[ad_1]

As we method the yr’s second half, buyers are actively analyzing the market outlook, macro dangers, and forecasts for the upcoming company earnings season. The purpose is to reposition portfolios to align with potential alternatives strategically.

In its outlook report for the second half of 2023, funding supervisor Carmignac emphasizes the significance of making ready for a number of situations because of central banks’ dependence on financial information. The specialists assert that regardless of persistent wage inflation, a declining potential development fee, and a low fairness danger premium, it stays untimely to declare the top of the financial tightening cycle in 2023.

When evaluating fairness markets, Carmignac analysts spotlight the numerous lower in volatility, with the index reaching its lowest level in three years. This decline, in relation to its correlation element, creates a good atmosphere for efficient inventory choice.

VIX Overview

Becoming a member of the sentiment, the specialists at Federated Herme additionally anticipate a constructive outlook for the inventory market within the second half of 2023. They anticipate earnings development to behave as a catalyst, driving an upward trajectory in inventory costs.

As summer season arrives, quite a few buyers are capitalizing on the chance to reposition their portfolios strategically. Some are even putting their bets on tourism shares, recognizing the potential on this sector.

In line with the eToro platform, the worldwide journey and tourism business contributes roughly 8% to the world financial system and is projected to expertise a 23% development fee this yr, reaching a worth of $9.5 trillion. This anticipated development would mark the sector’s third consecutive yr of surpassing 20% growth.

Development Vs. Worth

In line with analysts at Federated Hermes, the upbeat earnings forecast comes towards a backdrop of rising rates of interest, one thing that usually advantages development shares greater than their value-focused counterparts.

Analyzing funding alternatives by sector, the specialists favor two decisions in defensive sectors for this second half of 2023: Know-how and shopper.

Know-how (NYSE:): Carmignac analysts spotlight the alternatives created by synthetic intelligence and the tendency of this sector to evolve favorably, given the prevailing financial local weather through which long-term charges are falling and development is slowing.

Shopper: The main target on this sector lies in reaching a decrease price base and capitalizing on the eventual turnaround in financial coverage. Nonetheless, Carmignac notes that the rotation from countercyclical to discretionary consumption continues to be far-off. Elements resembling disinflation, financial slowdown, and intensifying value wars amongst retail distribution teams form the important thing issues.

Different sectors that will additionally profit within the second half of 2023 embrace:

Healthcare (NYSE:): in line with Carmignac analysts, this sector combines short-term resilience and long-term development prospects. Federated Hermes specialists concur, including that the development on this sector will proceed to rise. Nonetheless, the tempo of ascent appears far more modest in comparison with the robust development anticipated for the expertise and communications sectors.

Some commodities, resembling : in line with Carmignac, are doubtlessly enticing in a interval of geopolitical uncertainty and rising considerations about recession.

In a panorama crammed with market alternatives, it turns into essential to have entry to dependable and impactful market info that may affect portfolio choices. InvestingPro, an expert instrument, generally is a worthwhile useful resource.

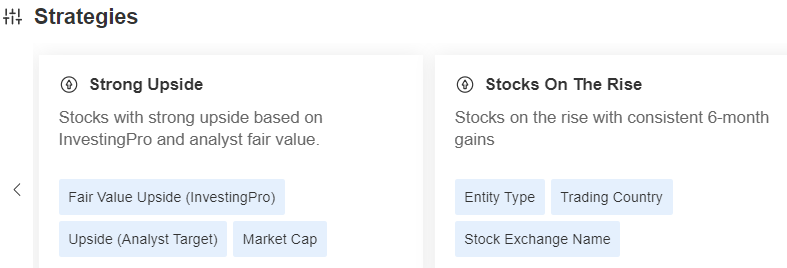

Amongst its numerous options, InvestingPro allows customers to establish shares exhibiting a powerful uptrend in line with each its algorithms and analysts’ honest worth assessments. Moreover, it supplies insights into bullish shares with constant six-month earnings efficiency, providing worthwhile info for buyers.

Supply: InvestingPro

Supply: InvestingPro

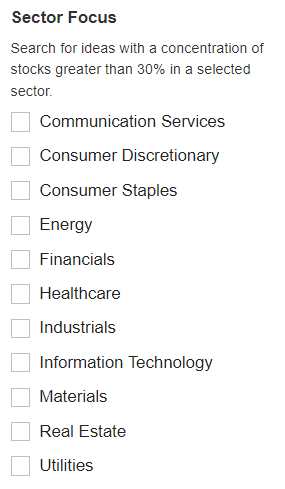

InvestingPro additionally permits you to seek for funding concepts with greater than 30% inventory focus in a given sector.

Sector Focus

Supply: InvestingPro

Are you contemplating new inventory additions to your portfolio or divesting from underperforming shares? For those who search entry to the best market insights to optimize your investments, we suggest making an attempt the InvestingPro skilled instrument without cost for seven days.

Entry first-hand market information, elements affecting shares, and complete evaluation. Reap the benefits of this chance by visiting the hyperlink and unlocking the potential of InvestingPro to boost your funding choices.

And now, you should purchase the subscription at a fraction of the common value. So, prepare to spice up your funding technique with our unique summer season reductions!

As of 06/20/2023, InvestingPro is on sale!

Take pleasure in unbelievable reductions on our subscription plans:

Month-to-month: Save 20% and get the pliability of a month-to-month subscription.

Annual: Save an incredible 50% and safe your monetary future with a full yr of InvestingPro at an unbeatable value.

Bi-Annual (Internet Particular): Save an incredible 52% and maximize your income with our unique net supply.

Do not miss this limited-time alternative to entry cutting-edge instruments, real-time market evaluation, and knowledgeable opinions.

Be part of InvestingPro right this moment and unleash your funding potential. Hurry, the Summer time Sale will not final ceaselessly!

Disclaimer: This text was written for informational functions solely; it doesn’t represent a solicitation, supply, recommendation, counsel, or suggestion to take a position, neither is it meant to encourage the acquisition of property in any manner.

[ad_2]

Source link