[ad_1]

Laurence Dutton

One machine can do the work of fifty extraordinary males. No machine can do the work of 1 extraordinary man. – Elbert Hubbard.

I’ve attacked the “new bull market” narrative for a number of months now, and every single day that goes by it seems increasingly more are realizing I used to be proper all alongside. Everybody was fooled by idiosyncratic threat within the large-cap averages, most notably the NASDAQ 100-Index (NDX). Most shares exterior of the Magnificent 7 have not performed all that effectively, and seem to have been in a bear market rally, not a brand new bull market.

Is there a catch-up commerce sooner or later? Probably sure, and that is the place the Direxion NASDAQ-100® Equal Weighted Index Shares ETF (NASDAQ:QQQE) comes into play. QQQE seeks to offer funding outcomes that correspond to the NASDAQ-100 Equal Weighted Index earlier than charges and bills. The first objective is to supply an funding avenue that leverages the expansion potential of NASDAQ’s largest non-financial firms whereas mitigating the dangers related to market capitalization-weighted indexes.

Importantly, the QQQE ETF adopts an equal-weighted strategy the place every constituent is initially set at 1% weight. This system is designed to supply broader diversification, permitting for extra balanced publicity throughout market segments and particular person shares. It additionally goals to present larger efficiency contribution from firms with smaller market capitalization.

ETF Holdings and Elements

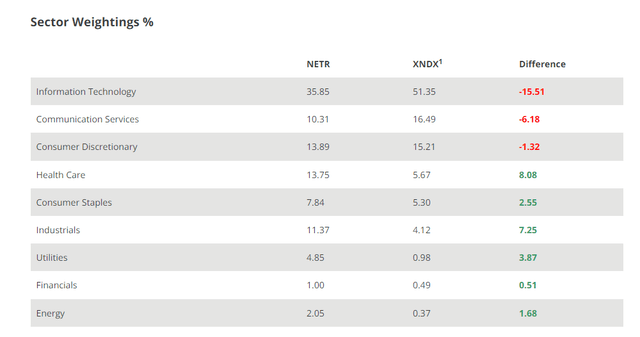

The QQQE consists of 100 of the biggest non-financial securities listed on NASDAQ. Nevertheless, in contrast to conventional market capitalization-weighted indexes, every constituent of the QQQE is initially set at a weight of 1%. The QQQE’s holdings characterize a broad vary of sectors, with data expertise, communication companies, and shopper discretionary being probably the most distinguished ones.

Once we have a look at sector weightings relative to the NASDAQ 100, we will clearly see that what makes QQQE completely different is that the equal weighting methodology ends in sector underweights in Expertise, Communication Providers, and Client Discretionary.

direxion.com

Peer Comparability: QQQE vs. QQQ

When evaluating the QQQE ETF to different related ETFs out there, probably the most notable competitor is the Invesco QQQ Belief ETF (QQQ). The QQQ can be primarily based on the NASDAQ-100, however in contrast to QQQE, it’s a capitalization-weighted index ETF.

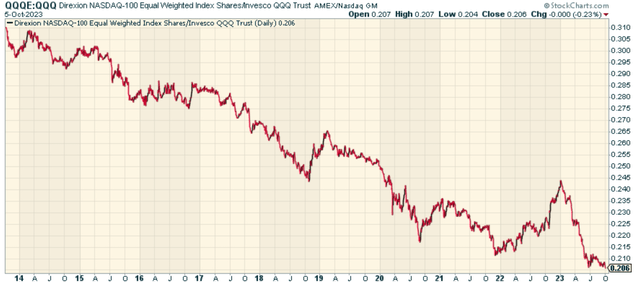

Over the previous decade, QQQ has persistently outperformed QQQE. This will largely be attributed to the meteoric rise of mega-cap tech shares like Apple (AAPL), Microsoft (MSFT), and Alphabet (GOOG) (GOOGL), which carry vital weight in QQQ resulting from its capitalization-weighted methodology.

StockCharts.com

Nevertheless, it is important to notice that the dominance of those mega-cap shares introduces the next degree of focus threat in QQQ. As such, whereas QQQ has outperformed QQQE previously, the latter’s equal-weighted strategy might doubtlessly supply a extra balanced and risk-averse funding technique.

That is maybe the true purpose to contemplate rotating. The highest heaviness of the NASDAQ relative to every little thing else.

Potential Dangers and Market Vulnerabilities

Whereas the QQQE’s equal-weighted methodology presents a number of benefits, it is not proof against market vulnerabilities. The ETF’s efficiency continues to be closely reliant on the broader expertise sector, which has been experiencing a major bull run for the previous few years. If cash begins rotating out of the tech sector, QQQE might be susceptible to a major decline.

Furthermore, QQQE’s underperformance towards QQQ means that this was by no means a wholesome market to start with. The truth that a small variety of mega-cap shares are driving the market efficiency is a trigger for concern and will sign an impending market correction (or company credit score occasion).

Conclusion

The Direxion NASDAQ-100® Equal Weighted Index Shares ETF presents a singular tackle buying and selling and investing within the NASDAQ. Nevertheless, its heavy reliance on the tech sector continues to be a problem from my vantage level. I would not think about initiating a place right here, however I do assume it is value taking note of as a fund for every time an actual new bull market begins that’s pushed by extra than simply 7 names.

[ad_2]

Source link