[ad_1]

Hitra

Bridgford Meals Company (NASDAQ:BRID) has lately seen a pullback in shares over the previous yr attributable to stagnant steering. I imagine that Bridgford is a purchase as a result of agency’s stable stability sheet amid macro headwinds, distribution growth ensuing in higher long-term FCF, and undervaluation assuming my DCF figures.

Enterprise Overview

Bridgford Meals Company, together with its affiliated firms, is engaged within the manufacturing, promotion, and distribution of frozen, refrigerated, and snack meals objects inside the US. The corporate’s two primary divisions are snack meals merchandise and frozen meals merchandise. Biscuits, numerous bread and roll dough items, dry sausage, and beef jerky merchandise make up nearly all of its product line. The corporate provides each retail shoppers and the meals service trade all kinds of about 130 frozen meals objects. Distributors, cooperatives, and wholesalers all distribute these items. Moreover, Bridgford Meals supplies about 160 snack meals merchandise, that are distributed to supermarkets, mass merchandisers, comfort shops, and different comparable companies by customer-owned distribution facilities and a direct retailer supply community.

Financials

Bridgford is at present valued at round $101.3 million available in the market, with a Return on Invested Capital of three%. The inventory is presently priced at $11.16 per share, barely beneath its 200-day shifting common of $12.26. It is noteworthy that the corporate’s P/E GAAP ratio is at 22.91. This determine is decrease than comparable friends indicating a relative undervaluation for the agency.

Bridgford P/E GAAP In comparison with Friends (In search of Alpha)

Though Bridgford doesn’t pay a dividend, the agency has decreased its debt considerably and is dedicated to investments in its core enterprise to return higher shareholder worth sooner or later. The agency has additionally maintained its excellent shares, which demonstrates its dedication to preserving worth as properly.

Annual Shares Excellent (TradingView) Share Efficiency (In search of Alpha)

Earnings

Bridgford lately reported disappointing earnings in Q3 2023 with web revenue falling from $41.3 million to $684,000 and gross sales falling from $59.52 million to $54.2 million. This demonstrates that Bridgford is experiencing problem throughout these macro headwinds to have regular money flows. However, though earnings have been weak, the agency’s skill to leverage by its stable stability sheet as talked about later on this article together with its distribution growth will enable the agency to leverage whereas additionally stabilizing money flows in the long run.

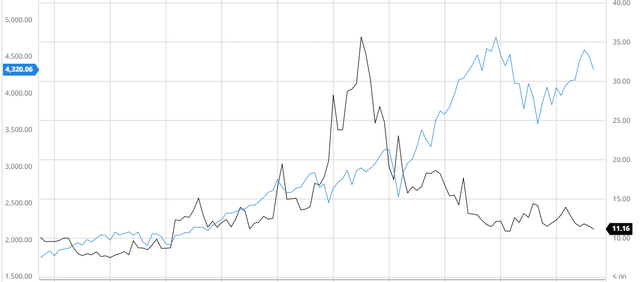

Efficiency In comparison with the Broader Market

Over the previous 10 years, Bridgford has underperformed within the S&P 500 attributable to a current decline in earnings and revenues. I imagine that the agency should restructure its technique to stimulate progress and get better from current adverse value motion in the long term.

Bridgford In comparison with the S&P 500 10Y (Created by creator utilizing Bar Charts)

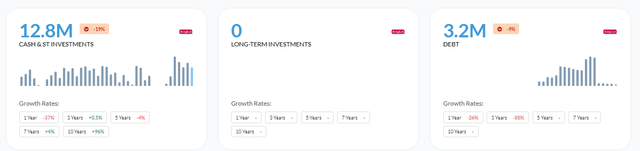

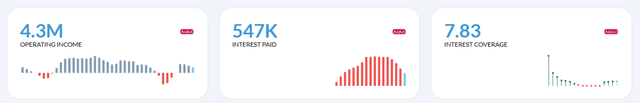

Stability Sheet

Bridgford additionally maintains a strong monetary place with a considerable discount in debt and enhanced curiosity protection at 7.83. This resilient, low-debt stability sheet supplies the corporate with flexibility for potential leveraging, significantly during times of difficult macroeconomic situations which will pressure money flows. Demonstrating a Present Ratio of three.46 and an Altman-Z-Rating of 4.14, Bridgford’s ongoing operations are steady and promising for the close to to medium time period.

Monetary Place (Alpha Unfold) Curiosity Protection (Alpha Unfold) Solvency Ratios (Alpha Unfold)

Valuation

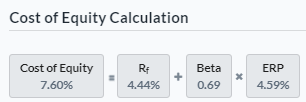

With the intention to calculate an correct truthful worth for Bridgford, I first needed to discover the agency’s Price of Fairness through the use of the risk-free charge from the 10-year treasury yield. Primarily based on this charge, I used to be capable of finding a Price of Fairness of seven.6%.

Price of Fairness (Created by creator utilizing Alpha Unfold)

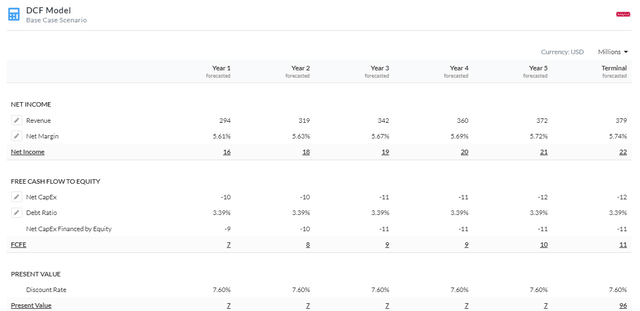

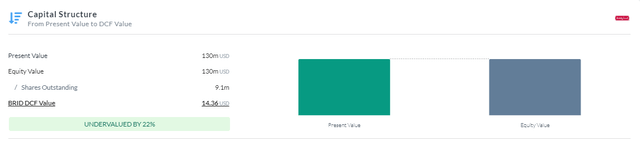

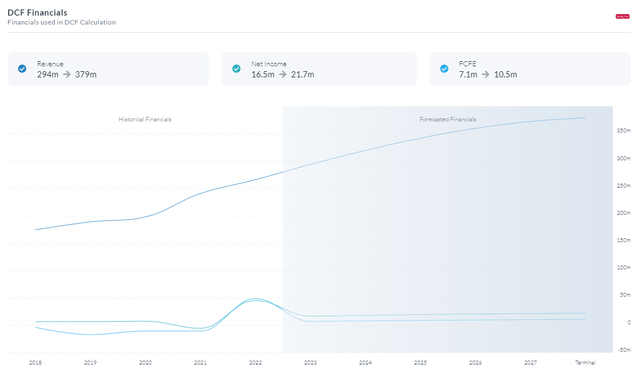

Assuming the beforehand calculated Price of Fairness, I created a 5-year Fairness Mannequin DCF utilizing FCFE. I made a decision to make use of the low cost charge of seven.6% as a result of the agency is satisfactorily leveraged for macroeconomic headwinds and can be capable of tackle debt if money flows grow to be a priority. I additionally estimated revenues and margins to develop with firm steering estimates as proven beneath. This resulted in a good worth of $14.36 presenting a possible upside of twenty-two%.

5-12 months Fairness Mannequin DCF Utilizing FCFE (Created by creator utilizing Alpha Unfold) Capital Construction (Created by creator utilizing Alpha Unfold) DCF Financials (Created by creator utilizing Alpha Unfold)

Distribution Community Growth Leading to Compounding Development

As a key part of its company technique, Bridgford Meals is devoted to increasing its distribution community. By maximizing how its objects are delivered to retail areas and finish customers, the company hopes to make sure that shoppers can simply entry its merchandise.

Their efforts to type strategic alliances with important retail chains and distributors served as one illustration of how they have been enhancing their distribution community. Bridgford Meals was in a position to enhance the visibility of its merchandise in shops and get higher shelf house by working with influential gamers within the retail sector. This technique improved each the accessibility of their merchandise and model recognition.

Bridgford Meals has regarded into increasing its distribution choices by adopting e-commerce. The enterprise tried to extend its presence in quite a few on-line marketplaces after realizing the rising development of on-line buying. By making this alteration, they have been in a position to attain prospects who valued the convenience of buying their items on-line, thereby increasing their buyer base.

By means of such methods, Bridgford Meals Company aimed to make its merchandise extra simply accessible to a wider viewers, guaranteeing that customers may discover their choices of their most well-liked shops or by on-line platforms. This won’t solely enhance gross sales but in addition develop margins as a result of underlying prices being reduce on an e-commerce platform together with higher wholesale pricing energy as soon as retailer objects grow to be extra in style in giant chain shops. This can end in improved money flows together with higher FCF resulting in the additional growth of its core enterprise to outpace opponents.

Dangers

Operational Dangers: Pure disasters, supply-chain disruptions, labor points, and some other operational challenges that have an effect on manufacturing and distribution.

Market Volatility and Fluctuating Commodity Costs: Worth fluctuations for elements like wheat, beef, and different uncooked commodities on account of market dynamics, climatic circumstances, or geopolitical occasions, which have an effect on manufacturing prices and complete profitability.

Regulatory and Compliance Dangers: Rules governing meals security and high quality have to be adopted; failure to take action may result in product recollects, authorized motion, reputational hurt, and financial losses.

Conclusion

To summarize, I imagine Bridgford is a purchase as a result of agency’s stable stability sheet amid macro headwinds, distribution growth leading to higher long-term FCF, and undervaluation assuming my DCF figures.

Editor’s Be aware: This text covers a number of microcap shares. Please pay attention to the dangers related to these shares.

[ad_2]

Source link