[ad_1]

Pakin Jarerndee/iStock through Getty Pictures

High quality Shares

September has not been a great month for equities throughout the previous few years, 2023 was no exception. The SPDR S&P 500 Belief ETF (SPY) fell by 4.74% final month, in 2022 it posted a lack of 9.24%, in 2021 it dropped by 4.66% and in 2020, the yr I began monitoring this collection, the ETF posted a lack of 3.74%. No different month has been so persistently unhealthy for SPY over the past 4 years. Vanguard’s Dividend Appreciation ETF (VIG) fell by 4.26% final month, and it too posted losses through the three prior Septembers. My watchlist from final month carried out even worse, posting a lack of 6.41%.

12 months-to-date my watchlist stays forward of VIG, +5.62% vs. +3.84%, however trails SPY that’s nonetheless up 13.03%.

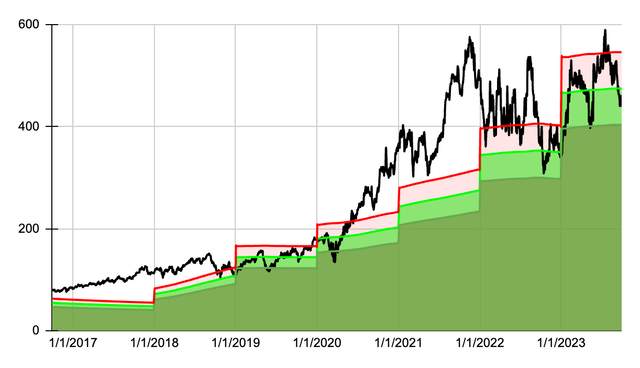

Whereas SPY continues to outpace my watchlist this yr, since inception, the watchlist maintains a decent degree of alpha. The long-term, 37-month, annualized return for my watchlist is 10.83% in comparison with 7.91% for VIG and eight.49% for SPY.

My purpose is to not beat SPY or VIG however to generate a long-term fee of return of at the very least 12%. Whereas we see the long run annualized fee of return dip under this goal I’m assured it’s going to bounce again within the subsequent few months.

The primary focus of this watchlist is to search out the most effective mixture of high quality firms buying and selling for engaging costs. I consider that is the optimum long-term technique to construct wealth.

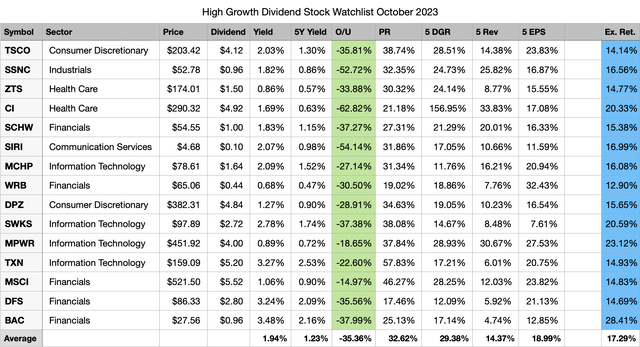

The highest 15 dividend progress shares for October supply a median dividend yield of 1.94%. Collectively, they’ve elevated dividend funds at a fee of 29.38% over the past 5 years. Primarily based on dividend yield concept, these 15 shares are about 35% undervalued proper now, and I believe they’re poised to supply sturdy long-term returns.

I’d advocate two approaches to dividend investing. The primary is to dollar-cost common into at the very least 10-20 or extra high quality dividend-paying shares throughout a number of sectors and industries. By dollar-cost averaging, you remove the chance of making an attempt to worth a inventory and over an extended sufficient interval, theoretically, you’ll purchase shares at market highs, lows, and in-between leading to a median value foundation someplace within the center. The second technique carries just a little extra danger. Put money into undervalued shares, additionally dollar-cost averaging into at the very least 10-20 distinctive high quality firms throughout a number of sectors and industries. The extra danger with this method comes from the possibility that your valuation technique proves to be incorrect. Nonetheless, by investing in a number of distinctive shares, the percentages that you simply precisely establish at the very least a couple of undervalued shares will increase. The ensuing upside from a couple of appropriate picks might greater than offset the underperformance from the unhealthy ones.

Watchlist Standards

The factors used to find out which shares are included in my high-growth dividend inventory watchlist stays unchanged for October 2023. It’s made up of the 8 elements listed under which have traditionally outperformed the broad universe of dividend-paying shares when analyzed collectively.

Market Cap of at the very least $10 billion. Payout Ratio no larger than 70%. 5-year Dividend Progress fee of at the very least 5%. 5-year Income Progress fee of at the very least 2%. 5-year EPS Progress fee of at the very least 2%. S&P Earnings and Dividend Score of B+ or higher. Large or Slender Moat (Morningstar). Exemplary or Customary Administration Group (Morningstar).

The principles recognized 131 shares for the month that have been all ranked primarily based on the above-mentioned metrics with the exclusion of market cap. I then computed the present valuation for every inventory utilizing dividend yield concept. All shares have been ranked for each high quality and valuation and sorted by the most effective mixture of each. Subsequent, I computed a forecasted fee of return for the subsequent 5-year interval for every of the shares. This return relies on forecasted earnings progress, a return to honest worth, and the dividend yield.

The best-ranked 15 shares with a forecasted return larger than or equal to 12% have been chosen for the watchlist. The long-term speculation for this watchlist is that it’ll outperform a broad high quality dividend fund akin to Vanguard’s Dividend Appreciation ETF, VIG, and that it’ll generate a 12% annualized fee of complete return.

Watchlist For October 2023

Created by Writer

Above are the 15 shares I’m contemplating for additional analysis through the month. They’re sorted in descending order by their rank and 5-year dividend progress fee.

The “O/U” column represents potential undervalue; this can be a comparability of the present dividend yield to the historic dividend yield as a operate of share worth.

The anticipated return within the desk above was computed utilizing a reduced 5-year EPS forecast, a return to honest worth, and the present dividend yield. There’s additionally a margin of security constructed into the forecasted return. These figures are simply assumptions primarily based on the accessible knowledge and there’s no assure these returns shall be attained.

There are 2 modifications to the highest 15 checklist from the prior month. FMC Company (FMC) and Greenback Common (DG) have fallen additional down the checklist, or don’t meet the 12% anticipated fee of return threshold and have been changed by Monolithic Energy Techniques (MPWR) and Texas Devices (TXN).

Previous Efficiency

The highest 15 checklist for September posted a lack of 6.41% and sees its long-term alpha over each benchmarks lower. The long-term annualized fee of return for the watchlist fell from 13.63% final month to 10.83%. My goal fee of return is 12%, and regardless of the volatility out there this yr, I stay optimistic that this watchlist will climb again above this purpose in the long term.

Month

Prime 15

All

VIG

SPY

1 Month

-6.41%

-5.43%

-4.26%

-4.74%

3 Month

-6.11%

-3.34%

-3.86%

-3.23%

6 Month

-2.54%

0.18%

1.88%

5.17%

1 12 months

20.29%

18.85%

17.34%

21.58%

2020

6.27%

6.15%

9.09%

7.94%

2021

33.81%

31.55%

23.75%

28.76%

2022

-8.58%

-15.12%

-9.80%

-18.16%

2023

5.62%

6.25%

3.84%

13.03%

Since Inception

37.31%

25.95%

26.46%

28.55%

Annualized

10.83%

7.77%

7.91%

8.49%

Click on to enlarge

Prime 5 previous and current watchlist shares in September 2023:

UnitedHealth Group (UNH) +6.21% Humana (HUM) +5.58% Progressive (PGR) +4.37% Cigna (CI) +4.01% W. R. Berkley Company (WRB) +3.60%

Two of the highest 15 shares chosen for the month of September have been amongst the highest 5 performing shares final month, Cigna and W.R. Berkley. In complete, there have been 74 distinctive dividend shares chosen by this watchlist since September of 2020.

Prime 5 Shares by Whole Return since becoming a member of the watchlist:

NVIDIA (NVDA) +227.29% (30 months). Computerized Information Processing (ADP) +84.82% (37 months). Progressive (PGR) +63.59% (32 months). CDW Company (CDW) +58.02% (32 months). UnitedHealth Group (UNH) +57.04% (32 months).

Since not all shares have been on the watchlist for the total 37 months of its existence, evaluating a month-to-month common return might help normalize the outcomes. Listed here are the highest 5 shares with the best common month-to-month return since becoming a member of the watchlist.

NVIDIA (NVDA) +4.03% (30 months) EOG Sources (EOG) +1.99% (7 months) Computerized Information Processing (ADP) +1.67% (37 months) Progressive (PGR) +1.55% (32 months) CDW Company (CDW) +1.44% (32 months)

Drivers Of Alpha

The watchlist underperformed VIG in September. 5 watchlist shares outpaced the ETF final month.

(CI) +4.01% (WRB) +3.60% (SIRI) +2.73% (DPZ) -1.93% (DFS) -3.82%

The remaining 10 shares underperformed VIG.

(BAC) -4.50% (MCHP) -4.63% (MSCI) -5.62% (TSCO) -7.07% (SCHW) -7.19% (SSNC) -8.50% (ZTS) -8.68% (SWKS) -9.33% (FMC) -21.65% (DG) -23.61%

Whole Return For All Watchlist Shares

Listed here are the whole returns for all previous and current watchlist shares since first showing on the watchlist. Out of the 74 shares which might be on this checklist, 52 (54 final month) have optimistic complete returns and 22 have unfavourable complete returns, the common return is 15.00% (21.87% final month). The watchlist has been round for 37 months, the common length for all 74 shares is 28.08 months.

Image

Since Becoming a member of

Depend

NVDA

227.29%

30

ADP

84.82%

37

PGR

63.59%

32

CDW

58.02%

32

UNH

57.04%

32

CTAS

55.37%

32

COST

54.92%

37

INTU

50.74%

37

KLAC

50.03%

29

TSCO

49.56%

32

AMAT

46.58%

32

TJX

45.14%

32

MSFT

43.74%

37

MSCI

41.13%

37

APH

38.27%

32

NOC

34.40%

37

LRCX

33.79%

32

ACN

33.38%

37

WST

33.04%

37

BK

32.16%

37

EXPD

31.65%

32

HUM

30.59%

31

GGG

30.10%

37

FDS

28.13%

37

LOW

26.83%

37

MPWR

25.79%

31

CI

23.94%

19

ROL

23.73%

20

FDX

23.62%

19

JPM

21.00%

32

FAST

20.99%

37

LMT

19.15%

37

CMCSA

16.82%

37

ROP

15.27%

37

EOG

14.80%

7

HD

14.49%

37

SHW

13.38%

32

BBY

13.08%

15

MA

12.35%

37

BLK

12.13%

37

DE

12.02%

22

TMO

11.54%

30

V

10.82%

37

MCO

10.37%

37

SCHW

10.15%

32

BX

8.77%

14

ZTS

5.58%

8

ATVI

4.39%

29

MCHP

4.24%

4

ICE

3.33%

32

WRB

3.14%

6

TXN

2.56%

32

MS

-3.35%

28

DFS

-3.82%

1

USB

-4.01%

35

DPZ

-4.04%

37

KR

-4.23%

3

BAC

-4.50%

1

JKHY

-5.15%

37

NTRS

-6.33%

37

GS

-8.44%

26

ALLE

-12.81%

3

TROW

-14.65%

37

SSNC

-18.22%

31

SBUX

-18.89%

21

LAD

-23.18%

30

SIRI

-29.86%

18

SWKS

-33.86%

21

FMC

-43.49%

16

DG

-46.70%

30

BALL

-47.07%

21

MKTX

-59.58%

32

AAP

-66.54%

15

PARA

-69.32%

27

Click on to enlarge

Dividend Evaluation for New Shares

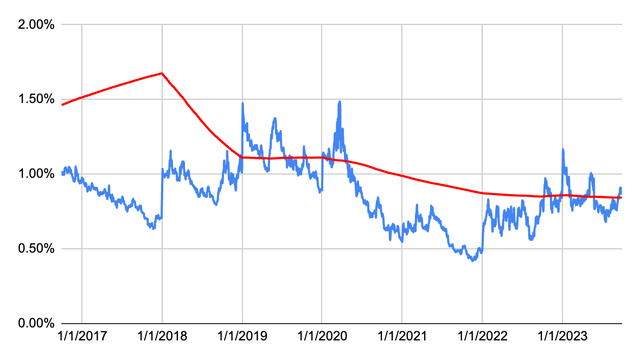

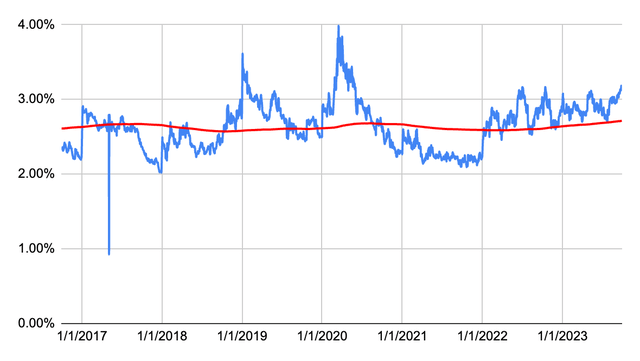

Beneath are a 7-year dividend yield concept chart, a dividend historical past chart, and a dividend progress desk for the two new shares on the watchlist this month.

First up is Monolithic Energy Techniques.

Created by Writer Created by Writer

12 months Dividend Progress CAGR 2023 4.00 33.33% 2022 3.00 25.00% 33.33% 2021 2.40 20.00% 29.10% 2020 2.00 25.00% 25.99% 2019 1.60 33.33% 25.74% 2018 1.20 50.00% 27.23% 2017 0.80 0.00% 30.77% 2016 0.80 0.00% 25.85% 2015 0.80 77.78% 22.28% 2014 0.45 -55.00% 27.48% 2013 1.00 14.87% 2012 2011 Click on to enlarge

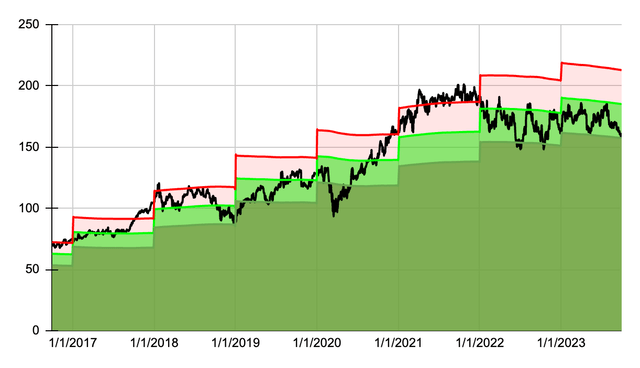

Up subsequent is Texas Devices.

Created by Writer Created by Writer

12 months Dividend Progress CAGR 2023 5.02 7.04% 2022 4.69 11.40% 7.04% 2021 4.21 13.17% 9.20% 2020 3.72 15.89% 10.51% 2019 3.21 22.05% 11.83% 2018 2.63 24.06% 13.80% 2017 2.12 29.27% 15.45% 2016 1.64 17.14% 17.33% 2015 1.40 12.90% 17.31% 2014 1.24 15.89% 16.81% 2013 1.07 48.61% 16.72% 2012 0.72 28.57% 19.31% 2011 0.56 20.05% Click on to enlarge

[ad_2]

Source link