[ad_1]

contrastaddict

August twenty eighth ended up being a very fascinating day for shareholders of each Kimco Realty (NYSE:KIM) and RPT Realty (NYSE:RPT). Shares of the latter shot up, closing up 17.4%, after information broke that the previous had agreed to accumulate the latter in a multibillion-dollar all-stock transaction. Though the sizes of the 2 firms are considerably completely different, the transaction ought to convey to Kimco Realty some worth, even when synergies predicted by the acquirer aren’t realized. For shareholders of RPT Realty, nonetheless, the deal just isn’t as clear a win as it’s for traders in Kimco Realty. Nonetheless, it does include a good thing about the numerous premium over the place shares of the enterprise have been buying and selling instantly earlier than the announcement. So if you add that into the image, I might argue that this transaction ought to be appeared upon favorably by each side of the deal.

A wonderful transaction, particularly for Kimco Realty

Based on the press launch issued by Kimco Realty, the corporate had agreed to accumulate all of RPT Realty in a transaction valuing the corporate at round $2 billion on an enterprise worth foundation. Primarily based alone calculations, the quantity is barely decrease than this at about $1.925 billion. However on the finish of the day, that is shut sufficient. The deal in query will contain shareholders of RPT Realty receiving 0.6049 of a share of Kimco Realty for every share of RPT Realty they at the moment personal. Utilizing closing market costs on August twenty fifth, which was the enterprise day instantly previous to the deal being introduced, this interprets to a value per share of $11.34 for RPT Realty, which works out to a premium of roughly 19%.

Kimco Realty

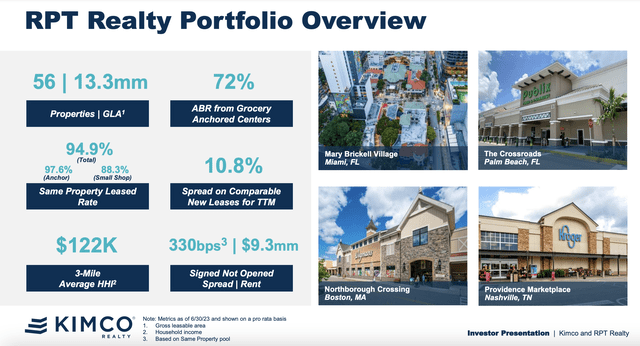

Even ignoring the monetary aspect of the image, this transaction does make loads of sense. Each firms have related property. The possession and leasing out of open air, grocery anchored purchasing facilities. Though there are different property within the combine as effectively, reminiscent of some mixed-use properties that Kimco Realty owns. After all, Kimco Realty is considerably bigger. As of the tip of its most up-to-date quarter, the corporate had pursuits in 528 purchasing heart properties all through the U.S. market. These have been unfold throughout 28 completely different states and amounted to 90.1 million sq. ft of grossly secure space. That is on prime of one other 21 different property pursuits that come out to roughly 5.5 million sq. ft. By comparability, RPT Realty has solely 56 properties in its portfolio that comprise 13.3 million sq. ft of area. This covers solely the multi-tenant properties that the corporate has. It additionally has one other 49 properties which might be internet leased below its RGMZ three way partnership. Nonetheless, the corporate owns solely 6.4% of that enterprise.

Kimco Realty

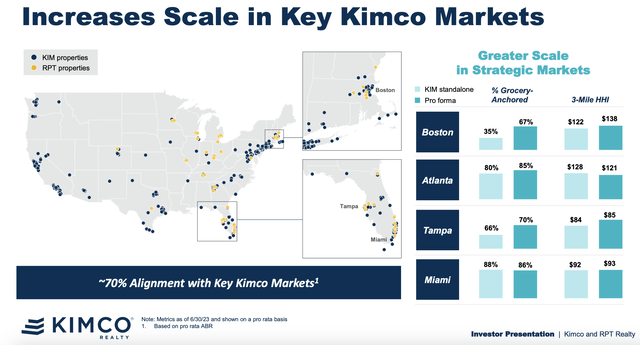

Regardless of the comparatively small measurement in comparison with what Kimco Realty boasts, the companies do have some significant geographic overlap. Noteworthy areas embrace Boston, Atlanta, Tampa, and Miami. In actual fact, the mixed firm will see its market share of grocery anchored property develop in three of those 4 markets because of this transaction. What’s extra, in three of the 4 areas, the publicity of the mixed enterprise to households with larger ranges of revenue will enhance. In Boston, as an illustration, inside 3 miles of a Kimco Realty location, residents have family revenue of about $122,000 per 12 months. That quantity ought to climb to $138,000 because of this transaction. In Tampa, we must always see a rise from $84,000 to $85,000, whereas in Miami we must always see the determine rise from $92,000 to $93,000.

Kimco Realty

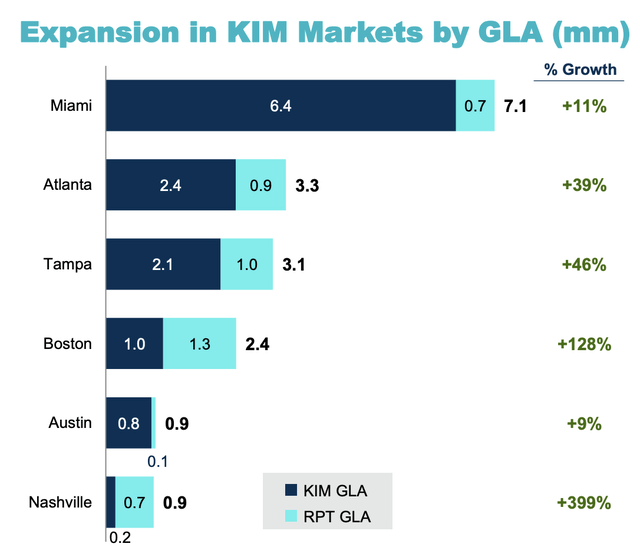

In Miami, gross leasable space for Kimco Realty is anticipated to rise from 6.4 million sq. ft to 7.1 million because of this buy. In Tampa, we must always see a rise from 2.1 million sq. ft to three.1 million sq. ft. The rise in Boston ought to be much more spectacular, taking the corporate from just one million sq. ft. And in Atlanta, the rise ought to be from 2.4 million sq. ft to three.3 million.

After all, these aren’t the one vital markets. Primarily based on the investor presentation launched by Kimco Realty, about 70% of properties at the moment owned by RPT Realty align with key strategic markets that Kimco Realty has recognized. This might be instrumental in serving to the corporate to develop and also will result in value chopping initiatives. Proper out of the gate, Kimco Realty is forecasting annualized value financial savings of about $34 million. However there are different advantages on the monetary aspect to this transaction. As an illustration, the corporate believes that there is over $9 million of signed however not open leases and that among the leases on its books are at charges which might be considerably beneath with the present market calls for. We do not know, nonetheless, the total impression this may have on the mixed firms prime or backside strains.

Writer – SEC EDGAR Information

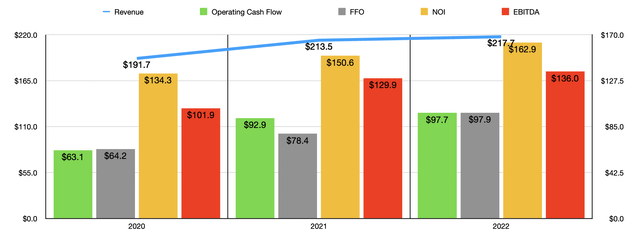

Given how some segments of the retail area have carried out lately, I can perceive why some traders is perhaps cautious of Kimco Realty choosing up unhealthy property. Nonetheless, this doesn’t appear to be the case. Over the three years ending in 2022, RPT Realty did they discover job rising the corporate, with income increasing from $191.7 million to $217.7 million. Working money movement over this window of time jumped from $63.1 million to $97.7 million. Different profitability metrics have seen an analogous enhance. FFO (funds from operations), NOI (internet working revenue), and EBITDA, have all risen properly over this window of time.

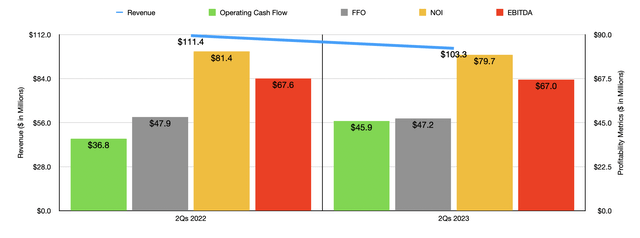

Writer – SEC EDGAR Information

This isn’t to say that every thing is incredible. There are some weaknesses within the present fiscal 12 months. Within the first half of 2023, RPT Realty reported income of $103.3 million. That represents A decline in comparison with the $111.4 million the corporate reported one 12 months earlier. This drop was largely attributable to a $12.5 million hit related to the corporate’s determination to dump sure properties to RGMZ and one other subsidiary known as R2G. Precise property economics nonetheless stay constructive, with the occupancy fee of its property rising from 91.5% within the first half of 2022 to 91.6% the identical time this 12 months. However with the decline in income got here a lower in many of the firm’s profitability metrics. As you possibly can see within the chart above, working money movement did enhance. Nonetheless, the entire different profitability metrics declined modestly 12 months over 12 months.

Writer – SEC EDGAR Information

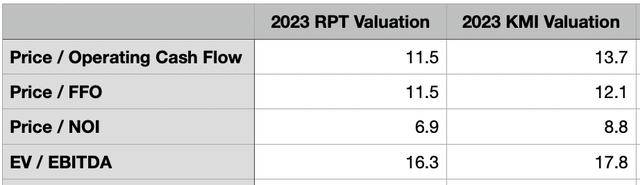

One factor that makes evaluating this transaction quite simple is the truth that each firms have been very clear about what they count on monetary efficiency to appear to be for the 2023 fiscal 12 months. As an illustration, if we take the midpoint of steerage for RPT Realty for its FFO per share, we must always anticipate FFO this 12 months of $84.8 million. Primarily based alone calculations, this could translate to the outcomes proven within the desk above. That desk additionally exhibits the anticipated figures for Kimco Realty utilizing the identical strategy.

Kimco Realty

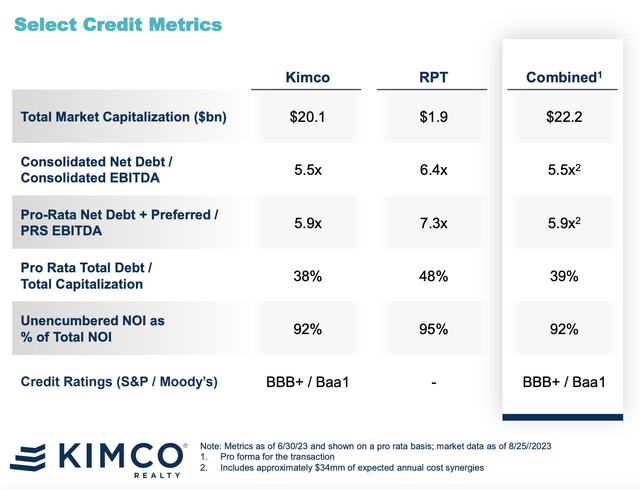

Taking the aforementioned calculations, I then determined to cost the businesses. On a ahead foundation, the implied buyout value for RPT Realty interprets to a value to working money movement a number of of 11.5. That is decrease than the 13.7 ranking that we get for Kimco Realty. The value to FFO a number of is 11.5 in comparison with 12.1 for the acquirer. Transferring on to the worth to NOI strategy, we’ve got a a number of of 6.9 versus 8.8, respectively. And in the case of the EV to EBITDA strategy, we get 16.3 in comparison with 17.8. And what makes this actually nice is that it assumes that not one of the synergies predicted by Kimco Realty come to move. Now, it’s true that RPT Realty has the next internet leverage ratio of 6.4 in comparison with the 5.5 that Kimco Realty has. However the mixed firm ought to nonetheless have a internet leverage ratio of solely 5.5. It is because the dimensions disparity between the 2 companies will end in shareholders of RPT Realty receiving solely 8% of the brand new enterprise, whereas traders in Kimco Realty will get 92%.

Kimco Realty

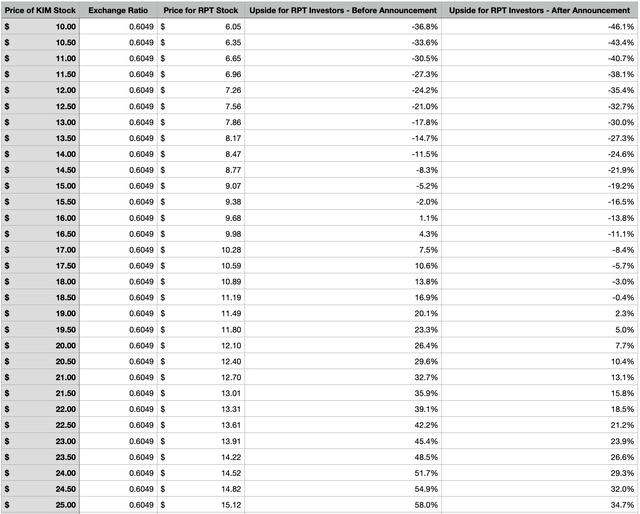

There may be one danger that traders ought to pay attention to. And this pertains to the truth that the all-stock nature of the deal signifies that the 2 firms ought to transfer in tandem with each other. Holding all else the identical, within the occasion that Kimco Realty sees its share value drop by 50%, you’d see a 50% drop related to Kimco Realty. Alternatively, you’d see an analogous enhance an organization a 50% rise in Kimco Realty shares. This isn’t one thing that you simply get with an all-cash deal and it’s one thing you solely get partially with a money and inventory deal. To get some perspective of how this may look below completely different pricing situations for Kimco Realty, I created the desk beneath. You possibly can see how, for every $0.50 per share that Kimco Realty strikes, shares of RPT Realty ought to transfer.

Writer – SEC EDGAR Information

Takeaway

All issues thought-about, I might make the case that this deal in all probability is sensible for each events. If there’s a winner, it’s definitely Kimco Realty since it’s utilizing it is barely costlier inventory to choose up a wholesome enterprise. After all, this ignores the synergies that would sweeten the tip consequence even additional. However I do not prefer to assume that can come to move. There is not actually something I dislike concerning the transaction. I might argue that upside from right here is restricted for RPT Realty because the present unfold between the place shares are immediately and the implied buyout value is just one.1%. However in case you are bullish about Kimco Realty itself, shopping for into Kimco Realty then choosing up RPT Realty may very well be a barely cheaper option to get in on the motion.

In relation to the popular shareholders of RPT Realty, the administration group at Kimco Realty, in a name on the matter, talked about that the models might be primarily swapped out for models within the new, mixed firm. They may have pursuits which might be related in nature to what the prevailing RPT Realty most well-liked models have. So there isn’t a purpose for traders who favored the popular models beforehand to alter their thoughts on them now.

[ad_2]

Source link