[ad_1]

Understanding the intricacies of Bitcoin balances on crypto exchanges is an integral a part of analyzing the market. These balances, marked by inflows and outflows, barometer the market’s well being, sentiment, and potential future actions. As these balances shift, they paint an image of investor habits, confidence, and technique. Equally, quantity modifications supply insights into the market’s liquidity and buying and selling exercise.

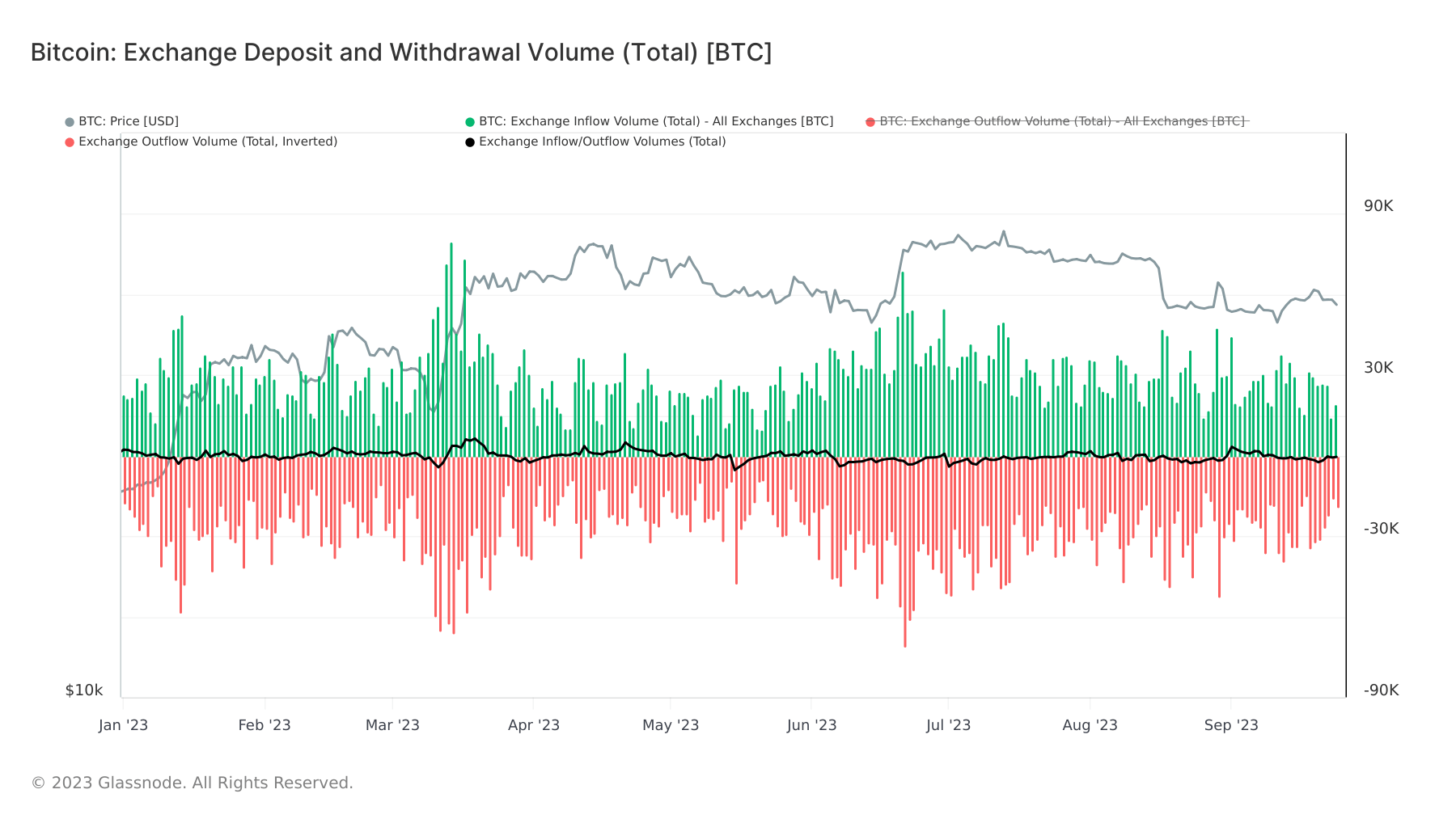

Analyzing September’s change deposit and withdrawal volumes reveals a constant sample of Bitcoin withdrawals surpassing deposits. This isn’t a fleeting pattern both—because the starting of 2023, withdrawals have been outpacing deposits, suggesting a broader market narrative.

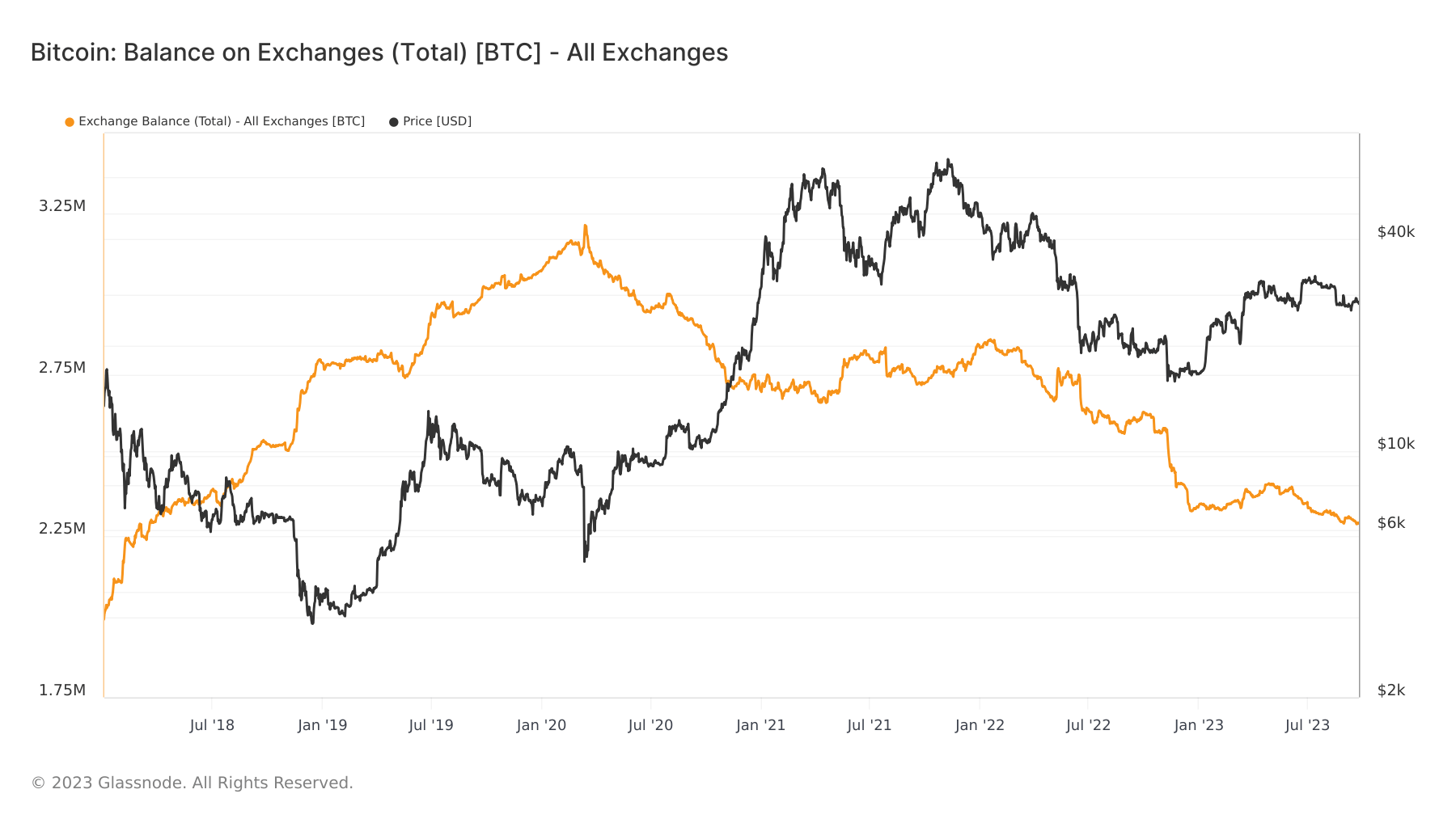

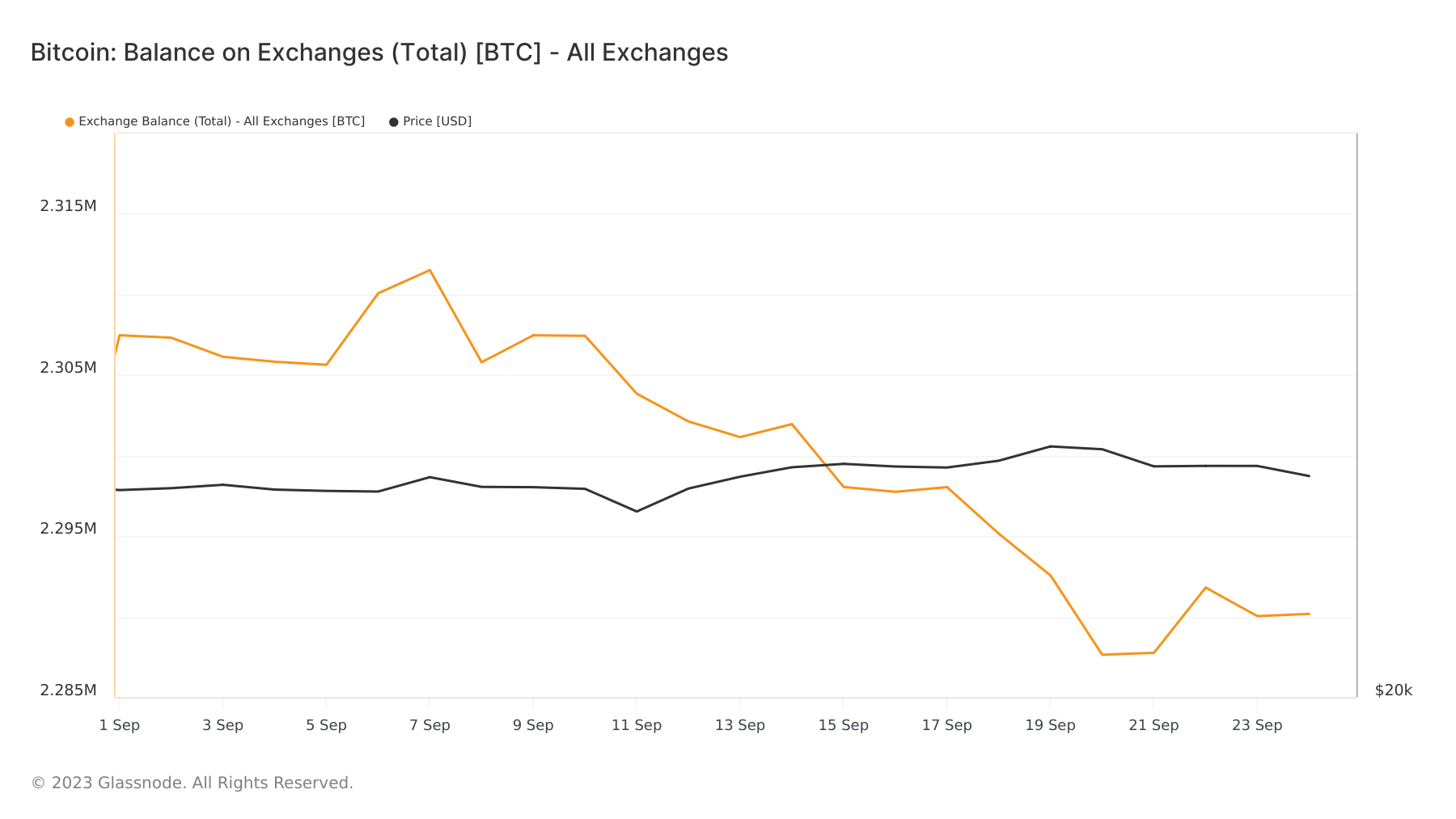

The regularly reducing Bitcoin stability on exchanges additional confirms this pattern. Trade balances peaked in March 2020 at 3.21 million BTC. Nonetheless, the next months and years have seen this quantity lower drastically, standing at 2.29 million BTC on Sept. 25, 2023. Regardless of intermittent intervals of optimistic change inflows, the overarching pattern has been a lower.

Because the begin of September alone, exchanges have seen a discount of over 17,000 BTC of their Bitcoin balances.

The dominance of withdrawals over deposits may signify a market pivot in the direction of a long-term holding technique, occurring because of both an anticipatory technique for future good points or as a protecting measure towards market volatility.

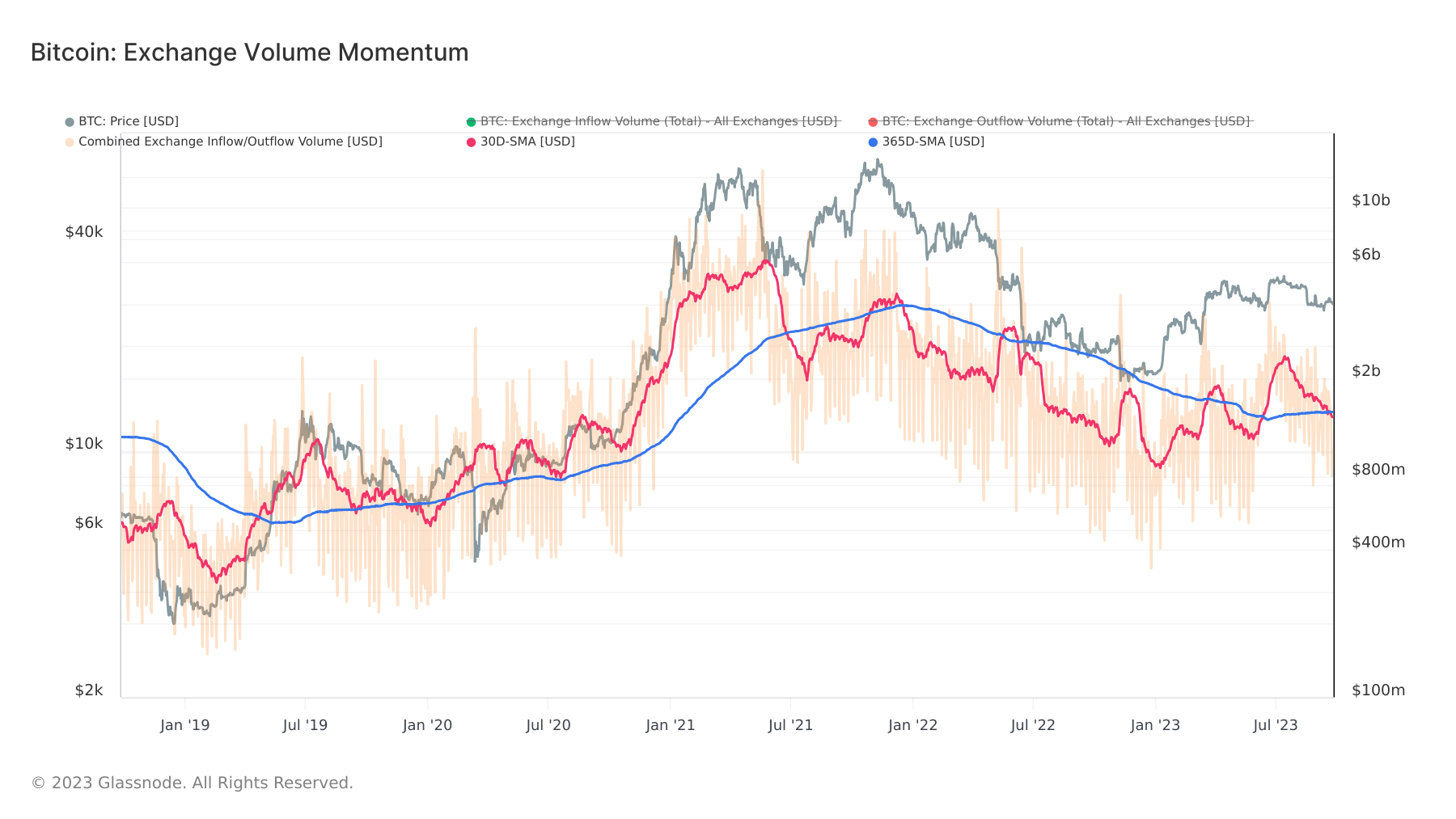

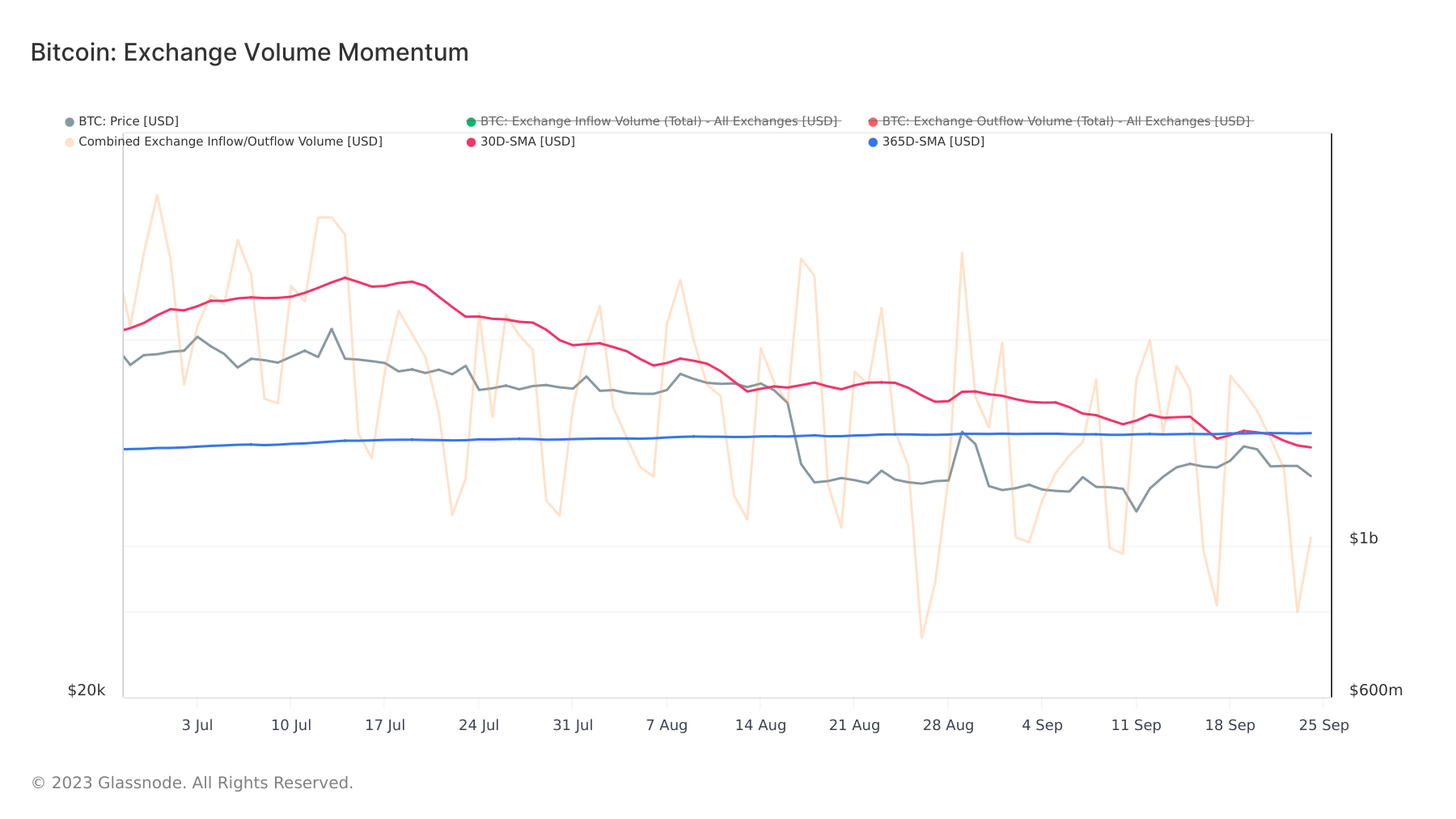

The change quantity momentum additional confirms this pattern. This metric, which juxtaposes the month-to-month common of mixed inflows and outflows towards the yearly common, is a dependable indicator of investor curiosity in Bitcoin. A month-to-month common surpassing the annual common sometimes alerts an uptick in exchange-related on-chain exercise, usually accompanying value surges.

Conversely, when the month-to-month common lags behind the yearly common, it suggests a contraction in exchange-related on-chain exercise. This contraction is symptomatic of waning curiosity within the asset and a decline in buying and selling volumes. In keeping with Glassnode, the month-to-month common has been downward since July, culminating in falling beneath the yearly common on Sep. 21. This decline correlated with Bitcoin’s value dip from $27,225 to $26,220.

The dominance of withdrawals and the declining change quantity momentum level to a market that’s changing into extra conservative. Traders appear to be shifting from a buying and selling mindset to a holding one, presumably anticipating future good points or just hedging towards uncertainty. The latest dip in Bitcoin’s value, coupled with the drop within the month-to-month common, highlights the potential influence these metrics can have on market actions.

The submit A cautious Bitcoin market is shifting from buying and selling to holding appeared first on CryptoSlate.

[ad_2]

Source link