[ad_1]

tadamichi

A Little About Me

My first profession was in retail banking, working in financial savings and investments. Not a CFA. Not an expert analyst. Nor a portfolio supervisor. However actually, somebody who dealt day by day with individuals with very excessive internet value (usually £500k to £5 million), and needed to maintain a working understanding of how the markets operated and of particular person inventory concepts. The job led to 2008 after months of verbal abuse and one loss of life risk. You’ll be able to most likely make your individual connection between the dates, my function and most people at giant…

Working now as an educator, there are three issues that I attempt my finest to be: humble, sort and sincere. I’ve used Searching for Alpha for a few years passively for analysis, however as I begin to contribute extra to the Searching for Alpha group as a reasonably new analyst, I want to use these similar values right here as I do in my day-to-day life.

That is the primary replace since I started publicly sharing my portfolio right here within the final quarter. I’ve determined to name it the Moats and Monopolies portfolio to mirror the character of the businesses by which I make investments.

Investing Philosophy

Earlier than you learn any additional, it is value me sharing my ideas on investing proper out of the gate to make sure that you do not waste your time studying the remainder of the article do you have to be on a distinct path. I’ll flip 40 this quarter. With this in thoughts, my investing horizon is 15-20 years and my objective is to make use of my portfolio to retire early. I’m lengthy solely and think about myself an element proprietor within the corporations by which I make investments. I don’t dabble in shorting, choices buying and selling or any form of momentum or quick time period buying and selling. I don’t imagine that I can predict or time the market nor am I a macro economist.

I imagine that the easiest way to truly obtain Alpha is to be concentrated in a small quantity of top quality property after which holding them for lengthy intervals of time to permit their values to compound. I’m 99% invested within the inventory market (with the opposite 1% a speculative quantity of Bitcoin) and don’t maintain any bonds or various investments, as I imagine that over the long run the inventory market provides the most effective returns. I don’t care about volatility; I’m a reasonably rationale particular person and acknowledge that that is the price of admission to generational wealth creation.

I outline high quality property as those who have excessive free money movement margins or the long run means to create and maintain them. These excessive margins are maintained by corporations which have defensible moats towards competitors or, even higher, monopolistic elements of their enterprise that enables them to proceed to compound over time. As well as, these high quality corporations ought to have the ability to make investments their earnings at charges of return. I imagine you will need to perceive the unfold between returns on invested capital and weighted common prices of capital (ROIC – WACC) in addition to proudly owning corporations that may keep returns on capital employed (ROCE) which are constantly above 20%. High quality property have manageable debt, and with a few exceptions (the railways that I personal), they need to have debt that may be paid off with not more than 5 years of free money flows.

I keep away from corporations that I don’t perceive and whose cashflows I can not to an affordable extent forecast. Firms which are over reliant on market cycles and commodities, akin to banks, automobile makers and miners are averted. I’m comfortable to pay greater costs for high quality property. I’m not comfortable to invest on greater costs for corporations that haven’t demonstrated that they’ve sustainable and worthwhile enterprise fashions as a result of different individuals are hyping them.

I do probably not care about dividends at this stage in my investing life. They’re a pleasant little dopamine hit once they hit my account however I’m extra occupied with whole return, and dividends are each tax inefficient and probably wasted alternatives to spend money on corporations that may spend money on themselves.

I keep away from Twitter/X, Reddit and different locations the place individuals talk about shares on a daily foundation. Life is for daily, investing is for quarter to quarter on the most.

Lastly, I imagine in understanding what I personal. The Moats and Monopolies portfolio has simply 20 shares and a handful of ETFs. Which means I can maintain up-to-date with what is going on with my corporations in addition to investing my time into modeling out what I imagine to be lifelike targets for future money flows.

Adjustments

Buys

Enphase – Enphase (ENPH) is an organization that I’ve been a fan of for some time. It develops micro-inverters for photo voltaic panels and is beginning to department out into different battery storage and residential charging options for electrical autos. It is without doubt one of the two dominant gamers within the US residential market and is rising shortly internationally, notably in Europe. It has had some points not too long ago with inventory ranges and has slowed manufacturing accordingly. There have additionally been some disincentives in some US markets for installations, decreasing demand. I see these as quick time period headwinds and my thesis is that the market has overreacted in its selloff of over 50% over the previous yr. Throughout that point, revenues, working earnings and money flows have all continued to develop and the corporate has a wholesome 20%+ free money movement margin, little debt and excessive returns on invested capital and capital employed; additional, the long run tail winds for renewable vitality are plentiful. There’s an argument that the corporate’s know-how has been considerably commoditized, however even when that’s true, competitors can not commoditise long run relationships constructed with installers over time and Enphase has labored arduous to ship glorious service to the companies it serves.

Video games Workshop – (OTCPK:GMWKF) is a small British firm primarily liable for creating merchandise underneath the Warhammer identify. It sells its merchandise instantly on-line and in its retail shops and is more and more open to licensing its mental property – prior to now few years to video video games and throughout the previous few months Amazon Prime for a possible TV collection. There isn’t a actual competitors for this recreation/artwork challenge/collectible/immersible universe. It is had a little bit of a run up this yr following pleasure for the aforementioned Amazon deal (which additionally excites me), so I’ve initiated a small place with the hope to growing it when the value cools down. 25% free money movement margins with a excessive dividend return and a beautiful administration workforce who perceive their market and are respectful to their followers, I imagine it is a nice small cap to purchase, maintain and overlook with incremental dividend re-investment to additional compound future returns.

Linde – (LIN) is the one dividend aristocrat I (now) personal. One other British firm, however with a really completely different remit – together with Air Liquide (OTCPK:AIQUF), it dominates the economic fuel house and a latest acquisition of rival Praxis signifies that it has a market main share within the manufacturing of many industrial gases. It’s the epitome of a boring firm, and its margins are barely decrease than the same old I purpose for; nonetheless, with publish merger efficiencies, it ought to have the ability to obtain round 18% free money movement margins. My thesis is sort of straight ahead: 1) we are going to at all times want industrial gases and extra importantly 2) I imagine that hydrogen gasoline will turn into an more and more essential a part of our world decarbonisation makes an attempt and Linde is in a robust place to learn.

Sells

Starbucks – (SBUX) is an effective firm. I had owned it for the most effective a part of a decade and been nicely rewarded over that point; nonetheless, as my investing philosophy slowly evolves, it was time to kill a few my infants. Starbucks has reached saturation ranges in its home markets and is reliant on rising markets for its progress. This might have an effect on future margins as revenues develop over time however earnings will not essentially maintain tempo. Additional, Starbucks’ free money movement margins are decrease than I’m now on the lookout for and their debt considerably greater. There are additionally smaller questions surrounding the CEO transition and unionisation makes an attempt from firm owned shops within the US. To make clear, I don’t suppose Starbucks is a nasty firm by any means – in actual fact, I imagine it’s a maintain for many traders and can hover round a market common return with a reliable and simple to grasp enterprise mannequin. If I have been retaining extra holdings in my portfolio, it could nonetheless have a spot, however as I actually whittle down, I am unable to discover a place for it in my prime 20 concepts.

Deere & Firm – (DE) is one other good firm, and like Starbucks, I’d proceed to carry it if I have been extra diversified. It has been a strong funding for me through the years, rising its earnings and elevating its dividend because it strikes in the direction of the inevitable good and linked evolution of its agricultural merchandise. I like corporations which have compounded over many many years, and though previous efficiency shouldn’t be a assure of future returns, it’s the most dependable indicator that we have now. Deere was bought because of its comparatively excessive capital expenditures, low free money movement margin and its more and more giant debt because of providing loans and cost plans to its enterprise clients. It is a threat that’s arduous to judge, which makes my means to forecast its future tougher than I would really like it.

PayPal – (PYPL) is an fascinating one. On paper, at its present valuation, it provides among the best threat adjusted funding alternatives within the giant cap house. Having stated that, that is the one funding that I’ve bought at a loss for a few years and to be frank – I am glad to see the again of it. Might it do an Adobe/Meta/Nvidia like mega restoration? Presumably. Would I care if it does? No. It has a historical past of poor/weird resolution making that has alienated a few of its customers and confused possibly of its traders. I discovered the brand new CEO appointment underwhelming and amidst growing competitors within the digital cost/pockets house, it is time for me to promote and reallocate funds into what I understand as higher alternatives.

Netflix – (NFLX). I actually beloved proudly owning Netflix. I get pleasure from a variety of its premium content material and it’s successfully what we deal with as tv in our family. I’ve owned the inventory for a very long time, having signed up throughout the first few weeks of it being first accessible as a streaming choice within the UK and have by no means cancelled. Having stated that, I’ve bought shares at completely different factors in its rise and had a comparatively small allocation of my portfolio left in it. As I thought-about what have been the perfect alternatives inside my investible universe, I mirrored on how media corporations have come and gone over the many years and regardless of intervals of dominance, no media firm has stayed on the prime for the period that I want to maintain my positions. Additional, I imagine that person generated content material will proceed to extend in each reputation and manufacturing values than scripted studio exhibits. This was a reluctant promote, however I imagine that it’s in the end the proper one.

Nintendo – (OTCPK:NTDOY) – Nintendo is one other good firm that was arduous to justify as nice – notably with my concentrate on a reasonably streamlined portfolio. I bought Nintendo comparatively not too long ago as administration appeared more and more occupied with extracting worth from its IP, with a trove of iconic characters accessible to be licensed into motion pictures and TV exhibits in addition to new generations of video video games for future consoles. I imagine that Nintendo has to modernise and as we endure a interval of transition from bodily purchases to digital purchases and possibly subscription providers for gaming, I ponder if Nintendo is prepared for the change. One other reluctant promote.

Know-how ETFs – I owned 2 know-how centered ETFs – one primarily based on an MSCI Semiconductor index, one other on an MSCI World know-how firm index. In focusing down my property, I merely determined to promote out and make investments extra into the Nasdaq 100, which I’ve arrange as a financial savings plan to speculate on a month-to-month foundation and hopefully reap the benefits of drawdowns over the subsequent yr or two.

My portfolio

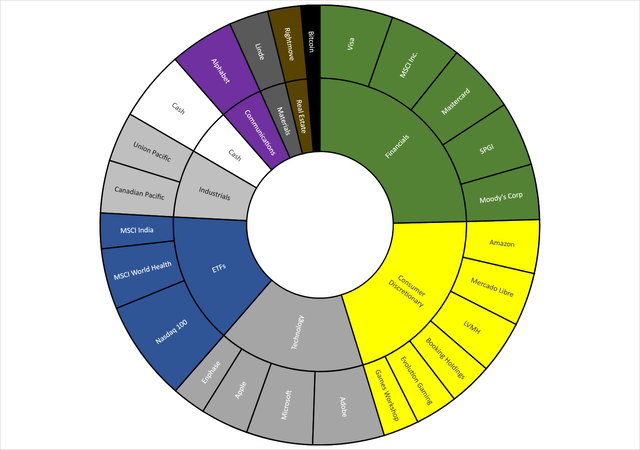

My portfolio by sector (Writer’s personal work)

5.23% Visa

5.18% MSCI Inc

5.15% Adobe

5.00% Mastercard

4.78% Microsoft

4.61% S&P International

4.66% Alphabet

3.99% Moody’s

3.84% MercadoLibre

3.85% Amazon

3.76% Canadian Pacific Railway

3.84% LVMH

3.60% Union Pacific

3.46% Apple

3.11% Reserving Holdings

2.65% Video games Workshop

3.05% Evolution Gaming

2.82% Linde

2.43% Rightmove PLC

2.43% Enphase

14.25% ETFs

1.36% Bitcoin

6.95% Money

Variety of Shares – 20

Variety of Complete Holdings (together with money) – 24

Median Market Cap (billions) – €113,999

Imply Common Age of Firm – 61 years

Weighted Gross Revenue Margin – 72.94%

Weighted Levered FCF Margin – 27.42%

Weighted ROIC – 35.32%

Weighted WACC – 11.34%

Weighted ROCE – 67.66%

PE on Value* – 31.29

FCF Yield on Value* – 3.62%

10 Yr Income Progress – 15.40%

10 Yr FCF Progress – 22.49%

*That is skewed by my Amazon holding.

My prime 6 particular person holdings by present market worth

Visa (V) – I maintain Visa as I imagine it is without doubt one of the finest corporations on the planet. Regardless of latest jumps in free money movement, Visa nonetheless has an extended pathway of progress with many elements of the world nonetheless unbanked and lots of developed markets akin to Germany and Japan having comparatively low card utilization in comparison with others. Sure, there may be competitors within the digital cost house, however the ubiquity of Visa (and Mastercard) and the safety it provides each its enterprise clients and their shoppers means that it’s going to stay a best choice for a few years. In the end, its most important competitor is money and it’s successful this gradual struggle of cost attrition. As well as, it converts round half of its income to free money movement, has very excessive returns on invested capital and capital employed (25.5% and 45.51% respectively).

MSCI – (MSCI). One other nice firm that has its fingers throughout the markets with excessive margin and recurring income streams. It supplies monetary knowledge to analysts, portfolio managers and institutional traders in addition to offering most of the greatest indices with which passive ETF suppliers create funding merchandise. It has free money movement margins round 35% and excessive returns on invested capital (25%) and capital employed (38%).

Adobe (ADBE) – I maintain Adobe as a result of it’s a regular compounder that grows its revenues and money flows in virtually each market situation. It has an more and more diversified income stream and is benefiting from the transfer in the direction of synthetic intelligence by doing one thing I imagine could be very intelligent – slightly than merely designing AI that can scrape the web and can inevitably face copyright infringement regulation fits sooner or later, it’s creating its personal knowledge set from its artistic suite. It’s an extremely nicely managed firm and even when its Figma deal falls via, it nonetheless has such a complete software program suite that it’s going to proceed to develop for a few years. It is present free money movement margin is just under 40% with returns on invested capital and capital employed at 20.53% and 33.97% respectively.

Mastercard (MA) – See Visa.

Microsoft – (MSFT) is a tech ETF unto itself. If I have been solely to carry one inventory within the know-how sector, it could be Microsoft. If I have been solely to carry one inventory interval, it could be Microsoft. It has fingers in lots of rising pies and some monopolistic or oligopolistic elements of its enterprise, together with Home windows, Workplace, Xbox, Bing (do not chortle) and the jewel within the crown – the cloud infrastructure as a service platform, Azure. It has a free money movement margin of round 23% in the mean time and because it continues to maneuver legacy applications onto recurring cloud subscriptions, I’m assured this may proceed to tick up over time. It has a 25% return on invested capital and a virtually 40% return on capital employed.

S&P International – (SPGI) is one other of the best corporations on the planet. It has an enormous knowledge set associated to commodities and shares all around the globe and sells it at very excessive margins. It’s a part of a small oligopoly together with Moody’s (MCO) and Fitch (privately listed): to ensure that corporations to boost cash from the debt markets, it should obtain credit score rankings from 2 of those 3 corporations. S&P additionally receives cash from indices it licenses to ETF suppliers, akin to the ever-present S&P 500. Every of those elements of its enterprise are excessive margin and principally recurring income. Its present free money movement margin is just under 30%; nonetheless, its returns on invested capital and capital employed measurements are presently lowered by its latest acquisition of IHS Markit, however I am assured they’ll tick again up greater after these rising pains have settled.

Benchmarking

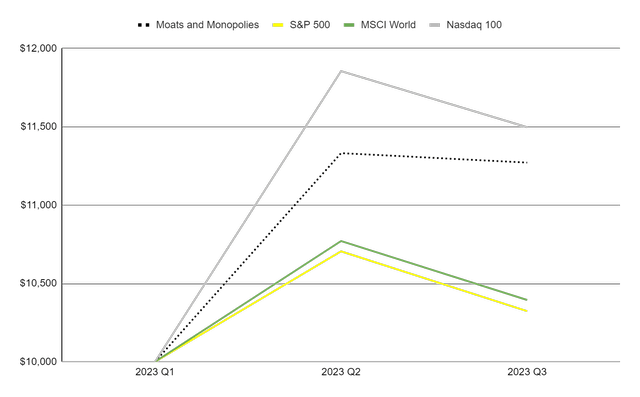

Benchmarking the Moats and Monopolies portfolio (Writer’s personal work)

After I determined to start my portfolio share, I additionally needed to supply full transparency by benchmarking my portfolio’s efficiency towards the primary benchmark indices – assuming an imaginary $10000 beginning quantity. Within the graph above, you may see Moats and Monopolies portfolio is the dotted line, with the S&P 500 colored yellow, the MSCI World inexperienced and the Nasdaq 100, gray. Rain or shine, I’ll proceed to replace this every quarter shifting ahead.

Thanks for studying and be happy to observe alongside. I recognize any constructive and type suggestions in addition to any funding concepts you want to share!

[ad_2]

Source link