[ad_1]

HAKINMHAN

Again in my finance teacher days (nights) on the College of North Florida, I’d urge my investments college students to at all times concentrate on whole shareholder yield, not merely a inventory’s dividend charge. As you may think, there is a respectable ETF to seize each corporations’ dividend and buyback yields. I assert that it’s a savvier play than going with fundamental dividend-focused methods.

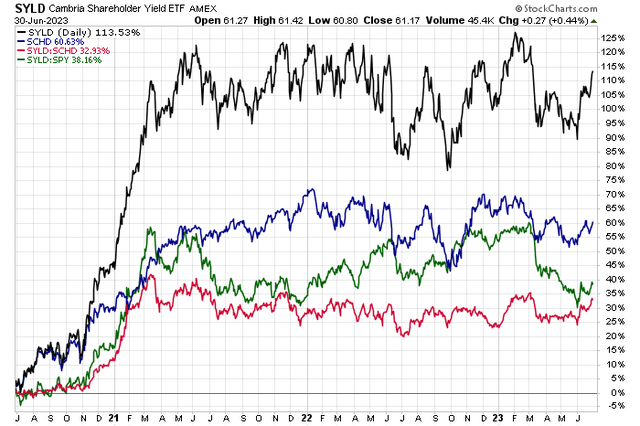

I’ve a purchase ranking on the Cambria Shareholder Yield ETF (BATS:SYLD), although its expense ratio is on the excessive aspect whereas latest worth motion (whole return) has been lackluster.

Nonetheless, after surging within the second half of 2021 by early 2022 and outpacing the favored Schwab U.S. Dividend Fairness ETF (SCHD), there are some enhancing absolute and relative developments together with bullish seasonal components to contemplate. Additionally, now that each one 23 banks handed the Fed’s quarterly stress take a look at, there’s room for these buyback-heavy monetary corporations to extend their dividends and inventory repurchases.

SYLD: Superior Whole Returns vs. SCHD, SPY Final 4 Years

Stockcharts.com

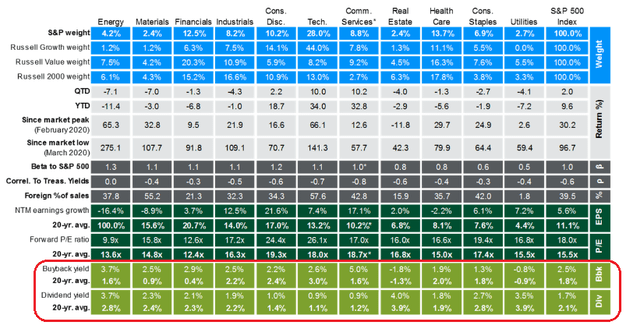

Investments 101: Look At Whole Shareholder Yield, Not Simply the Dividend Fee

J.P. Morgan Asset Administration

In line with the issuer, SYLD makes use of a quantitative strategy to spend money on US equities with excessive money distribution traits. The preliminary screening universe contains shares in the US with market capitalizations over $200 million. The ETF is comprised of the 100 corporations with the best-combined rank of dividend funds and web inventory buybacks, that are the important thing elements of shareholder yield. The ETF additionally screens for worth and high quality components, together with low monetary leverage.

With a 10-year monitor document, Cambria’s whole yield fund is an energetic ETF and encompasses a considerably expensive 0.59% annual expense ratio. Its trailing 12-month yield is far larger than the S&P 500’s common (2.8% versus 1.9% on the SPX) whereas whole belongings below administration sum to $757 million.

Lead portfolio supervisor Meb Faber is thought for his concentrate on long-term fundamentals and quantitative analysis, and that strategy is put to work by this fund. By way of tradeability, SYLD encompasses a 0.15% 30-day median bid/ask unfold, and quantity sometimes totals round 100,000 shares every day, so utilizing restrict orders throughout illiquid durations of the buying and selling day is prudent.

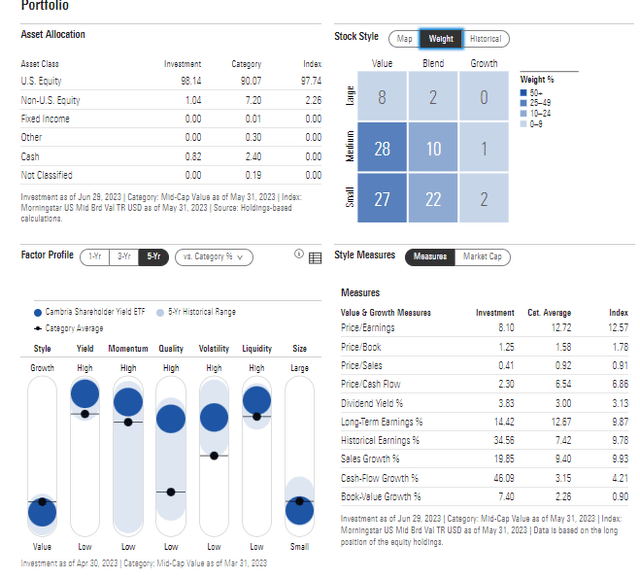

Digging into the portfolio, the 5-star, gold-rated ETF’s portfolio plots on the decrease left portion of the Morningstar Type Field. The mid-cap worth fund sports activities an exceptionally low price-to-earnings ratio close to 8 whereas it trades an affordable 0.4 occasions gross sales contemplating the long-term EPS progress charge is north of 14%. SYLD, a top-ranked fund in its sub class, boasts sturdy momentum and earnings high quality with excessive liquidity. Volatility, nonetheless, tends to be elevated with SYLD in comparison with the market. What I like about SYLD is that it is not all that concentrated. Simply 17% of belongings are within the high 10 holdings.

SYLD: Gold-Rated Fund With Excessive Momentum & High quality, Low P/E

Morningstar

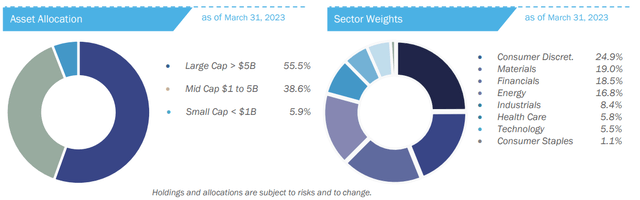

Despite the fact that the portfolio holds a excessive variety of SMID-cap shares, about half the allocation is taken into account giant cap by Cambria. Traders should know what they personal – I discover that the sector breakout reveals publicity to risk-on cyclical sectors like Client Discretionary, Supplies, Financials, and Power. There are not any Utilities sector shares within the fund and the Client Staples sector is simply 2% of the ETF as of March 31, 2023.

SYLD: Important SMID Cap Publicity, Heavy in Cyclical Sectors

Cambria Funds

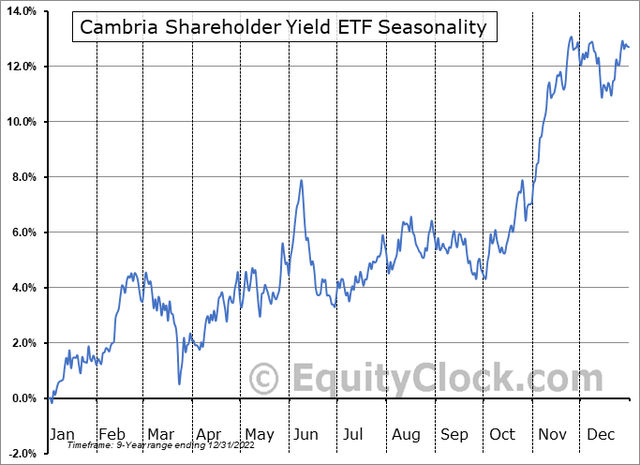

Seasonally, early July marks a great time to get lengthy SYLD, in line with knowledge compiled by Fairness Clock. The annual cadence favors being lengthy in Q3, forward of what’s typically a bullish October by February stretch.

SYLD: Bullish Seasonal Second Half Tendencies

Fairness Clock

The Technical Take

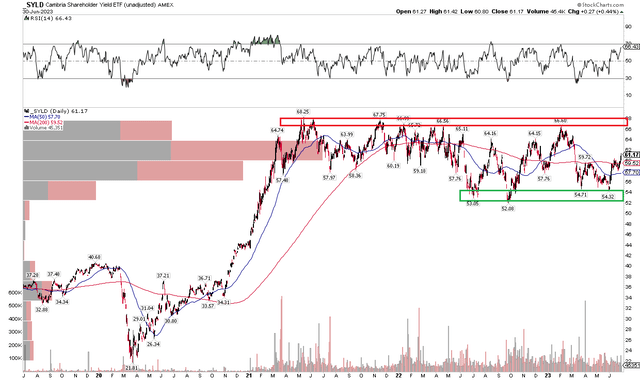

I hope you are not sleepy as a result of the chart sample is kind of unexciting proper now. Discover within the chart under that SYLD has been rangebound since early 2021. That two-and-a-half-year stretch of principally 0% returns comes as so many areas of the market have moved up and down like a curler coaster. However maybe relative tranquility is one thing to be valued for long-term, yield-focused traders.

By way of key worth ranges to watch, there’s clearly resistance within the $66 to $68 zone whereas the $52 to $55 vary has emerged as assist. A bullish breakout by $68 would suggest a measured transfer worth goal of $84 ($68 – $52 = $16; $16 + $68 = $84). With a flat 200-day transferring common amid excessive quantity by worth on this sturdy buying and selling vary, no imminent breakout is clear. Total, it’s a impartial chart.

SYLD: Calm & Sideway Value Motion Since Early 2021

Stockcharts.com

The Backside Line

I’ve a purchase ranking on SYLD. For my part, whole yield (web buyback yield plus dividend yield) is a greater solution to discover shareholder-accretive corporations. With a low earnings a number of and outperformance in comparison with the S&P 500 within the final 4 years, this regular ETF provides ballast to long-term traders’ portfolios.

[ad_2]

Source link