[ad_1]

Whereas it is not widespread information, some tech shares supply nice dividend yields

Actually, they far exceed the S&P 500’s 1.3% yield

Utilizing insights from InvestingPro, let’s delve deep into 4 such shares

There is a widespread perception that expertise corporations sometimes do not pay substantial dividends, and in the event that they do, the yields are sometimes low or simply for the sake of it. Nevertheless, a more in-depth look reveals that a number of expertise corporations supply dividends with notably enticing annual yields, particularly when in comparison with the ‘s modest +1.3% yield.

Actually, as of the second quarter of 2023, dividends from expertise shares have delivered a yield of practically 15%, which is in shut proximity to the monetary sector’s yield, barely exceeding 15%.

Let’s discover a few of these tech corporations utilizing the InvestingPro software, which gives invaluable information and insights.

1. IBM

Worldwide Enterprise Machines (NYSE:), headquartered in Armonk, New York, is an organization that makes a speciality of manufacturing and advertising and marketing pc {hardware} and software program. It additionally gives infrastructure, web internet hosting, and consulting providers.

IBM has a wealthy historical past, with its origins courting again to 1911 when it was based because the Computing Tabulated Recording Company, the results of a merger involving 4 corporations. It formally adopted the title IBM in 1924. One notable side of IBM is its dividend, which boasts a formidable annual yield of +4.60%.

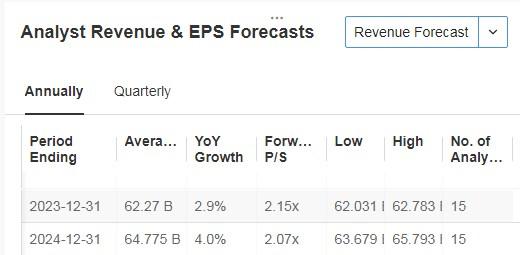

On July 29, IBM reported its newest and the earnings per share (EPS) exceeded forecasts by a considerable +8.9%. Wanting forward, IBM is ready to launch its subsequent earnings report on October 25, and market expectations are optimistic, anticipating an actual income enhance of +5.04%. For the present fiscal yr, precise income forecasts level to a development of +2.9%, and for 2024, an much more promising development charge of +4% is predicted.

IBM upcoming Earnings

IBM Income and EPS Forecast

Supply: InvestingPro

InvestingPro fashions give it a possible at $160.59, whereas RBC Capital Markets elevated it to $188.

IBM Goal Worth – InvestingPro

Supply: InvestingPro

Within the final 12 months, its shares are up +17% and within the final 3 months, they’re up +9%.

It reached its resistance final week and thus far hasn’t been in a position to overcome it.

2. HP

HP (NYSE:), headquartered in Palo Alto, California, got here into existence following the cut up of Hewlett-Packard into two separate entities in November 2015. HP stands out because the world’s main firm in printer gross sales and is a major participant within the world marketplace for computer systems and laptops.

An attention-grabbing improvement for HP is the latest announcement of the appointment of David Meline as a brand new member of its board of administrators. David Meline, the previous Chief Monetary Officer (CFO) of Moderna (NASDAQ:), is ready to formally be part of the board on November 1, 2023.

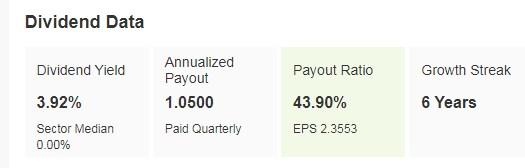

HP additionally boasts a noteworthy dividend yield of +3.92%.

HP Dividend Information

HP Payout Historical past

Supply: InvestingPro

HP reported its monetary on August 29, which confirmed some weaknesses. Whereas the earnings per share (EPS) managed to surpass expectations by a slight margin, the precise income fell quick, recording a -1.5% lower.

The upcoming outcomes are scheduled for launch on November 21. As for the outlook for 2023, expectations should not notably optimistic. Nevertheless, issues appear to take a optimistic flip in 2024, with the market anticipating a +4.5% enhance in EPS and a +2.6% development in precise revenues.

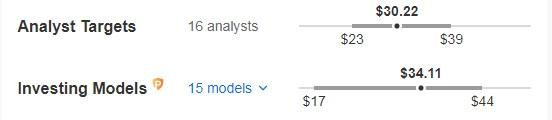

By way of inventory efficiency, over the previous 12 months, HP’s inventory has elevated by +3%. Nevertheless, it is price noting that they’ve skilled declines in latest occasions, about -26% within the final 3 months. Nonetheless, there is a optimistic outlook for the inventory because it might bounce again, with potential seen at $30.22, whereas InvestingPro fashions challenge a fair increased potential at $34.11.

HP Worth Targets

Supply: InvestingPro

In mid-July it started to fall and is approaching certainly one of its helps.

3. Corning

Corning (NYSE:) specializes within the manufacturing of glass, ceramics, and associated supplies, primarily designed for industrial and scientific purposes. The corporate initially operated below the title Corning Glass Works till 1989 when it adopted its present title, Corning Included. Corning Included has a protracted historical past, with its founding courting again to the yr 1851.

Notably, Corning Included gives an interesting dividend yield of +3.59%.

Corning Included Dividend Information

Corning Included Dividend Historical past

Supply: InvestingPro

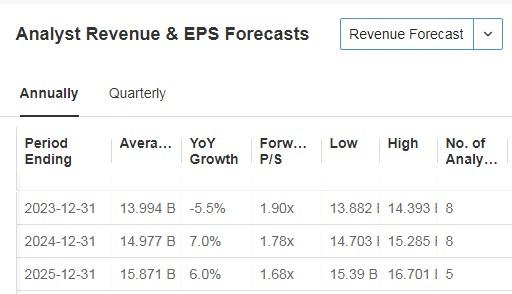

July 25 confirmed barely better-than-expected precise revenues (+0.1%) however barely decrease EPS (-0.3%). It stories its subsequent outcomes on October 24. The market expects precise revenues for 2023 to fall by -5.5%, in distinction for 2024 it expects a rise of +7% and for 2025 +6%.

Corning Included Newest Earnings

Corning Included EPS and Income Targets

Supply: InvestingPro

The corporate has seen a drop in demand from its shopper electronics prospects as smartphone makers try to wash up a list buildup brought on by excessive inflation and rising rates of interest.

The corporate has taken aggressive steps this yr to chop prices and offset the droop in its core markets, which, mixed with earlier value will increase, has helped it proceed to develop its gross margin.

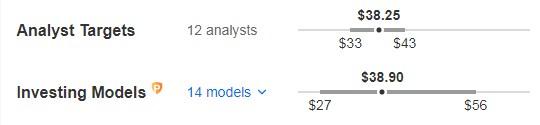

With information up to date on the shut of the week, its shares are up +0.77% over the past 12 months however down -11% over the past 3 months. The market and InvestingPro fashions agree on the potential it might have. Within the first case at $38.25, and within the second case at $38.90.

Corning Included Worth Targets

Supply: InvestingPro

It has been falling since mid-July and could be very near key assist.

4. Juniper Networks

Juniper Networks (NYSE:), established in 1996, is a multinational company specializing in networking and safety programs. The corporate’s headquarters are located in Sunnyvale, California. Notably, Juniper Networks is a key competitor to Cisco (NASDAQ:), notably within the European market, the place it competes straight with Cisco within the discipline of networking and safety options.

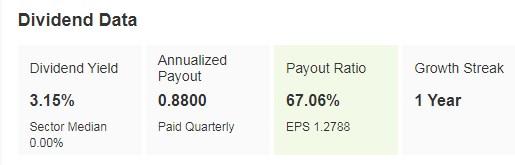

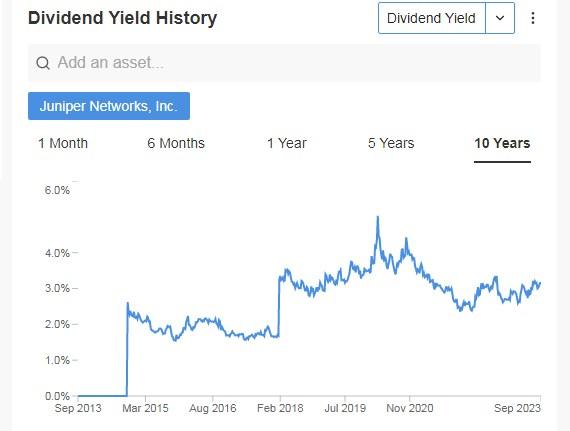

Juniper Networks gives a pretty dividend yield of +3.15%.

Juniper Networks Dividend Information

Juniper Networks Dividend Yield Historical past

Supply: InvestingPro

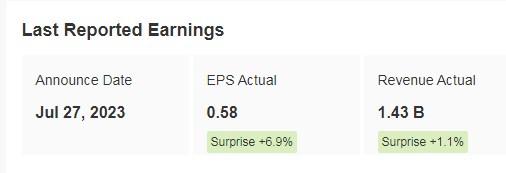

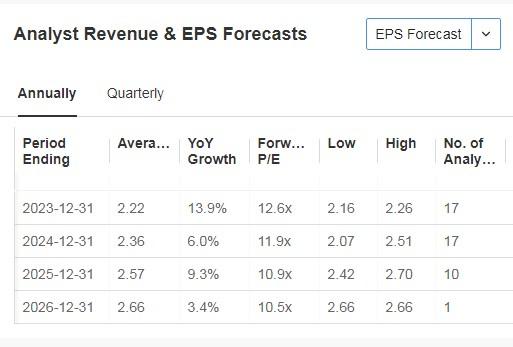

Good have been offered on July 27 with EPS up +6.9% and precise income up +1.1%. The subsequent earnings might be offered on October 26. The market expects 2023 EPS development of +13.9% and 2024 EPS development of +6%.

Juniper Networks Earlier Earnings

Juniper Networks Income and EPS Forecasts

Supply: InvestingPro

With information up to date on the finish of the week, its shares are up +5% within the final 12 months, whereas within the final 3 months, they’re down -5.5%. The market sees potential at $32.69, whereas InvestingPro fashions see it at $34.78.

Juniper Networks Worth Goal

Supply: InvestingPro

The inventory has been in a bearish section since April and could be very near its assist.

***

Discover All of the Information you Want on InvestingPro!

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, supply, recommendation, counsel or advice to speculate as such it’s not meant to incentivize the acquisition of belongings in any manner. As a reminder, any sort of belongings, is evaluated from a number of factors of view and is extremely dangerous and due to this fact, any funding choice and the related threat stays with the investor. The creator doesn’t personal the shares talked about within the evaluation.

[ad_2]

Source link