[ad_1]

piyaset/iStock through Getty Photos

Just a few weeks in the past, I famous that constructive catalysts have been percolating for the wheat market, and that I used to be ready for additional constructive updates on the catalysts earlier than issuing a purchase suggestion.

This previous week, we received affirmation on two of our catalysts, with El Niño situations confirmed and the Russia/Ukraine grain deal falling aside. I’m upgrading the Teucrium Wheat ETF (NYSEARCA:WEAT) to a purchase to make the most of a attainable worth surge in wheat as El Niño will seemingly result in worsening drought situations in North America and excessive climate could disrupt grain manufacturing in the remainder of the world.

El Niño Confirmed With Sea Temperatures Seemingly To Break Document

This previous week (June eighth), the Nationwide Oceanic and Atmospheric Administration (“NOAA”) formally confirmed that El Niño has begun, with El Niño situations anticipated to strengthen into the Northern Hemisphere winter season.

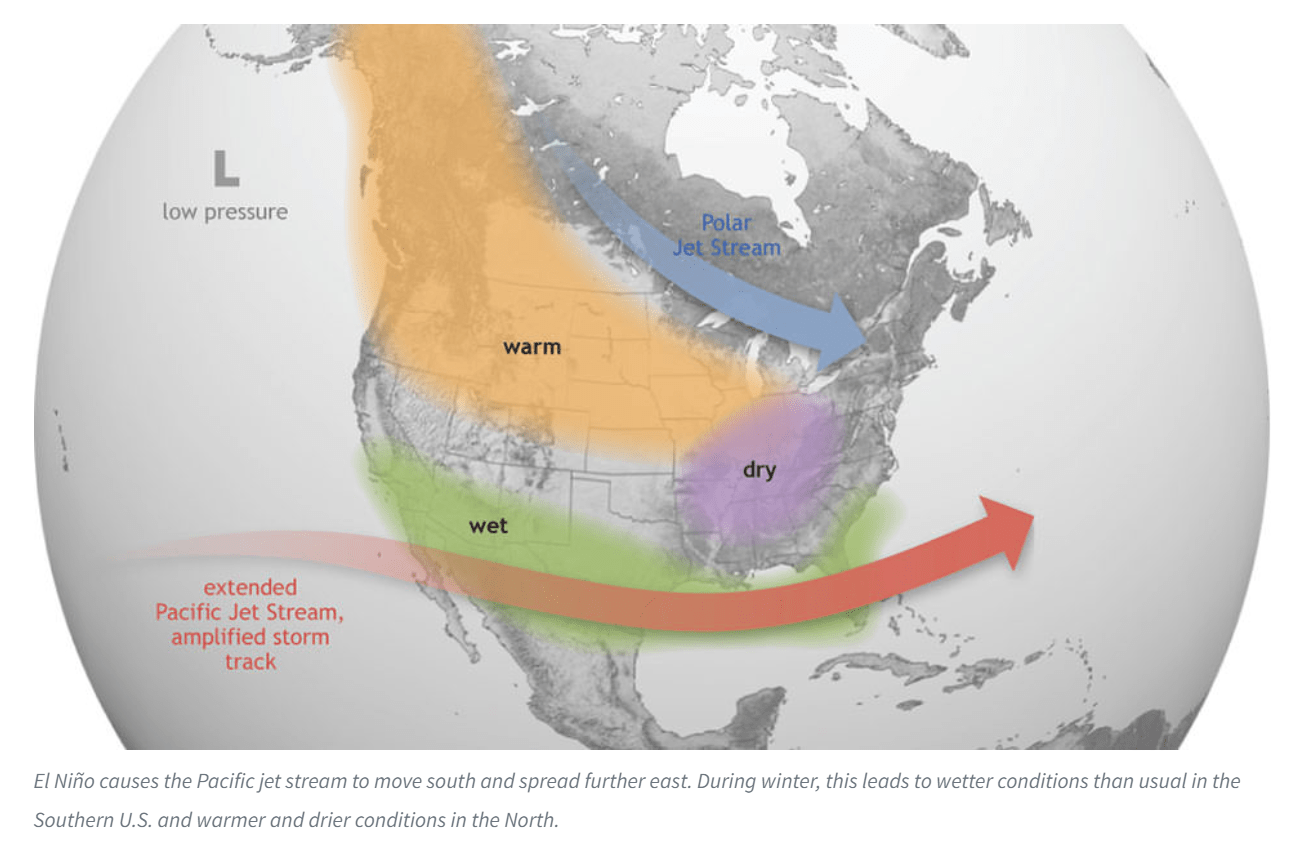

Recall from my earlier article, “El Niño tends to trigger areas within the northern U.S. and Canada to be dryer and hotter than regular, which might be detrimental to wheat manufacturing” (Determine 1).

Determine 1 – El Niño may deliver dryer and hotter climate to U.S. and Canada (NOAA)

Though the USDA at the moment expects ample wheat provides in its newest June WASDE report, I worry wheat situations will deteriorate within the coming months as a result of El Niño.

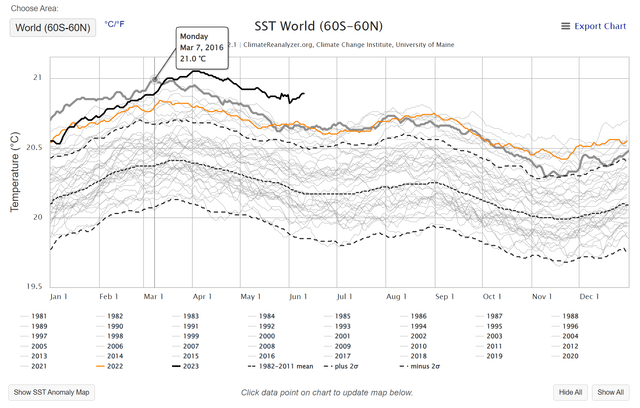

Extra importantly, coming into the present El Niño, world sea floor temperatures are already close to peak ranges, even with the cooling results of a 3-year La Niña. As the present El Niño develops over the approaching months, we’ll very seemingly smash by means of 2016’s El Niño-driven temperature data (Determine 2).

Determine 2 – Floor sea temperatures close to document highs to start present El Nino (climatereanalyzer.org)

Excessive sea temperatures are sometimes related to excessive climate occasions, particularly for droughts and tropical storms. In the previous couple of months, we have now seen record-shattering warmth waves throughout giant swathes of Asia and large wildfires in Canada. The growing El Niño will seemingly create much more excessive climate over the approaching months, which might be detrimental to meals manufacturing internationally.

As I highlighted in my prior article, one space particularly which have benefited from La Niña was Australia, which loved a number of record-breaking wheat crops and was the primary ballast to world wheat costs final 12 months when Russia invaded Ukraine.

Nevertheless, the Australian authorities is now projecting wheat manufacturing to say no by 34% in 2023/24, under the ten 12 months common, because of the unfolding El Niño. Australia is the world’s second-largest wheat exporter, supplying Asian consumers. If Australian wheat exports are in the reduction of, Asian consumers must supply wheat from elsewhere.

Russia Could Not Renew Wheat Export Deal

Sadly, one space the place wheat exports could decline can be Ukraine / Russia. Though Russia renewed the July 2022 export deal on the final minute in Could, the Russian authorities has indicated they see ‘no prospect’ of extending the settlement when it expires in mid-July.

It is because current escalation in assaults from either side (Russia allegedly destroyed the Kakhovka dam, whereas Ukraine is rumoured to be behind the destruction of Russia’s ammonia pipeline) could make any deal untenable.

WEAT ETF As A Medium-Time period Play

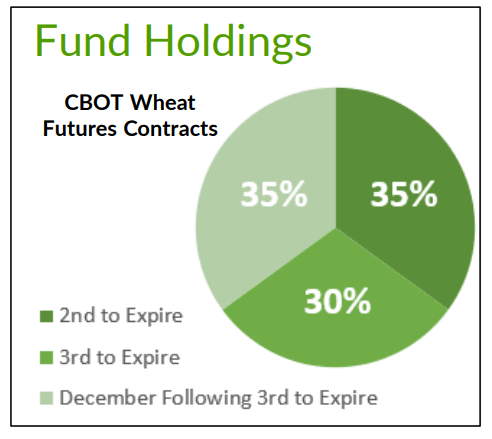

The Teucrium Wheat ETF doesn’t maintain bodily wheat commodities; as an alternative, it owns a basket of wheat futures that should be rolled at every contract expiry (Determine 4).

Determine 3 – WEAT ETF holds wheat futures (teucrium.com)

Because of the contango nature of commodity futures the place longer-dated futures are typically increased in worth, the WEAT ETF shouldn’t be held for the long run because the fund loses worth throughout every contract ‘roll’. Nevertheless, for short- to medium-term trades, the WEAT ETF does provide the specified publicity to the commodity.

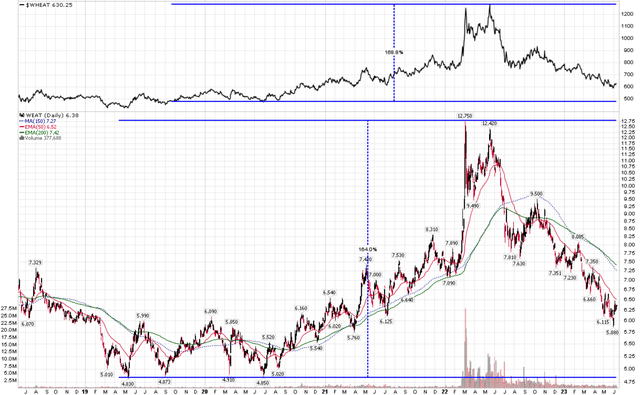

For instance, in 2020 to 2022, when spot wheat costs rallied 169% from $4.80 / bushel to $12.00 / bushel, the WEAT ETF delivered related returns of 164% (Determine 4).

Determine 4 – WEAT might be appropriate for short- to medium-term trades (Writer created with worth chart from stockcharts.com)

Conclusion

I’m upgrading the WEAT ETF to a purchase on a affirmation of El Niño situations. I imagine the growing El Niño could trigger excessive climate occasions that can cut back the worldwide wheat crop, inflicting wheat costs to rally. Already, Australia is forecasting a 1/3 drop in its upcoming 2023/24 crop. Moreover, the Russia/Ukraine grain export deal will not be prolonged in July as a result of current escalation in assaults by either side.

Whereas I perceive the contango decay from the WEAT ETF’s construction, I really feel the upside catalysts will in all probability be far stronger than the futures roll decay within the coming quarters.

[ad_2]

Source link