[ad_1]

Wealthy Polk/Getty Photographs Leisure

Activision Blizzard (ATVI) bought a proposal for 15x EV/EBITDA, and Rovio (OTC:ROVVF) bought a proposal round 13x EV/EBITDA. Whether or not in additional conventional gaming or cellular gaming, multiples are excessive they usually’re excessive for the explanations that gaming is a shopper staple now and one of many extra worthwhile ones at that. Sega Sammy (OTCPK:SGAMY), which is primarily a videogame and IP enterprise coming from the gaming monolith of Sega with monster IPs like Sonic, is valued extra by its Sammy, a Pachinko machine manufacturing enterprise, than by its vaunted Sega enterprise. We posit that along with the Pachinko house being undervalued, contemplating all of the components like earnings progress, Sega is far more suited to be valued at 2x its present EV/EBITDA a number of. Sega Sammy is one other robust purchase.

Sega Sammy’s Enterprise and Outcomes

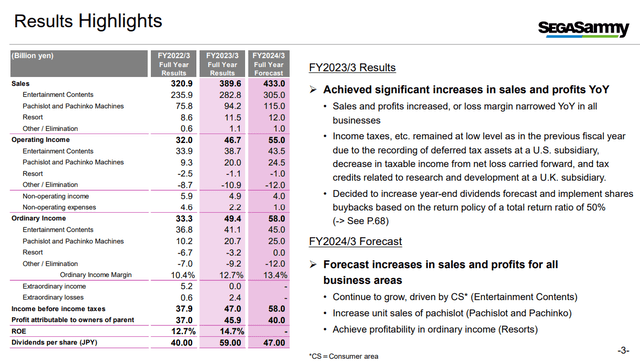

The next chart tells you most of what it’s essential to learn about Sega Sammy. Its earnings is about 3:1 break up between the videogame and IP enterprise and the Pachinko machine enterprise – who cares about resorts.

Outcomes and Forecasts (FY Pres)

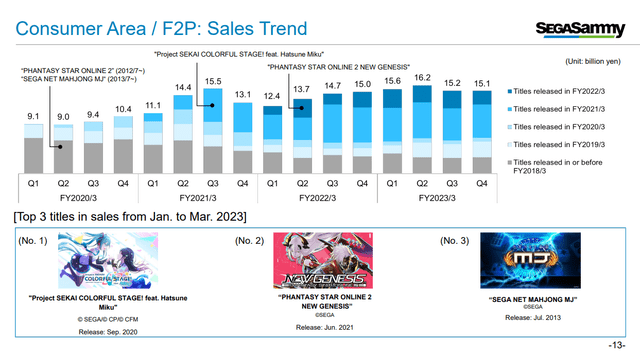

The videogame enterprise has been bolstered by an unlucky rarity: an honest Sonic title. Some are essential of Sonic Frontiers (2021) however finally it has offered phenomenally properly with over 3 million copies, driving Sega’s videogaming outcomes. The Sonic motion pictures have been good as properly, and carried out properly on the Field Workplace. Persona 5 is doing very well too.

Gross sales Traits from Releases (FY Pres)

Their technique of prolonging lifecycles of video games with remasters is an effective one, and may proceed to be efficient because it perpetuates the meme of the abused Sonic fan. Sonic Origins shall be launched quickly that brings a few of the earliest and traditional Sonic titles to new platforms. They’re additionally popping out with Sonic Superstars which is a modernised side-scrolling Sonic recreation that ought to hit the nostalgia buttons of their market. Basically, there’s little concern round them delivering progress on this section as forecast.

They’re consolidating their gaming and IP technique by buying Rovio Leisure, the Finnish cellular gaming firm answerable for the Offended Birds video games and IP that has been leveraged into very profitable Offended Birds motion pictures that greater than tripled their budgets in B.O gross. The a number of for Rovio is across the 13x EV/EBITDA mark which is per what you’d anticipate from a cellular gaming firm, and may assist bolster the case that Sega’s inventory needs to be equally valued, particularly as gaming turns into an much more dominant a part of the combo. This transaction ought to shut within the coming quarters.

In any other case Sega Sammy makes Pachinko machines. Pachinko was a little bit of a dying market attributable to demographic components, nevertheless it was compounded in 2016 by legal guidelines round playing habit, that had been enacted into regulation not due to the Pachinko trade however due to the latest legalisation of casinos. Payouts had been decreased and so was pleasure, and promoting curbs additionally restricted progress in new market segments. However guidelines have loosened lately and the top of pandemic restrictions has seen a increase within the trade.

Backside Line and Dangers

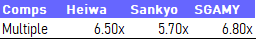

SGAMY’s a number of is sensible while you evaluate it with different Pachinko machine producers in Japan.

Pachinko Comps (VTS)

Due to this fact there are two attainable the explanation why Sega Sammy could deserve a better valuation. The primary is that Pachinko machine producers are already means too low-cost while you evaluate them to firms that make slot machines, usually across the 7x mark like Worldwide Sport Expertise (IGT). Pachinko producers are extra cash generative and extra worthwhile, they usually have comparable trade constructions and end-markets to fit machine makers, arguably much less buyer bargaining energy too which is a profit. They’ve valuations that dip beneath slot machine makers, not by a lot however by sufficient the place considerably superior economics aren’t being correctly appraised making the bottom case for a better valuation.

Nevertheless, the extra apparent concern is that Sega Sammy is primarily a videogame firm not a Pachinko machine producer, they usually have as a lot model energy arguably as Nintendo (OTCPK:NTDOY), even beginning resorts too to turn into a Disney (DIS). Sega’s a number of is half that of Nintendo. It’s a good smaller fraction of ATVI and different gaming shares. Whereas Sega is a little more iffy on their gaming observe document lately in comparison with Nintendo, they’re rising, and a beneficial wave of deregulation on Pachinko in addition to extra sturdy IPs coming beneath their belt from Rovio make a a number of at half that of Nintendo’s fairly tough to justify.

As stated, the dangers are that the video games haven’t been possibly pretty much as good as they need to have been popping out from Sega. The notion that Sonic video games aren’t what they was is a pervasive one. Not like Nintendo, they can’t be relied upon fairly as a lot to launch constant blockbusters, regardless that Nintendo has had a slip up or two like with Pokemon Scarlet/Violet. however some have been good and even a few of those who had been much less good nonetheless offered quite properly. Furthermore, Sega titles promote internationally, and macro dangers are fairly diversified. Whereas a world financial downturn is not good for many shopper firms, video games are mainly a shopper staple, and needs to be comparatively resilient particularly when backed by IPs like Sonic. Japan’s accommodating financial regime can be holding its home spending energy at a wholesome stage, so not even the extra marginal Pachinko enterprise is more likely to undergo because of domestic-only exposures. Though for each videogaming and Pachinko, it’s attainable that revenue progress disappoints, however some revenue progress is way extra possible than not.

The market appears to be ignoring the story right here particularly as they consolidate with Rovio, an excellent use for his or her huge money steadiness protecting 25% of market cap. Often Japanese firms neglect to make use of these sums, so we’re glad to see them buck the development with extra shrewd and shareholder-friendly motion.

Editor’s Observe: This text discusses a number of securities that don’t commerce on a serious U.S. change. Please pay attention to the dangers related to these shares.

[ad_2]

Source link