[ad_1]

Subsequent week, the “ahead 4-quarter estimate” will soar to $230.69 (or thereabout) because the vary of quarters is modified from the present Q2 ’23 to Q1 ’24 to Q3 ’23 by means of Q2 ’24.

S&P 500 information

The ahead 4-quarter estimate this week fell to $224.01 from final week’s $224.33;

The PE ratio on the ahead estimate is nineteen.9x vs. 18.11x to start out the quarter;

The earnings yield is now 5.03%, its lowest degree in fairly some time. If we use subsequent week’s anticipated ahead estimate, the S&P 500 earnings yield jumps to five.2%;

The “anticipated” Q1 ’23 bottom-up quarterly estimate of $50.71 on 3/31/23, jumped to an precise Q1 ’23 bottom-up estimate of $53.09 as of 6/30/23.

Traders will wish to see a repeat of the “upside shock” in Q2 ’23 earnings which begin in about 10 days.

How did S&P 500 EPS and income development change between This autumn ’22 and Q1 ’23?

SP 500 EPS And Income Development Change

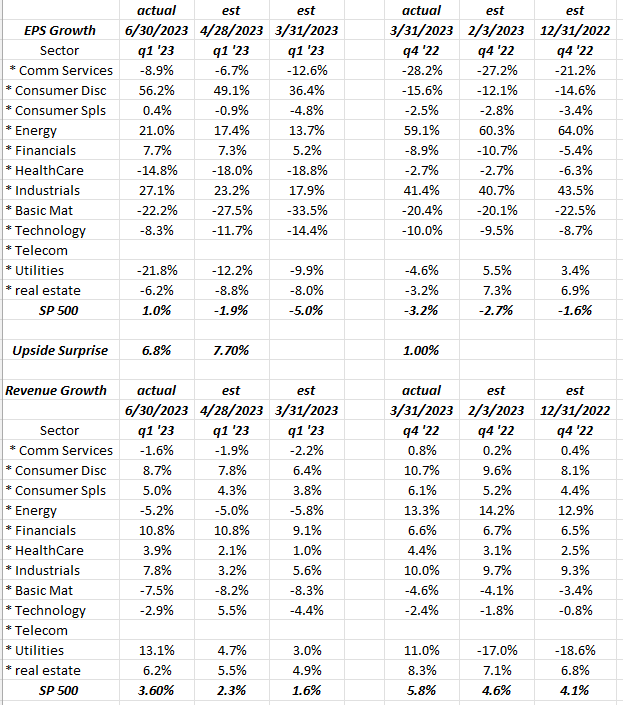

It’s not a option to publish a spreadsheet this “busy,” however I wished to point out readers the change in S&P 500 EPS and income development between This autumn ’22 and Q1 ’23.

To start with – regardless of Silicon Valley Financial institution and regional financial institution points – notice the expansion in monetary sector EPS (prime half of desk) after which monetary sector income development (backside half of desk).

The three rows to the fitting are the development in This autumn ’22 EPS and income, whereas the three rows to the left are Q1 ’23 EPS and income.

Client Discretionary and Communication Companies had been the massive constructive change between This autumn ’22 and Q1 ’23 EPS, with power being the larger damaging change.

Vitality income noticed a giant swing negatively between the 2 quarters and can doubtless occur once more in Q2 ’23.

Word, too, how the expertise sector was a push for each EPS and income. The numbers actually haven’t modified regardless of the YTD return for the tech sector. Crimson flag ? Perhaps, or the market’s out in entrance of the basics, which might occur too.

Conclusion

Whereas the info is sourced from IBES information by Refinitiv, the spreadsheets are up to date each 4 – 6 weeks to throughout earnings season so I can see how the info is trending, reasonably than simply studying it.

It does fear me that the tech sector is up as a lot as it’s YTD, and the numbers are nonetheless kinda “meh”.

2024 tech sector estimates famous final week right here, seem like first rate development. The market may very well be out in entrance of this too.

With the lengthy weekend, tons extra can be written.

Wished to get this up earlier than too lengthy.

Take all of this as one particular person’s opinion and with wholesome skepticism. Previous efficiency is not any assure or indicator of future outcomes and none of that is recommendation. Gauge your personal urge for food or consolation degree for market volatility.

Thanks for studying.

[ad_2]

Source link