[ad_1]

ImagineGolf/iStock through Getty Photographs

Introduction

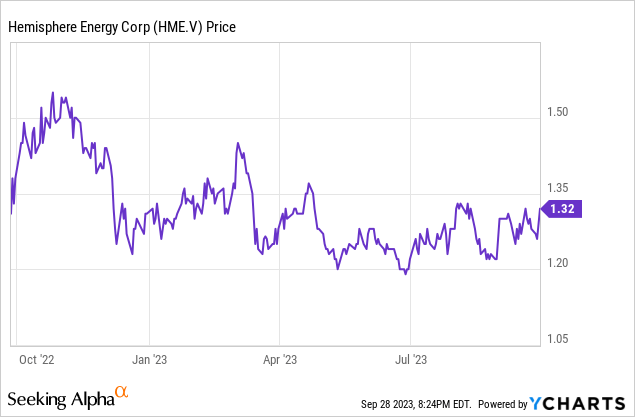

Again in July, I argued Hemisphere Vitality (TSXV:HME:CA) (OTCQX:HMENF) was an fascinating dividend candidate because of its sturdy dividend coverage. The corporate is paying a quarterly dividend of C$0.025 per share which represented an 8% dividend yield, however Hemisphere’s dividend coverage bases the dividends on the working money move. Because the oil value was going up (and subsequently continued to extend all through the third quarter) I argued the dividend would possible be elevated. This has now occurred. And though the Q3 outcomes clearly nonetheless must be reported, Hemisphere has simply introduced a C$0.03 particular dividend, bringing the anticipated dividend for the yr is C$0.13 for a yield of in extra of 10%. I wished to have one other take a look at the inventory to determine how sturdy the third quarter will probably be.

The Q2 outcomes permit us to run the numbers on Q3

Earlier than diving into my expectations for the third quarter, it is essential to have a better take a look at the Q2 outcomes as that would be the place to begin for my Q3 projections.

As Hemisphere Vitality primarily produces heavy oil (representing in extra of 99% of the overall oil-equivalent manufacturing), the WCS value and the differential between gentle oil and heavy oil is essential for the corporate (and its shareholders).

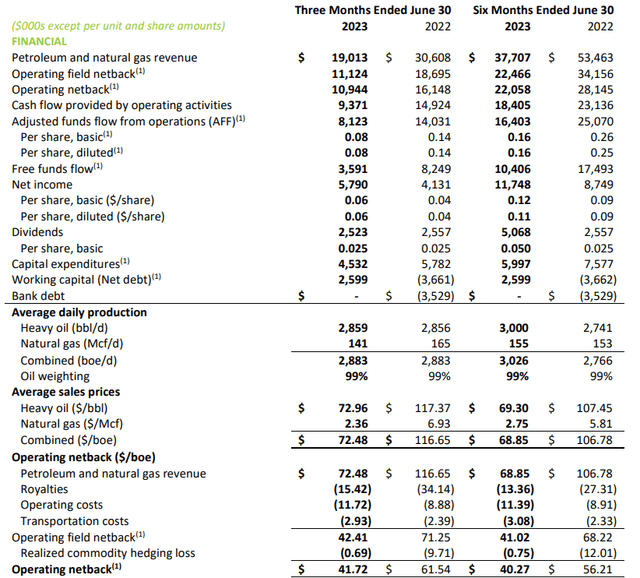

In the course of the second quarter of the present monetary yr, Hemisphere reported a median realized value of C$73 for its heavy oil and about C$2.36 for the very small quantity of pure gasoline that was produced through the quarter. This resulted in a median acquired value of C$72.48 per barrel of oil-equivalent and this meant the overall netback was C$42.41 per barrel of oil-equivalent, excluding hedge losses. The very best working price wasn’t the pure manufacturing price or the transportation expense, however the royalties. As you may see under, the royalties made up about 50% of all manufacturing prices.

Hemisphere Investor Relations

The whole income reported by Hemisphere within the second quarter was roughly C$19M and about C$15M after taking the royalty funds into consideration. The whole web income of C$14.8M additionally included about C$0.2M in hedging losses.

Hemisphere Investor Relations

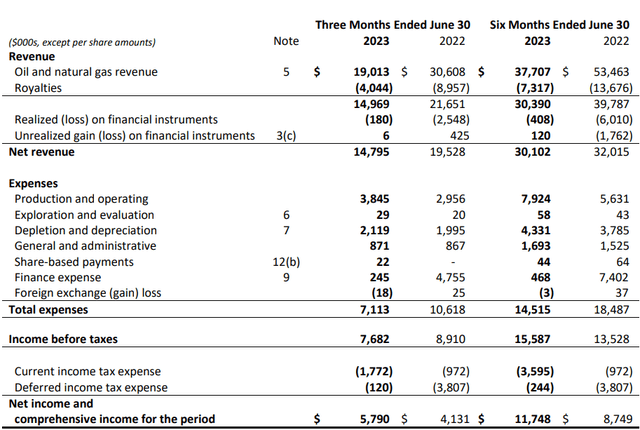

And the revenue assertion clearly additionally offers proof of the low price nature of the manufacturing. The whole manufacturing prices had been lower than C$4M and depletion and depreciation bills made up about 30% of all working bills. That is nice as this meant the pre-tax revenue got here in at C$7.7M representing a web revenue of C$5.8M after masking a C$1.9M tax invoice. This implies the EPS within the second quarter was roughly C$0.06 and this clearly additionally means the quarterly dividend of C$0.025 per share may be very properly coated because the payout ratio is lower than 50%. And that was based mostly on a median realized value of simply C$73 per barrel for the heavy oil.

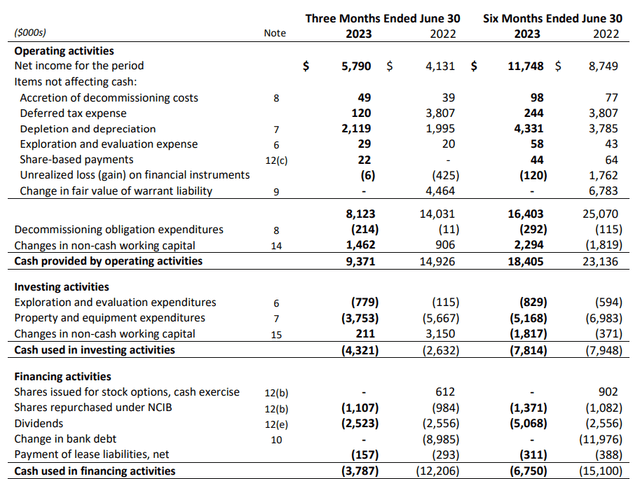

This wasn’t simply an accounting revenue as the corporate’s money move assertion seems to again up the sturdy web revenue.

The picture under exhibits the corporate generated about C$9.4M in working money move, however after deducting the C$1.5M contribution from working capital adjustments and the C$0.2M in lease funds, the adjusted working money move was C$7.7M. The whole capex and capitalized exploration money outflow was C$4.5M, leading to a web free money move of C$3.2M or C$0.032 per share.

Hemisphere Investor Relations

Whereas this nonetheless absolutely coated the quarterly dividend, the free money move outcome was considerably decrease than the online revenue. This was predominantly attributable to the excessive capex and capitalized exploration which got here in at greater than twice the depreciation bills. This additionally was larger than the normalized capex as Hemisphere continues to be guiding for a full-year capex of C$14M, representing C$3.5M per quarter. And even should you would use C$4M per quarter, the free money move outcome would clearly nonetheless be sturdy.

Now we now have established how sturdy the outcomes had been within the second quarter, let’s take a look at what we could anticipate from the third quarter.

Oil costs continued to extend and it is essential to notice the heavy oil value is growing as properly. The WCS value was C$83 in July, C$87 in August and can possible exceed C$95 for September. This implies we are able to anticipate the common realized value for the quarter to exceed C$85 per barrel and it might even are available in nearer to C$90/barrel.

Assuming C$88/barrel as common realized value for the quarter, Hemisphere’s income per barrel will elevated by roughly C$14 in comparison with the second quarter. And after deducting the royalties and tax funds, the online working money move ought to improve by roughly C$7/barrel. At a manufacturing fee of three,000 boe/day, this represents a further web free money move of C$21,000/day or C$1.8M for the quarter.

A particular dividend is underway

Which implies the Q3 free money move outcome could very properly are available in at C$5.5M within the third quarter (utilizing a normalized capex of C$4M) and that might signify about C$0.055 per share.

The corporate’s dividend coverage requires a payout ratio of 30% of the adjusted funds move. At a median heavy oil value of C$88/barrel, the annualized adjusted funds move could be roughly C$38M which implies the annual dividend ought to be roughly C$0.12 per share. That is topic to high quality adjustment issue per barrel of oil.

That additionally was what I used to be anticipating within the earlier article. However earlier this week, Hemisphere Vitality introduced it should pay a particular dividend of C$0.03 per share in November. Mixed with the conventional quarterly dividends of C$0.025 per quarter, the full-year dividend will are available in at C$0.13.

Funding thesis

And this reconfirms Hemisphere’s standing as a small-cap oil firm with dividend potential. As of the top of June, the corporate had no gross debt and a web money place of roughly C$4M, so it is smart the corporate continues to concentrate on maintaining its shareholders comfortable. I am trying ahead to seeing the Q3 outcomes and I would not be shocked to see an adjusted working money move of C$10M and a normalized free money move results of C$6M. In the interim, I am barely extra conservative and I’ll use an anticipated free money move of C$5.5M based mostly on a median WCS value of round C$88/barrel. However have in mind the present WCS oil value is now greater than 10% larger at roughly C$100/barrel.

I’ve an extended place in Hemisphere, and though I am primarily specializing in capital features, I am very pleased with the beneficiant dividend funds.

Editor’s Observe: This text discusses a number of securities that don’t commerce on a serious U.S. change. Please concentrate on the dangers related to these shares.

[ad_2]

Source link