[ad_1]

zhengzaishuru

Not since November of final yr have we seen oil costs the place they’re right now. We’re shut, by far, to the very best pricing that crude has traded in any respect yr. As of this writing, WTI crude, as an illustration, is at $91.18 per barrel. Not surprisingly, Brent crude is even greater at $94.78 per barrel. Given the state of the economic system extra broadly, I can perceive why some could imagine that oil costs are going to drop within the close to time period. It is a distinct chance. This perception would possibly even be emboldened by knowledge offered by the EIA (Power Data Administration) that exhibits this yr and subsequent yr leading to international provides outpacing international demand. Nevertheless, from what we’re seeing within the pricing setting and from what we’re seeing from OPEC itself, the information offered by the EIA is nearly actually incorrect and it would not be surprising to see costs rise even farther from right here.

Count on excessive costs to stay

The final article that I revealed that lined the oil market typically got here out in early April of this yr. At the moment, I used to be speaking in regards to the new OPEC+ manufacturing minimize and the way that represented a “huge reward” to the oil sector. Usually after I speak about investing, I wish to establish particular person firms that ought to rise or fall materially. However in the case of the oil patch, there are lots of several types of firms to select from, with each having a considerably totally different danger vs. reward payoff in comparison with the others. For some traders, it simply makes it simpler to purchase into an ETF that appreciates if oil costs rise or drops in the event that they fall.

Again then, the ETF I selected as the first emphasis for my article was United States Oil Fund, LP ETF (NYSEARCA:USO). However there are many others to select from, each with its personal positives and negatives. Examples embody United States Brent Oil Fund ETF (BNO), ProShares Extremely Bloomberg Crude Oil ETF (UCO), Invesco DB Oil Fund ETF (DBO), United States 12 Month Oil Fund ETF (USL), Direxion Each day S&P Oil & Fuel Exp. & Prod. Bull 2x Shares ETF (GUSH), and MicroSectors U.S. Large Oil Index 3X Leveraged ETNs (NRGU). To be clear, traders can be clever to judge every of those ETFs individually to see which one most closely fits their very own funding preferences and danger urge for food. However usually, one factor that these all ought to have in widespread is that, as oil costs rise, they need to respect. This needs to be true no less than within the quick time period.

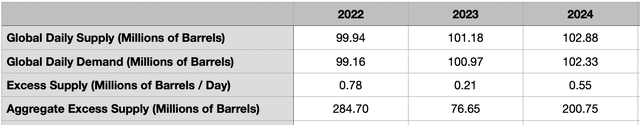

Creator – EIA Information

Whatever the automobile that every particular person investor chooses to play within the oil market, a case might be made by some that costs are too excessive and may drop from right here. There is definitely knowledge to assist that view. Take knowledge offered by the EIA, as an illustration. In its most up-to-date Quick-Time period Power Outlook, which was revealed earlier this month, the company calculated that, for 2023, international oil provide would are available at about 101.18 million barrels per day. This may be about 0.21 million barrels per day greater than the 100.97 million in consumption that might be skilled. This disparity won’t appear to be a lot to some traders. Nevertheless it might have a serious impression on international oil markets if true. The overall extra provide, unfold over a single yr, can be 76.65 million barrels.

Creator – EIA Information

Now, it is necessary to level out that simply because inventories are rising that this should not essentially translate to a bearish outlook on oil. All of it is dependent upon how a lot crude already is on the market. Typically, the vary that needs to be thought-about wholesome for the setting can be between 55 and 60 days’ price of provide of crude in OECD nations. At any time when this quantity begins ticking above 60, we begin to drift into bearish territory. Primarily based on the STEO report issued, by the top of this yr, we needs to be at roughly 60.57 days’ price of provide for OECD nations. That might translate to extra crude amongst developed nations of 26 million barrels. To make issues worse, the 2024 calendar yr ought to see international demand of 102.88 million barrels per day. That is 0.55 million barrels per day greater than the 102.33 million barrels per day of consumption that has been forecasted. That might translate to 200.75 million barrels of further crude all year long, with OECD inventories climbing to 2.84 billion barrels, or 62.14 days.

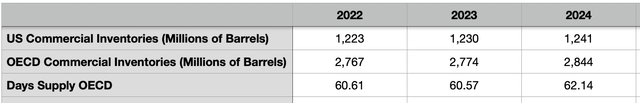

EIA

Trying on the most lately accessible weekly knowledge, we see that home crude inventories for the US, excluding what’s within the SPR (Strategic Petroleum Reserve), are about 1.27 billion barrels. That is a rise over the 1.23 billion barrels of crude seen one yr earlier. Nevertheless, if we embody the SPR into the image, home inventories would have declined from 1.65 billion barrels to 1.62 billion. It’s because, in an effort to fight excessive oil costs, the US has drained a number of the oil within the SPR, taking inventories from 422.6 million barrels final yr to 351 million this yr.

So to summarize, what we’ve on the bearish aspect of the equation is the EIA forecasting continued progress in manufacturing that exceeds consumption. Now we have proof within the type of current inventories of the image trying worse than it did final yr if we ignore the SPR. Though not talked about beforehand, oil manufacturing is also the very best that it has been in additional than two years, with output averaging 12.90 million barrels per day right here at house. And also you even have excessive pricing that, in principle, ought to appeal to extra drillers that might, in flip, trigger much more provide to come back onto the market.

All of that is fantastic, however there are some points with the information from what I can see. For starters, whereas this isn’t essentially a problem, the timing for oil costs to climb seems to be proper. Regardless that the EIA has forecasted extra provide on a worldwide scale for this yr in its entirety, the present quarter that we’re in, which is the third quarter, ought to really see demand outpace provide to the tune of 0.58 million barrels per day. And within the fourth quarter, we should always see demand outpace provide by 0.23 million barrels per day. All mixed, this could trigger international inventories to drop by 74.5 million barrels between the beginning of the third quarter and the top of this yr.

However if you dig into the precise knowledge offered by the EIA, you find yourself with points as properly. For starters, the company has Russia producing 10.57 million barrels of crude per day within the second quarter and 10.48 million barrels per day within the third quarter. For 2023 as an entire, the estimate is 10.64 million barrels per day. Nevertheless, Russia has considerably lowered its personal output. S&P, as an illustration, lately estimated that, by 2024, the nation ought to solely be producing between 9.4 million and 9.5 million barrels of crude every day. OPEC, nevertheless, sees Russia dropping manufacturing from 10.85 million barrels per day within the second quarter of this yr to solely 10.22 million barrels per day within the third quarter. This yr as an entire, we’re taking a look at about 10.45 million barrels per day, which might be about 69.4 million barrels of crude, within the mixture, decrease than what the EIA knowledge suggests.

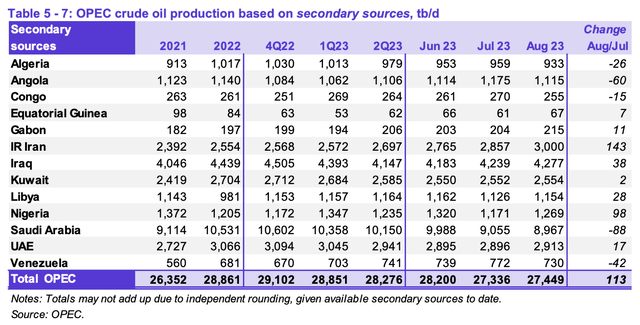

Creator – OPEC Information

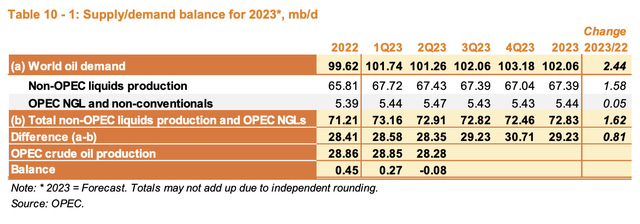

There are another minor variations on the availability aspect. However the larger variations contain demand. For instance, OPEC believes that international oil demand this yr will common about 102.06 million barrels per day. That is 1.09 million barrels per day greater than what the EIA forecasted. For the third quarter of this yr, OPEC believes that its personal manufacturing would should be roughly 29.23 million barrels per day in an effort to match demand. But when we take knowledge offered by the group for the primary two months of the third quarter, we’re taking a look at a mean of 27.39 million barrels per day. That interprets to a deficit of two.04 million barrels per day. That deficit is prone to develop to three.32 million barrels per day within the closing quarter of this yr if OPEC manufacturing averages the identical quantity throughout that point. And with Saudi Arabia having simply reaffirmed its goal of retaining manufacturing decrease by 1 million barrels per day by the remainder of this yr, that deficit is trying doubtless.

OPEC

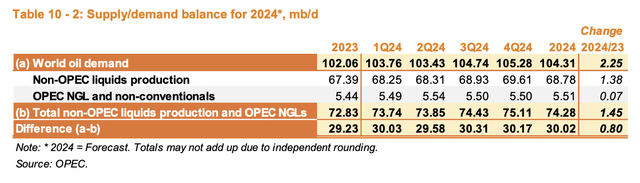

If these estimates turn into correct and if the historic knowledge reported by OPEC for the primary and second quarters of this yr are appropriate, then we might be taking a look at an mixture deficit of oil this yr of 476.1 million barrels. Whereas no person is aware of what the longer term holds, the group does assume that international demand in 2024 will common 104.31 million barrels per day. And even with non-OPEC output slated to rise by 1.45 million barrels per day from 2023 to 2024, the group would wish to place out 30.02 million barrels per day subsequent yr in an effort to keep away from additional shortfalls.

OPEC OPEC

As I discussed earlier on this article, US manufacturing is greater than it has been in years. That pattern is also trying set to proceed. Nevertheless, it might take fairly some time earlier than US output rises sufficient to carry costs down. For starters, as of August of this yr, which is the latest month for which we’ve knowledge accessible, there have been solely 4,749 DUC wells throughout the key basins. That is really down from the 5,191 reported one yr earlier. To place this in perspective, in August of 2019, which was proper earlier than the COVID-19 pandemic, DUC wells numbered 8,156. The depend of wells is commonly seen because the depend of spots from which oil firms can realistically extract crude in a reasonably quick window of time. That is as a result of a large portion of the price of extracting oil comes from the drilling course of. So when drilling is already executed, however your entire properly shouldn’t be accomplished, it may be considered as a mechanism to shortly ramp up output. However to see the DUC properly depend fall so low signifies that this potential is restricted. In actual fact, the latest Drilling Productiveness Report issued by the EIA even indicated that manufacturing throughout the key basins ought to fall, collectively, by 40,000 barrels per day from September to October.

Takeaway

At this cut-off date, I’d say that traders most likely have extra causes to be bullish on crude than they’ve causes to be bearish. Sure, there are specific financial uncertainties and people might play an enormous function in what occurs to pricing from this level on. However absent a serious downturn within the economic system, the prevailing stability between provide and demand in crude may have a a lot bigger function in figuring out what occurs with costs. Regardless that knowledge offered by the EIA is displaying a reasonably bearish scenario, the OPEC knowledge signifies in any other case and the market, from a pricing perspective, clearly is on its aspect. Whereas some could argue that OPEC shouldn’t be essentially the most dependable supply on the market, my expertise and taking a look at its knowledge is that it tends to be fairly correct. And if you mix that with a decrease DUC depend, decrease manufacturing shifting ahead in main basins, greater pricing out there, and decrease home inventories if we embody the SPR, I’d argue that the bullish case shifting ahead is certainly extra compelling.

[ad_2]

Source link