[ad_1]

Treasury yields are probably the most necessary market drivers and indicators. Representing the return an investor will obtain by holding a authorities bond to maturity, these yields present a snapshot of investor sentiment, future rate of interest expectations, and the general financial well being of a nation.

When analyzing Treasury yields, distinguishing between two elementary yield actions — inversion and flattening is important.

A yield curve plots the yields of bonds with equivalent credit score high quality however various maturities, providing a visible illustration of how short-term yields examine to long-term yields. Underneath regular financial circumstances, the curve slopes upward, signifying increased yields for bonds with longer maturities. Nonetheless, the curve doesn’t stay static. Its form morphs in response to altering financial circumstances and investor sentiment, resulting in phenomena like inversion and flattening.

Inversion happens when short-term yields surpass long-term yields. This inversion indicators market contributors’ pessimism about near-term financial prospects.

Conversely, a flattening yield curve signifies a decreasing distinction between short-term and long-term yields. Each these actions within the curve have profound implications for the market, usually appearing as harbingers of financial downturns.

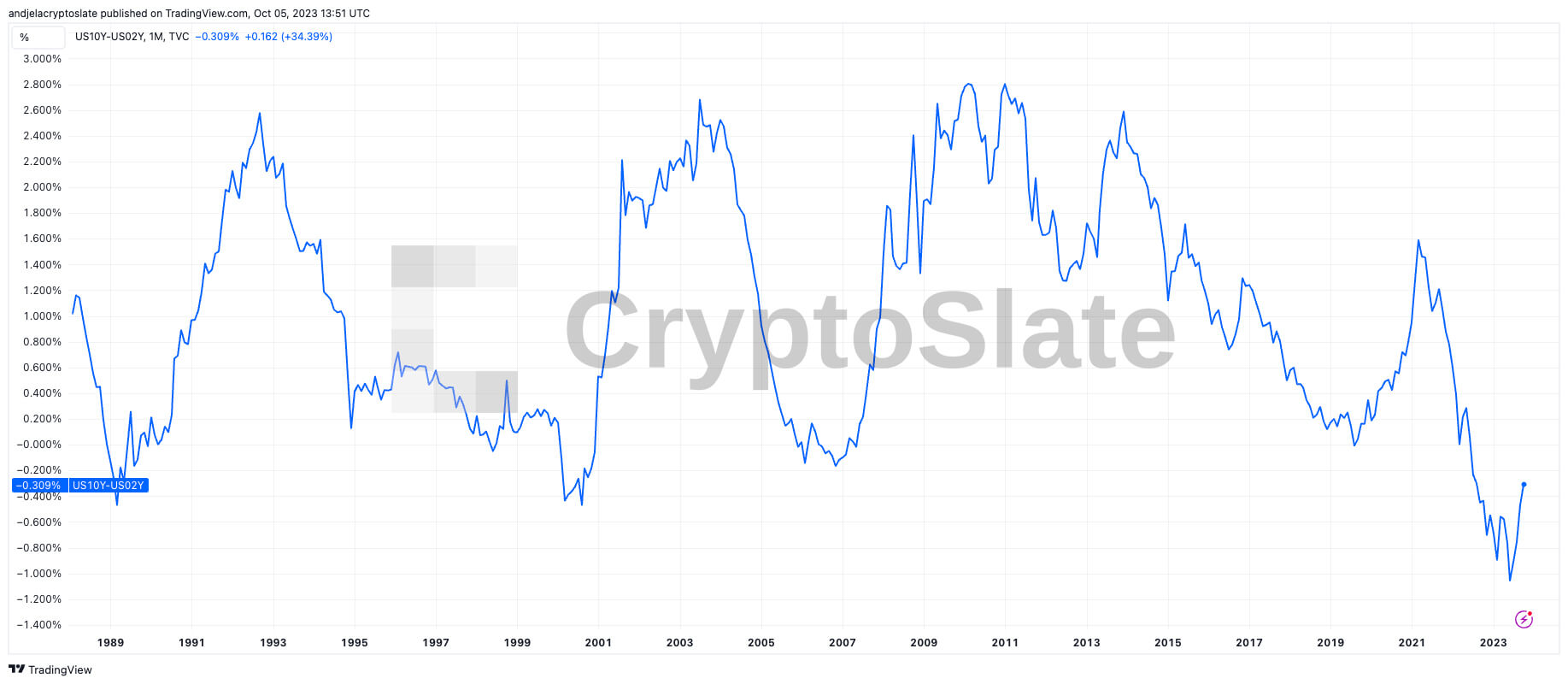

There are numerous methods of assessing the well being of the Treasury invoice market and, in flip, the broader monetary market, however the “10-2” unfold stands out for its historic accuracy in predicting financial downturns.

The two-year and 10-year Treasury notes are among the many most liquid and actively traded U.S. authorities securities. The two-year word displays short-term financial expectations, whereas the 10-year word signifies longer-term expectations. The unfold between these two yields offers a transparent image of the yield curve’s slope over an affordable time horizon.

The ten-2 unfold has traditionally been a dependable predictor of upcoming recessions. When the yield on the 2-year word exceeds that of the 10-year word (leading to a unfavorable 10-2 unfold), it signifies an inversion of this section of the yield curve. Such inversions have preceded each U.S. recession over the previous 50 years, although the time lag between inversion and the onset of a recession varies.

A constructive 10-2 unfold (the place the 10-year yield is increased than the 2-year yield) often implies that buyers count on wholesome financial development and demand a premium for locking their cash for prolonged durations. Nonetheless, when a pointy rise follows a historic low within the unfold, it means that buyers foresee an financial slowdown or recession within the close to time period. They may be extra prepared to just accept decrease yields now for longer-term bonds in the event that they consider they’ll get even decrease returns sooner or later or in the event that they’re looking for safer, longer-term property in unsure instances.

Current actions within the 10-2 unfold point out a looming recession. As of Oct. 4, the distinction between the 10-year and 2-year Treasury yield now stands at -0.29%. This marks a substantial shift from the -1.06% noticed on June 1, 2023, the bottom level the unfold has touched since 1982.

Such vital dips within the unfold have traditionally preceded financial challenges.

As an example, in November 2006, the unfold contracted to a low of -0.17%, previous the onset of the 2007 recession. Equally, a decline to -0.47% in August 2000 heralded the following dot com crash and the next recession. These historic precedents, amongst others, solidify the 10-2 unfold’s status as an financial crystal ball, offering early warnings of monetary storms on the horizon.

The present flattening and the related unfavorable unfold have immense implications for the market. It suggests buyers anticipate decrease returns, prompting a shift in the direction of longer-term bonds. Such conduct usually displays considerations about future financial stability and development prospects.

The put up The ten-2 Treasury yield unfold: A harbinger of financial downturn? appeared first on CryptoSlate.

[ad_2]

Source link