[ad_1]

vichie81

By Warren Patterson, Head of Commodities Technique

Weak gasoline weighs on crude

On the floor, it’s tough to pin yesterday’s sell-off on the EIA’s weekly stock report. US business crude oil inventories fell by 2.22MMbbls over the week, while crude shares at Cushing, the WTI supply hub, elevated by a modest 132Mbbls. So, nothing manifestly bearish in these numbers.

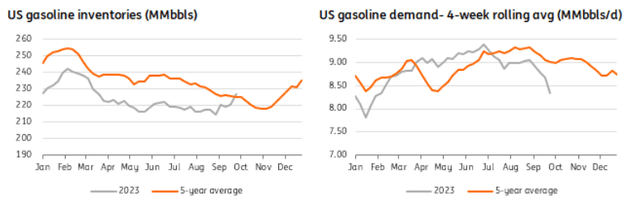

Nevertheless, what was extra bearish within the launch had been the gasoline numbers. US gasoline inventories elevated by virtually 6.5MMbbls over the week – the biggest improve since January 2022. This transfer has helped to take whole US gasoline inventories again above the five-year common for this time of yr. This huge construct occurred although refiners lowered working charges by 2.2pp over the week to 87.3%. Subsequently, it was weaker demand which was behind the big gasoline inventory construct. Seasonally, it’s regular to see gasoline demand falling throughout this time of yr with the driving season nicely and actually behind us. Nevertheless, even factoring on this seasonality, implied demand was very weak over the past week. Implied gasoline demand fell by 605Mbbls/d WoW to eight.01MMbbls/d. That is the weakest demand for this time of yr because the early 2000s. The four-week rolling common demand quantity has additionally been trending under the five-year common since July and this newest information level has dragged it to the bottom ranges since 2000. That is probably elevating considerations over demand, significantly on this increased worth surroundings.

This weak spot has weighed closely on the gasoline market and that is nothing new with the immediate RBOB gasoline crack falling from greater than US$40/bbl in mid-August to lower than $8/bbl at the moment. The weak spot in gasoline has fed by means of to weaker refinery margins, which seems to have finally fed by means of to crude oil.

US gasoline shares transfer increased, while demand developments decrease

EIA, ING Analysis

The charges surroundings isn’t serving to oil

The more moderen worth motion in oil additionally means that the rally we noticed over a lot of the third quarter has exhausted itself. The present charges surroundings together with the USD power has solely offered stronger headwinds to the market. US 10-year Treasury yields have hit their highest ranges since 2007 this week, while the USD index is at its strongest ranges since November 2022. Till we begin to see a shift within the ‘increased for longer’ narrative with regards to charges, the oil market will probably wrestle to push considerably increased.

Clearly, the exhaustion of the latest rally can even give Saudi Arabia and Russia confidence of their choice to proceed with their further voluntary provide cuts by means of till yr finish. We nonetheless forecast a big deficit for the rest of this yr, which means that costs will stay comparatively nicely supported. We proceed to count on ICE Brent to common US$92/bbl over 4Q23.

Content material Disclaimer

This publication has been ready by ING solely for data functions no matter a selected person’s means, monetary state of affairs or funding targets. The data doesn’t represent funding advice, and neither is it funding, authorized or tax recommendation or a proposal or solicitation to buy or promote any monetary instrument. Learn extra.

Unique Put up

[ad_2]

Source link