[ad_1]

pcess609

Transcontinental Inc. (TSX:TCL.A:CA)(OTCPK:TCLAF) lately delivered useful expectations close to working margin progress due to latest value initiatives and the deployment of raddarTM. I imagine that latest investments in sustainable packaging may convey the eye of ESG funds and buyers involved in sustainability investments. Beneath my completely different case situations, I obtained a valuation that seems considerably richer than the present inventory worth. Sure, I did see dangers coming from the full quantity of monetary debt or failed M&A integrations, nonetheless TCLAF does look low-cost.

Enterprise mannequin

Transcontinental is a frontrunner within the packaging trade in Canada, america, and South America. Moreover, inside Canada the place its facilities are operational, this firm is the biggest printing firm within the nation.

The corporate affords, together with these providers, primarily based on its expertise out there, product design, advertising and marketing, and product launch methods to its purchasers.

The numbers from the final annual report embrace 50% of income coming from the exercise of its packaging space, whereas the remaining 50% is distributed in its printing actions in addition to schooling and coaching actions. 47% for its printing actions and three% for its schooling and coaching actions, the place it publishes, prints, and markets bilingual books in English and French primarily made for academic functions. Though it represents a small share of the corporate’s annual income, this enterprise section seems to be the biggest writer of bilingual schooling books in Canada.

Every of those areas represents a section of operations: packaging, printing, graphics, and enhancing. The primary of those has working amenities in america, Canada, and a few South American nations, constituting the laborious core of the corporate’s enterprise.

Outlook: Price Initiatives Are Anticipated To Deliver Working Margin Progress

Contemplating the latest outlook given in the newest quarterly launch, I imagine that it’s time to take a look on the firm. First, administration expects a rise in profitability even disclosing sure pressures on quantity.

By way of profitability, regardless of the strain on quantity, we count on a rise in adjusted working earnings earlier than depreciation and amortization for fiscal yr 2023 in comparison with fiscal yr 2022. Supply: Quarterly Press Launch

Moreover, administration identified that future value discount initiatives and the continued deployment of raddarTM may have a useful impact on the revenue margins. Because of this, I imagine that enough FCF progress may result in a rise within the firm valuation.

This anticipated quantity discount, mixed with the impact of inflationary strain, ought to lead to decrease adjusted working earnings earlier than depreciation and amortization for fiscal yr 2023 in comparison with fiscal yr 2022. We count on this lower to be partially offset by value discount initiatives and the continued deployment of raddarTM which permits us to safe our retail flyer printing actions. Supply: Quarterly Press Launch

Market Expectations Embrace FCF/Web Gross sales Progress And FCF Progress

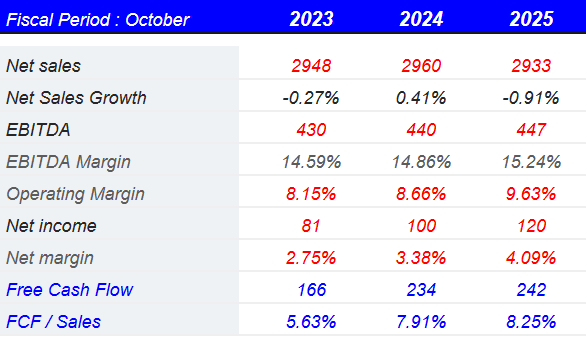

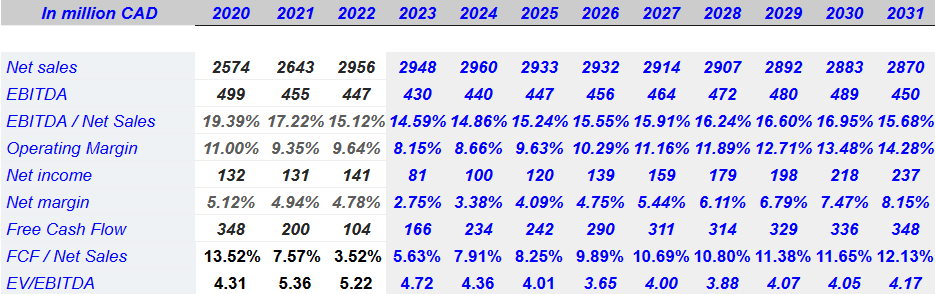

I imagine that probably the most fascinating from the expectations of different market analysts is the free money flows anticipated for the years 2023, 2024, and 2025. Even when the EBITDA margin and the web gross sales are anticipated to stay comparatively steady with near 0% gross sales progress and EBITDA/Web gross sales of 14%-15%, I feel that the numbers anticipated are useful.

2025 web gross sales are anticipated to be near CAD2.933 billion, with web gross sales progress of -0.9%, EBITDA of CAD447 million, with EBITDA margin shut to fifteen%, and web revenue of CAD120 million. Lastly, 2025 free money move could be near CAD 242 million, with FCF/web gross sales of 8.25%. Market analysts count on a rise within the FCF margin of shut to three% from 2023 to 2025.

Supply: S&P

Stability Sheet

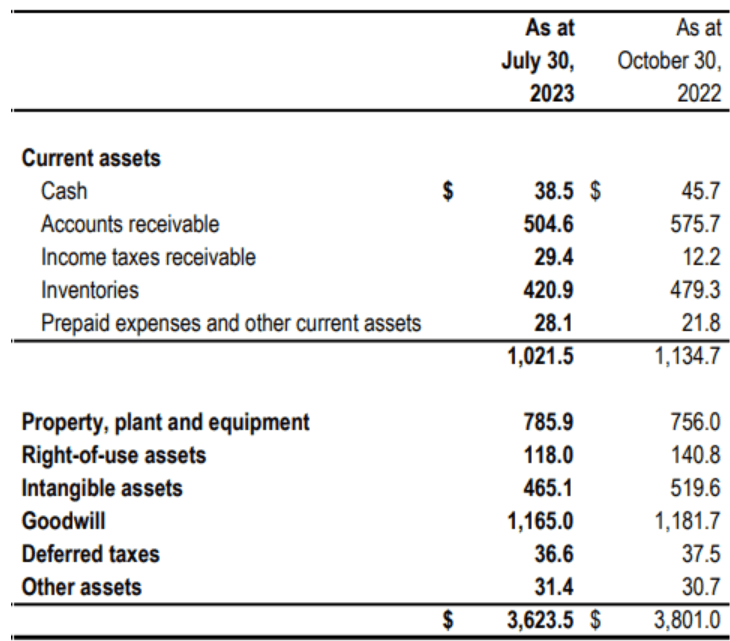

As of July 30, 2023, the corporate reported CAD38 million in money, with accounts receivable of CAD504 million, inventories of CAD420 million, and present belongings near CAD1 billion. The ratio of present belongings/present liabilities is bigger than 2x, so I feel that liquidity doesn’t appear to be an issue right here. Long run belongings embrace CAD785 million, with goodwill near CAD1.1 billion, and complete belongings of about CAD3.6 billion.

Supply: Quarterly Press Launch

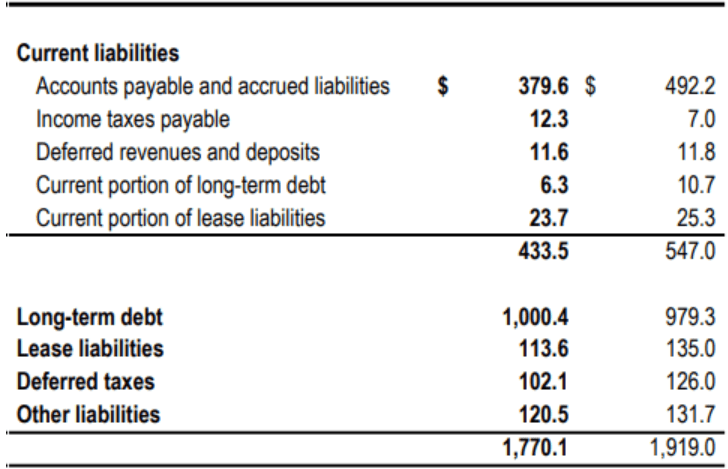

The record of liabilities doesn’t seem worrying. With accounts payable of CAD379 million, complete present liabilities are equal to CAD433 million, and long-term debt is the same as CAD1 billion. Given the present quantity of debt and the full quantity of goodwill, the corporate appears to finance new acquisitions due to long-term debt. The corporate was based within the Seventies, and has acquired many targets up to now, so I imagine that administration is aware of effectively learn how to do M&A. With this in thoughts, I’m not actually involved in regards to the complete quantity of debt.

Supply: Quarterly Press Launch

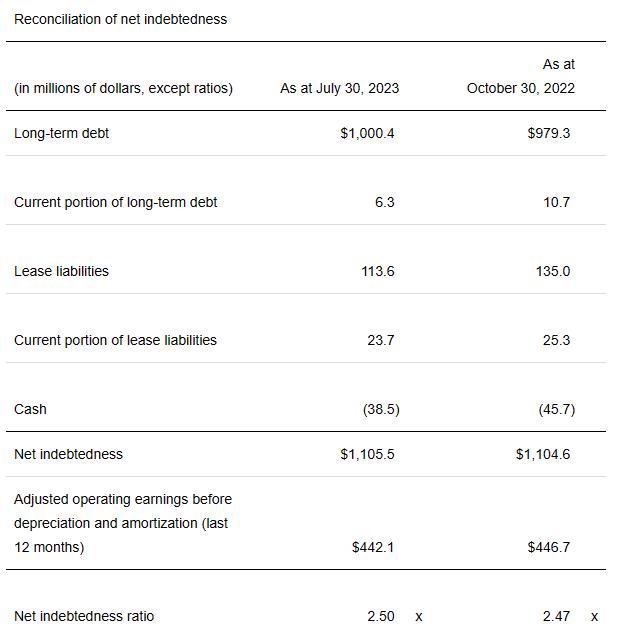

Within the final quarterly report, the corporate famous web debt near CAD1.105 billion, together with the debt and the full quantity of leases. The web indebtedness ratio is near 2.5x, which doesn’t appear that elevated.

Supply: Quarterly Press Launch

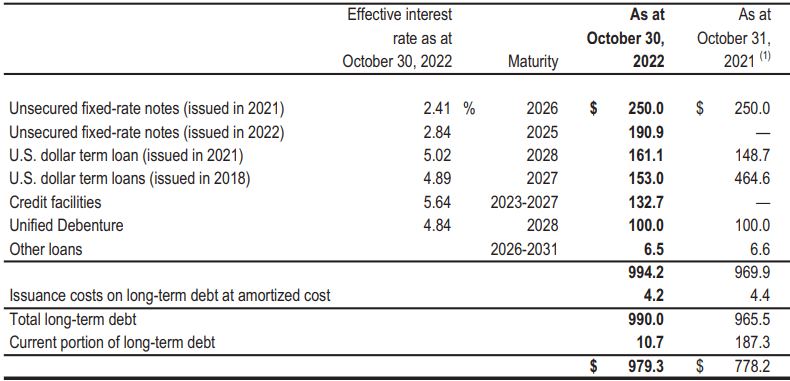

With regard to the efficient rate of interest paid, the corporate reported curiosity between 2.4% and 5.64% and maturities near 2023 and 2026. Given the FCF, I imagine that the corporate is in an excellent place to pay its debt obligations. I used a few of these figures in my valuation mannequin, so I imagine that buyers might want to take a look at it.

Supply: Quarterly Press Launch

First Catalyst: M&A, Introduction Of New Contracts, And New Tools Bought Will Most Possible Deliver Web Gross sales Progress And FCF Progress

Transcontinental maintains an lively progress technique pushed by each the natural progress of its gross sales within the packaging section and the opportunity of buying nationwide or worldwide companies throughout the areas by which it operates. Natural progress is predicted because of the buy of latest tools, new contracts signed, and the introduction of latest merchandise within the model throughout 2023 and 2024.

Within the printing section, higher outcomes are additionally anticipated than that in 2022, which is able to serve for the amortization of losses and the switch of the rise in prices that the corporate skilled within the earlier yr.

From the rise in earnings and margin because of the progress of its industrial actions in these two segments, the corporate expects to have enough quantities and liquidity to proceed with its present investments, cut back debt margins by the fee of obligations, and have higher margins for the search and investigation of potential acquisitions.

I Consider That Additional Investments In Sustainable Packaging Options Might Not Solely Deliver Lengthy Time period Value, However Additionally Consideration From ESG Funds

Within the final quarterly report, administration famous that latest investments in sustainability within the Packaging Sector will almost definitely convey long run progress. For my part, if the corporate efficiently communicates its funding in sustainability to the market, the demand for the inventory may improve. Let’s needless to say there’s a important variety of new funds on the market specialised in firms that incorporate environmental, sustainable investing, social sustainability, and company governance elements of their funding processes.

Within the Packaging Sector, our investments in sustainable packaging options place us effectively for the longer term and must be a key driver of our long-term progress. Supply: Quarterly Press Launch

Sustainable Finance Market dimension was valued at USD 4.2 trillion in 2022 and is projected to register a CAGR of twenty-two.4% between 2023 and 2032. Supply: Sustainable Finance Market Dimension

Base Case State of affairs

Considering earlier monetary figures and my very own assumptions, beneath my base situation, I assumed small web gross sales progress from 2023 to 2031 together with a small improve within the EBITDA margin and FCF progress.

My outcomes included 2031 web gross sales of CAD2.8 billion, with an EBITDA margin of 15.6%, working margin of 14%, and web margin shut to eight.1%. In addition to, with FCF/web gross sales near 12%, 2031 FCF could be near CAD348 million.

Supply: My Expectations

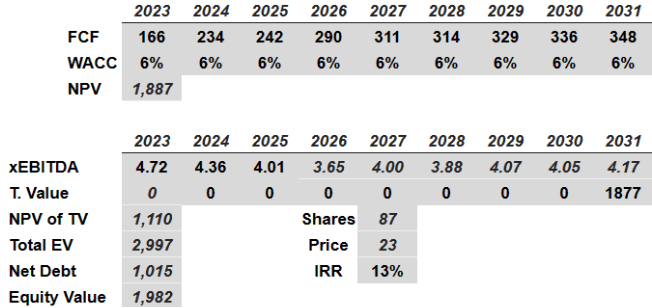

If we additionally assume a WACC of 6%, which isn’t removed from the price of debt reported by administration, and 2031 EV/EBITDA of 4.17x, the implied enterprise worth could be CAD2.9 billion. The fairness worth would additionally stand at near CAD1.9 per share, and the implied truthful worth could be near CAD22-CAD23 per share with an inner charge of return of 13%.

Supply: My Expectations

Finest Case State of affairs

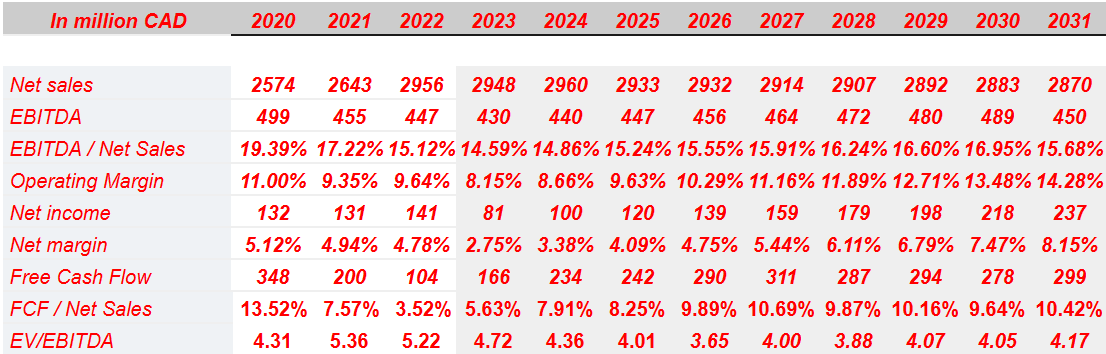

After rigorously reviewing earlier monetary outcomes, I included what I imagine is the very best potential consequence for Transcontinental. Beneath my greatest case situation, my numbers had been 2031 web gross sales of CAD2.870 billion, with EBITDA of CAD450 million, EBITDA / web gross sales of about 15%, and working margin of 14%. Moreover, with web revenue near CAD237 million, 2031 free money move could be near CAD299 million.

Supply: My Expectations

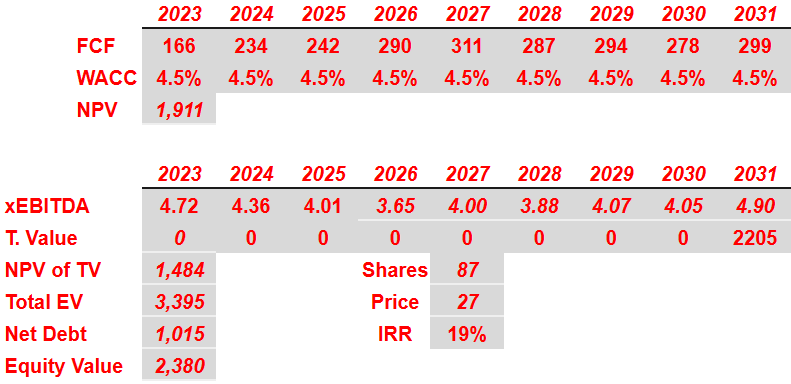

If we assume a WACC of 4.5%, the web current worth of the FCF from 2023 to 2031 could be near CAD1.9 billion. Now, with a terminal EV/EBITDA of 4.9x, the NPV of future terminal worth and the NPV of future FCF could be near CAD3.3 billion. Subtracting web debt of CAD1.10 million, the implied fairness could be near CAD2.38 billion. Lastly, the implied worth could be near CAD27 per share, and the IRR could be 19%.

Supply: My Expectations

Rivals

Though there are, on the nationwide degree, not numerous rivals providing providers just like these of the corporate, the aggressive surroundings is made up of different firms which have higher useful resource capabilities, higher technical information in regards to the operation of the merchandise throughout the trade, and broader gross sales channels than these accessible at Transcontinental.

Alternatively, along with the rivals throughout the native space, there are numerous firms from america that handle to insert themselves into parts of the Canadian market. Market situations are at present open as a rise in demand is predicted for each the packaging and printing segments and future consolidation within the medium time period.

Dangers

To begin with, we should level out that the worldwide printing trade is present process main adjustments since a big portion of consumers has digital alternate options to provide the identical merchandise. This issue, added to attainable laws on the door-to-door distribution of posters and methods that had been beforehand frequent in this kind of market, might characterize a threat issue within the quick time period for the event of the printing section.

In one other sense, though Transcontinental expects to keep up natural progress in its gross sales all through 2023, this projection will not be true, and could also be affected by the good rising competitors throughout the markets, which might lead the corporate to must adapt its gross sales technique progress within the quick time period by not representing the anticipated progress in monetary outcomes.

We should add the context of an unsure financial system generally, any minimize within the distribution and provide chains, the lengthy gross sales cycle typical of this trade, and the debt conditions that might finally result in not having credit score traces for funding and future acquisitions.

Conclusion

Transcontinental lately delivered useful expectations about future working margin progress pushed by value initiatives in addition to inorganic progress. For my part, it’s also fairly useful that administration made investments to develop extra sustainable packaging. Because of this, I imagine that ESG funds and different kinds of buyers might convey additional demand for the inventory. Beneath my two case situations, I obtained a double digit IRR and a goal valuation that’s considerably greater than the present inventory worth. There are some dangers derived from the full quantity of debt, potential provide chain disaster, and inflation, nonetheless I feel that the inventory is undervalued.

Editor’s Word: This text discusses a number of securities that don’t commerce on a serious U.S. alternate. Please pay attention to the dangers related to these shares.

[ad_2]

Source link