[ad_1]

MarkRubens/iStock through Getty Pictures

Introduction

International Atomic (OTCQX:GLATF) (TSX:GLO:CA) is a Niger-focused uranium miner about which I’ve written two articles on SA to this point, the newest of which was in June 2022 after I mentioned that the corporate was beginning to look costly as development-stage mining stage mining corporations not often commerce above 0.5x.

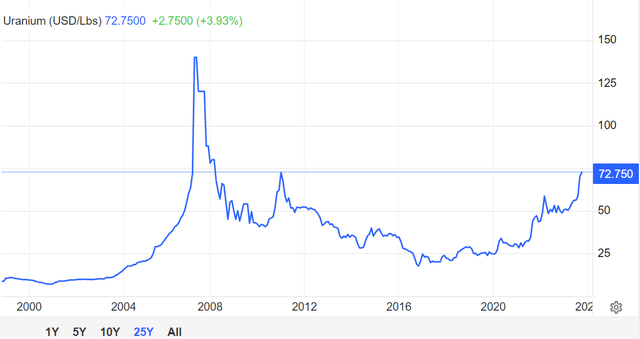

Properly, spot uranium costs have soared over the previous few months to over $70 per pound and are presently at their highest degree because the pre-Fukushima catastrophe because the president of Niger was arrested on July 26 in a army coup. Niger is a serious uranium provider and rising uranium costs as a result of tensions within the nation have lifted the share costs of most corporations within the sector considerably. International Atomic is among the many few exceptions as its market valuation has dropped by 1 / 4 because the coup happened. In my view, this creates a window of alternative to open a place as a peaceable decision of the battle could possibly be close to and the corporate claims that its operations within the nation are unaffected. Let’s evaluation.

Overview of the enterprise and up to date developments

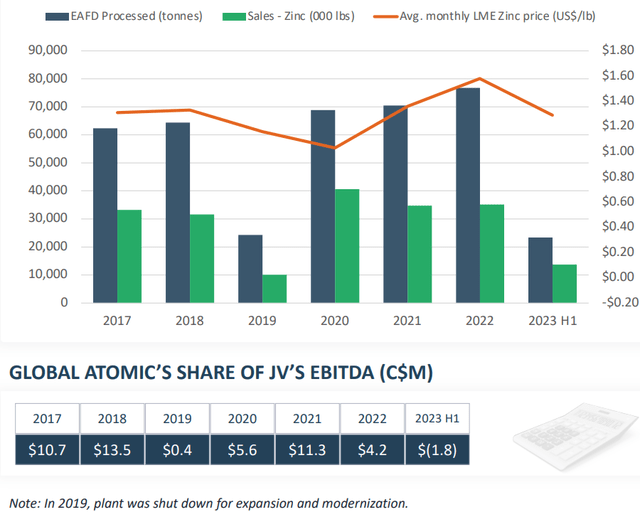

In case you aren’t conversant in International Atomic or my earlier protection, this is a short description of the enterprise. The corporate was based in 1994 and its fundamental property embody an 80% stake within the Dasa uranium venture in Niger and a 49% curiosity in a zinc oxide restoration plant in Iskenderun, Türkiye. The latter produces a 65% to 70% zinc oxide focus on the market to smelters by recycling Electrical Arc Furnace Mud (EAFD) containing 20% to 30% zinc which is sourced from native metal mills. The ability is 51% owned by European industrial companies agency Befesa (OTCPK:BFSAF) and usually has gross sales of between 30,000 and 40,000 kilos of zinc per 12 months. International Atomic’s share of the EBITDA from the plant usually surpasses C$10 million ($7.3 million) throughout years with excessive zinc costs. Sadly, 2023 is shaping up as a difficult 12 months as EAFD provide has been restricted following the February 2023 Türkiye-Syria earthquakes.

International Atomic

Utilizing a conservative valuation of 6x EV/EBITDA at about C$20 million ($14.6 million) EBITDA per 12 months, the stake of International Atomic within the facility can be price round C$60 million ($43.8 million).

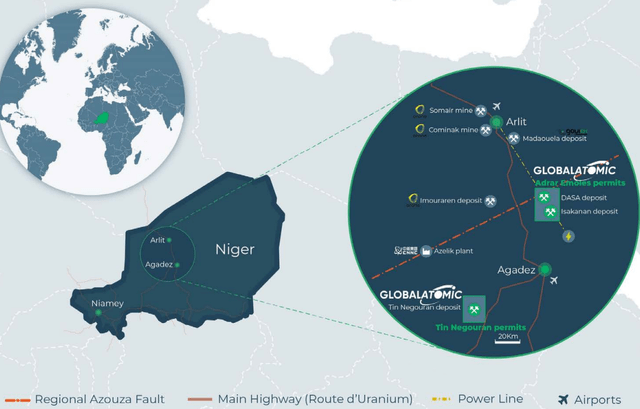

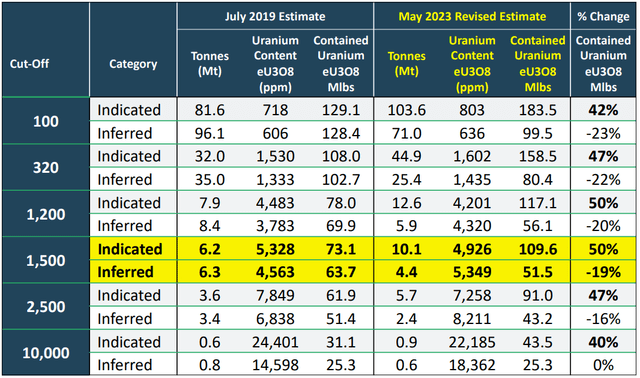

Transferring on to Dasa, that is the highest-grade sandstone-hosted uranium deposit on the planet and the biggest high-grade discovery in Africa within the final 50 years. It’s positioned close to town of Agadez within the Tim Mersoï Basin and it incorporates 109.6 kilos of uranium at a median grade of 4,926 ppm utilizing a cut-off grade of 1,500 ppm eU3O8.

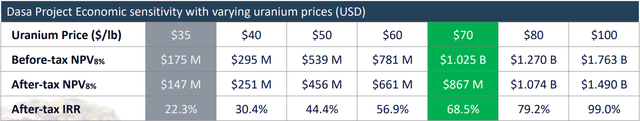

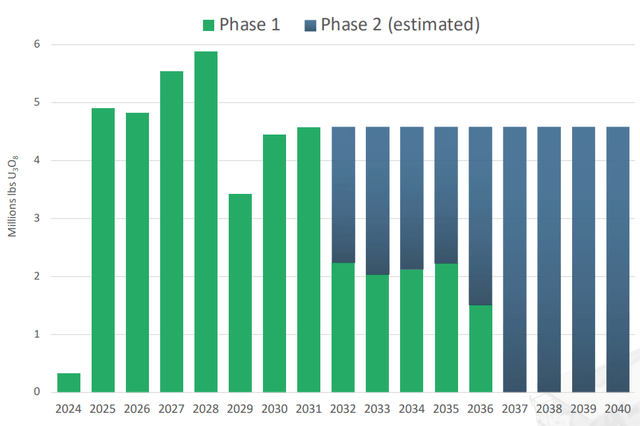

International Atomic International Atomic

In response to a feasibility research from 2021 that was primarily based on reserves of 47.2 million kilos of uranium, Dasa is anticipated to supply 44.1 million kilos of uranium throughout a 12-year Part 1 of mining at all-in sustaining prices (AISC) of simply $22.13 per pound due to the excessive grades. Utilizing an 8% low cost price, the after-tax internet current worth (NPV) is over $100 million even at $35 per pound of uranium, rating Dasa among the many lowest-cost uranium tasks on the earth.

International Atomic International Atomic

The preliminary CAPEX for Part 1 was estimated at $208 million, and building of floor and underground mine infrastructure is already underway, with the ramp growth now surpassing 600 meters (see slide 13 right here). International Atomic expects to finalize financing for the venture in This fall 2023 and fee the processing plant in Q1 2025. But, the corporate plans to launch an up to date mine plan and feasibility research within the first half of 2024 that shall be primarily based on the Could 2023 mineral useful resource estimate, and I feel that the preliminary CAPEX might surpass $250 million as a result of inflation. Nonetheless, my expectations additionally embody a rise within the NPV of a minimum of 30% contemplating indicated mineral sources soared by 50% between the 2019 and 2023 mineral useful resource estimates. At $70 per pound of uranium, a 30% enchancment interprets into an NVP of $1.13 billion.

Buying and selling Economics

So, why has the uranium spot worth been hovering recently? Properly, the primary purpose appears to be the considerations a couple of provide deficit because of the coup in Niger contemplating the nation is the seventh largest producer on the earth in line with the World Nuclear Affiliation with a market share of about 4%. For my part, the fears appear overblown contemplating uranium mining in Niger is ongoing and the army has not introduced plans to place restrictions in place. International Atomic, the corporate has issued a number of press releases reassuring buyers that its workers stays protected and that the event of Dasa continues. But, International Atomic has ready a contingency plan that might delay the commissioning of the processing plant by 6 to 12 months.

I feel that there could possibly be a peaceable decision to the political disaster in Niger within the coming weeks because the army just lately accepted a mediation proposal from neighboring Algeria. In late August, Algeria additionally proposed a six-month-long transition plan, overseen by a civilian. For my part, a peaceable decision of the scenario might drive uranium costs again to round $60 per pound nevertheless it is also a catalyst for the share worth of International Atomic. Wanting on the valuation of the corporate, the market capitalization stands at $323.1 million as of the time of writing. At $60 per pound of uranium, the NPV of Dasa stands at $330.5 million in line with the 2021 feasibility research. Let’s assume it will increase by about 30% with the up to date feasibility research to $429.7 million. I can’t discover a single uranium inventory that’s presently buying and selling beneath 1x NPV, so let’s take this quantity as an inexpensive valuation. Add $43.8 million for the Iskenderun zinc plant and we get to $473.5 million, which is 46.5% larger than the present market capitalization.

Wanting on the draw back dangers, I feel there are three main ones. First, I could possibly be over-optimistic a couple of peaceable resolution to the political scenario in Niger. We might see a breakdown in talks, adopted by a army intervention by a neighboring nation. Second, if a peaceable decision is reached, uranium costs might fall greater than I’m anticipating, even perhaps beneath $50 per pound. This could put important stress on the valuations of uranium miners. Third, I could possibly be overestimating the development within the NPV within the up to date feasibility research. It’s attainable that it stays near the present ranges on account of a excessive improve in preliminary CAPEX.

Investor takeaway

The market valuation of International Atomic has come beneath stress over the previous few months as a result of its publicity to Niger, however a decision to the battle within the nation appears to be on the horizon. The event of Dasa is ongoing and I feel that the corporate seems undervalued even when uranium costs drop to $60 per pound. But, there are a number of main dangers right here which is why I price International Atomic as a speculative purchase. For my part, risk-averse buyers ought to keep away from this inventory.

Editor’s Be aware: This text discusses a number of securities that don’t commerce on a serious U.S. alternate. Please concentrate on the dangers related to these shares.

[ad_2]

Source link