[ad_1]

Yijing Liu

Funding thesis

This 12 months, Tencent’s (OTCPK:TCEHY) inventory considerably underperformed the U.S. inventory market and plenty of buyers would possibly suppose that the inventory is undervalued. Nevertheless, my valuation evaluation means that the present share value seems overvalued. Furthermore, the corporate is in a secular decline in profitability metrics which I think about a pink flag. The newest quarter was stronger YoY, however I would like a couple of extra quarters of a transparent profitability enchancment path earlier than I alter my “Maintain” score.

Firm data

Tencent is a Chinese language conglomerate based in 1998. Since then, the corporate has grown into one of many world’s largest firms with a various portfolio of companies, together with social media, leisure, gaming, e-commerce, and monetary companies. Its flagship platform, WeChat, has develop into an integral a part of each day life for thousands and thousands.

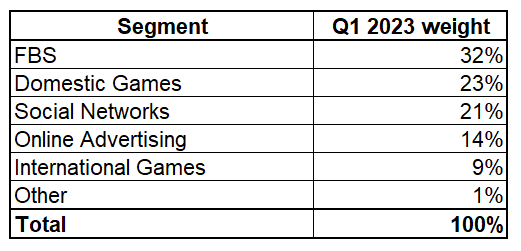

The corporate operates 5 segments: Social Networks, Home Video games, Worldwide Video games, On-line Promoting, and FinTech & Enterprise Providers [FBS]. In keeping with the most recent earnings presentation, FBS income represented virtually a 3rd.

Writer’s calculations

Financials

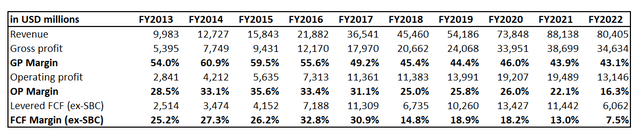

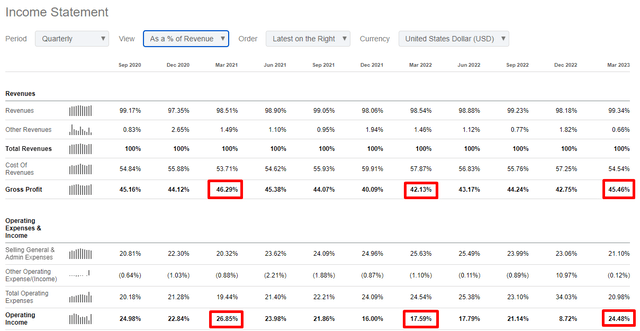

Tencent demonstrated stellar income development over the previous decade with a 23% CAGR. The primary pink flag that I see is that the gross margin deteriorated notably, regardless of a nine-fold improve in income. The working margin additionally softened considerably from 29% to 16%. Increasing profitability metrics whereas the enterprise scales up is essential for me as a long-term investor.

Writer’s calculations

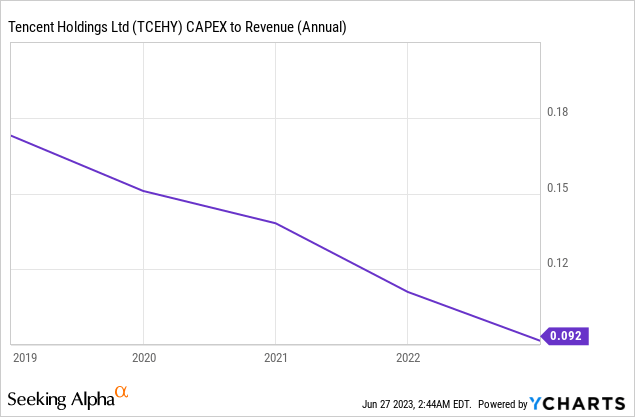

The free money move [FCF] margin with out stock-based compensation [SBC] additionally deteriorated considerably over the previous decade, which is the second massive pink flag for me. Some folks would possibly argue that the corporate invests closely in CAPEX to gasoline long-term development. However CAPEX was lowering over the previous three years whereas the FCF margin deteriorated from 18% to eight%, which is very large.

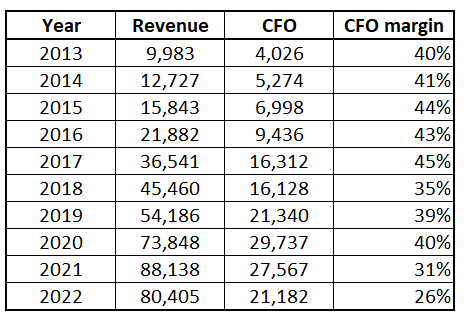

The important thing to the shrinking FCF margin is within the money move from operations [CFO]. Within the under desk, you possibly can see that the CFO margin deteriorated considerably over the previous three years and is at present on the lowest level within the decade. Due to this fact, I’ve a excessive conviction that the corporate’s working effectivity is deteriorating quickly.

Writer’s calculations

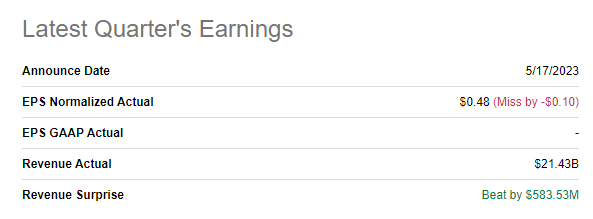

Now let me slender down my monetary evaluation to the quarterly stage. The newest quarterly earnings have been launched on Could 17. The corporate delivered higher-than-expected income however missed on the EPS.

Searching for Alpha

Income grew at about 2% YoY. This may be thought-about a constructive signal as a result of, within the earlier three quarters, the corporate demonstrated a YoY decline in gross sales. The constructive signal can also be that profitability metrics improved in comparison with the Q1 of 2022. However, profitability ratios are nonetheless weaker than those demonstrated throughout the Q1 of 2021.

Searching for Alpha

The constructive development is predicted to proceed in Q2 of the present fiscal 12 months. Consensus expects income at about $21.2 billion, indicating a 7% YoY development. It is very important word that EPS is predicted to increase from $0.43 to $0.61. Tencent’s monetary efficiency is more likely to show robust momentum. Nevertheless, I would like a pair extra quarters to have a conviction that the corporate is on the trail to sustainable profitability enchancment.

Tencent’s stability sheet seems in fine condition, with sturdy liquidity ratios and a considerable excellent money stability. The leverage ratio is conservative, although the corporate is in a web debt place.

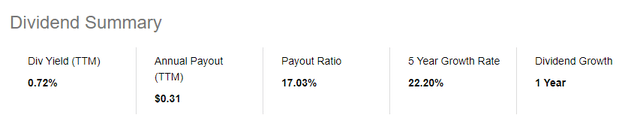

The corporate returns cash to shareholders through inventory buybacks and dividends. In FY 2022, the corporate spent about $4.7 billion on a share repurchase program. However, the dividend yield is just not enticing because the TTM yield is under 1%.

Searching for Alpha

Valuation

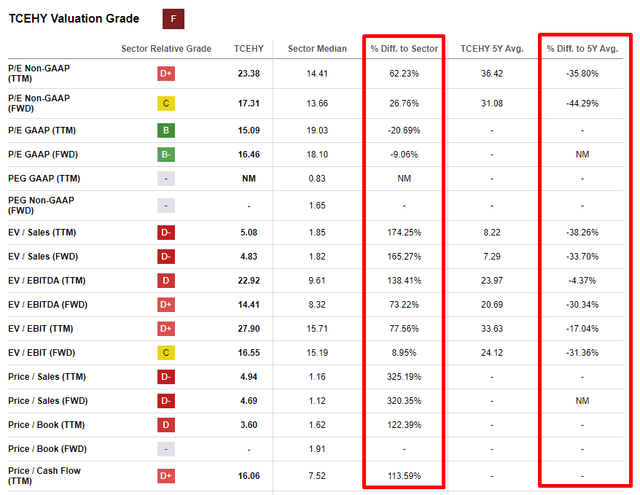

TCEHY inventory value demonstrated a 5% year-to-date decline. The inventory considerably underperformed each the broader U.S. market. However, the iShares MSCI China ETF (MCHI) demonstrated weaker efficiency with a 9% decline. Searching for Alpha Quant assigns TCEHY the bottom potential “F” valuation grade. That is because of the excessive multiples in comparison with the sector median. However, 5-year common valuation ratios are larger than the present multiples.

Searching for Alpha

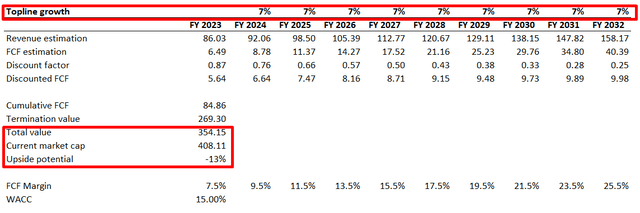

I think about Tencent’s dividend yield low and would not have sufficient confidence relating to the dividend development price. Due to this fact I can’t use a reduced dividend mannequin strategy for TCEHY. I implement the discounted money move [DCF] strategy to cross-check valuation multiples as a substitute. I take advantage of a excessive 15% low cost price for the valuation of Chinese language firms attributable to inherent political dangers. For a base case situation, I anticipate income development at a 7% CAGR over the subsequent decade. I anticipate a 7.5% FCF margin for FY 2023 that can increase by two proportion factors yearly.

Writer’s calculations

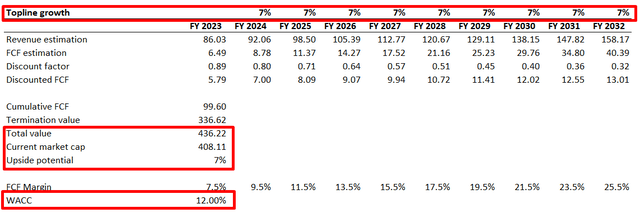

As you possibly can see, based mostly on the above assumptions, the DCF template returns a enterprise’s truthful worth at about $354 billion. It means the inventory is about 13% overvalued. Tencent bulls would possibly argue that the low cost price is unfairly excessive, so let me simulate a situation with a decrease WACC. For the second situation, let me use a 12% WACC. Different assumptions are unchanged.

Writer’s calculations

I believe that even beneath a a lot much less tight WACC, the inventory nonetheless doesn’t look attractively valued. I believe {that a} 7% upside potential is unlikely to be well worth the danger.

Dangers to contemplate

Tencent is without doubt one of the largest Chinese language firms, due to this fact there’s a substantial danger associated to anti-trust points. Anti-trust rules’ objective is to advertise truthful competitors and forestall monopolistic practices. Given Tencent’s dominant place in quite a few sectors, together with social media, gaming, and fintech, there’s a important danger that regulators could impose restrictions or provoke investigations to make sure a good sport for opponents. Regulatory actions might adversely have an effect on Tencent’s enterprise operations and monetary efficiency.

The corporate is extremely depending on its key platforms and the nearer they’re to full saturation, the less choices to drive sustainable income development the corporate can have. Sure, the corporate invests in lots of new ventures, however there isn’t a assure that these investments will in the end repay.

Backside line

To conclude, I don’t think about Tencent a superb funding choice. The principle motive is the present valuation, which I think about unattractive. The second essential motive is that my monetary evaluation revealed secular weaknesses the corporate is experiencing. In firms with robust development potential, profitability metrics have to enhance because the enterprise scales up. Trying again on the firm’s financials over the previous decade, we are able to see that it was vice-versa for Tencent. Due to this fact, I assign TCEHY inventory a “Maintain” score.

Editor’s Be aware: This text discusses a number of securities that don’t commerce on a serious U.S. change. Please pay attention to the dangers related to these shares.

[ad_2]

Source link