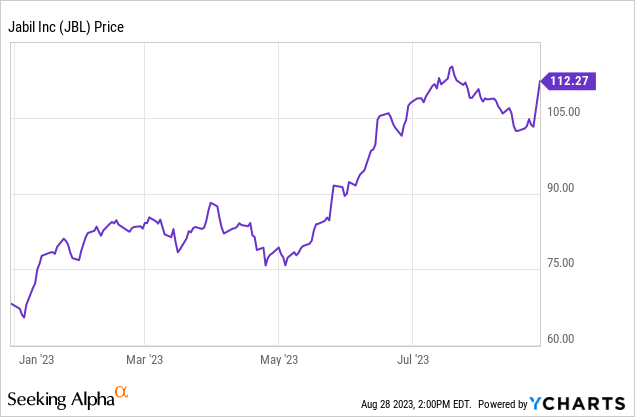

On Sunday, August 27, Jabil (NYSE:JBL) introduced it was promoting its Mobility enterprise in China to BYD Firm (OTCPK:BYDDY) (OTCPK:BYDDF) for $2.2 billion. The inventory responded very positively to the deal, and at pixel time is at the moment buying and selling +$9.05/share to $112.27 (+8.7%) at present. I am going to clarify why such a giant transfer is sensible, and why there may be doubtless extra to come back.

As my followers know, I’ve been banging the desk on Jabil as a result of the inventory has been considerably undervalued as in comparison with its free-cash-flow profile (see JBL: Deal with Your self And Purchase The ten% Dip). But at present, and even after the large transfer larger, Jabil nonetheless sells at a big low cost to the S&P 500:

TTM P/E Ahead P/E Jabil 15.9x 12.1x S&P 500 25.3x 19.9x Click on to enlarge

Market Cap

The large bounce within the inventory worth was as a result of the dimensions of the deal, $2.2 billion, equates ~16% of Jabil’s whole $13.5 billion market cap (and that’s after the large transfer up at present).

If we contemplate long-term debt ($2.87 billion) and money ($1.50 billion), Jabil’s complete enterprise worth is an estimated $14.87 billion. And even on that foundation, the deal nonetheless equates to ~15% of Jabil’s EV.

So, because the (comparatively new) CEO Kenny Wilson stated within the announcement:

This transformational deal would signify the biggest transaction within the historical past of our firm, and I’m thrilled to have the ability to work with a good firm like BYD to drive this enterprise efficiently ahead.

Share Buybacks / Valuation

Now, as I’ve been reporting on my protection of JBL, the corporate has been utilizing its robust free-cash-flow profile to emphasise share buybacks as a result of the corporate (and I) contemplate shares to be considerably undervalued.

My followers would possibly assume I’m being a hypocrite right here, contemplating I’ve been lambasting the large oil firms as a result of they considerably over-emphasizing buybacks as in comparison with dividends on to shareholders. However that is totally different. Vitality firms sometimes over-emphasize buybacks throughout commodity worth up-cycles (when their inventory costs are excessive) and droop them throughout down-cycles (when their shares truly signify good worth). Jabil has been producing growing FCF straight by the cycles. Certainly, as I’ve documented in my articles on In search of Alpha, JBL truly elevated its FCF on a yoy foundation throughout the pandemic.

For the quarter resulted in June (JBL’s Q3), the corporate repurchased 1.9 million shares for $154 million. That left $821 million remaining on its present repurchase authorization (as of Might 31).

So, even when JBL allocates solely half of the $2.2 billion towards inventory repurchases (the opposite half would doubtless go towards debt discount and cap-ex development/enlargement), that will nonetheless greater than double the prevailing inventory buyback authorization (i.e. to ~$1.9 billion).

And that’s precisely why the inventory is at the moment up 8.7% at present. Actually, I’d say the inventory has additional to climb as a result of an estimated $1.9 billion in inventory repurchases equates to ~12.8% of the present EV. And that does not even bear in mind any potential curiosity expense financial savings if the corporate retires, say, $500 million in debt (leaving $600 million for cap-ex enlargement).

Enterprise Affect

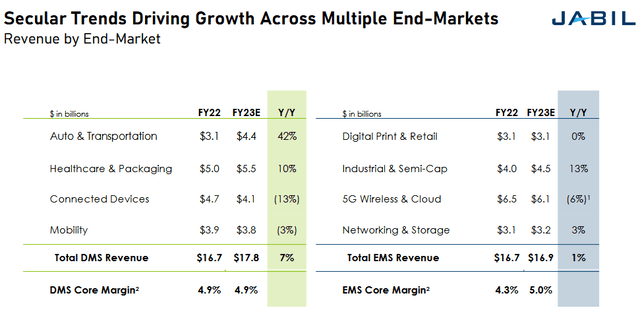

One of many large criticisms of Jabil is the low-margin its Mobility enterprise has achieved prior to now. The chart beneath exhibits Jabil’s working outcomes per section (slide taken from the Q3 presentation) for FY22 and estimated outcomes for FY23 (just one quarter left):

Jabil

As you may see, income for the Mobility section is predicted to say no 3% yoy. And, Apple (AAPL) is understood for being a really robust negotiator on suppliers like Jabil. Certainly, a part of the rationale that Jabil has been such an excellent funding over the previous few years is as a result of the corporate has been diversifying operations away from its over-dependence on Apple: new enterprise verticals like Autos (assume EVs) and Healthcare & Packaging have delivered robust income development and better margins for the corporate.

Word that EMS section core margins have been up 70 foundation factors yoy in Q3, whereas the DMS section core margin (house of the Mobility enterprise) stayed at 4.9%. That is even if the upper margin EV and Healthcare companies are additionally within the DMS section as properly.

Nonetheless, Mobility – in complete – is predicted to be $3.8 billion in income this yr, and it’s not clear to me precisely what proportion of that comes from “Mobility China”. However to illustrate, hypothetically, that it is 100% of it: that will equate to solely an estimated 11% of Jabil’s complete FY23 estimated income. That is actually a big chunk of the corporate. Nonetheless, what shareholders are prone to see for what’s left within the firm are: a big improve in general core margin and due to this fact an general larger free-cash-flow margin.

As well as, if the corporate buys again inventory wherever close to my estimate mentioned earlier, net-income and free-cash-flow per share are each going to rise considerably sooner than income development going ahead.

Meantime, one may argue that Jabil’s threat profile is considerably stronger now that traders do not have to fret concerning the CCP taking up Jabil’s Mobility manufacturing amenities in Chengdu and Wuxi, China – which, if this deal is finally consummated, will probably be bought to BYD.

Abstract & Conclusion

Contemplating new CEO Kenny Wilson has solely been in that position since Might of this yr, he actually wasted no time placing his stamp on the corporate by considerably growing shareholder worth. Will probably be attention-grabbing to see what the extra commentary across the deal will probably be – particularly, how JBL plans to allocate the $2.2 billion in proceeds. But as Wilson stated within the press launch:

If accomplished, the proceeds from this transaction will allow us to boost our shareholder-centric capital framework, together with incremental share buybacks. Moreover, it should present alternatives for additional funding in electrical automobiles, renewable power, healthcare, AI cloud information facilities, and different end-markets.

So, for my part, shareholders can anticipate one heck of a deliberate “incremental” share buyback program to be introduced comparatively quickly.

All in, JBL nonetheless appears considerably undervalued to me and, if the 2H of this yr proceeds as anticipated, the inventory may simply hit $125 by year-end (+11% from right here).

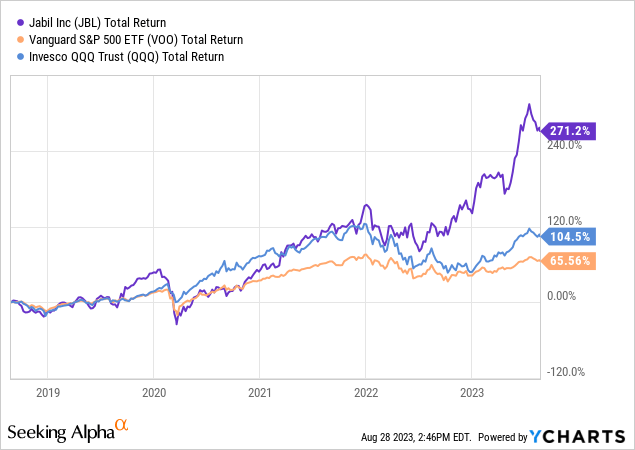

I am going to finish with a 5-year complete returns comparability of Jabil versus the Vanguard S&P 500 ETF (VOO) and the Invesco Nasdaq-100 Belief (QQQ):

As you may see, Jabil has robustly outperformed each of the broad market averages, and but nonetheless trades at a big low cost to each. The outcome: JBL is a BUY.

Editor’s Word: This text discusses a number of securities that don’t commerce on a serious U.S. trade. Please pay attention to the dangers related to these shares.

[ad_2]

Source link