[ad_1]

THEPALMER

Funding Rundown

2022 proved to be a report 12 months for Marten Transport Ltd (NASDAQ:MRTN) because the demand positioned on the transport and transportation business was very excessive. The identical does appear to carry within the first quarter of 2023 and MRTN had a YoY decline in internet earnings because the working bills began to climb as soon as once more, brought on by increased gas costs.

The market and business that MRTN is extremely depending on gas and the charges to make a good revenue. If like Q1 FY2023 has increased total prices utilized to those corporations we’ll see risky earnings experiences from the businesses within the sector. However in the long term that does dilute considerably and the outcomes steadiness out finally. What I discover extra vital to view is the revenues for the enterprise as that is one thing the corporate can considerably be answerable for given the aptitude they’ve to satisfy demand and develop new market share. For MRTN this appears proper now fairly constructive because the working revenues grew 3.8% YoY, regardless of a troublesome market setting. The share worth for MRTN inventory is beneath its 52-week excessive of $23.43 and sits at an FWD p/e round 17 proper now, making it interesting to start out a place proper now for my part.

Firm Segments

Marten Transport operates as a temperature-sensitive truckload service for shippers and clients primarily in the US, but additionally in Canada and Mexico. The corporate has divided its enterprise mannequin into 4 main segments, these being: Truckload, Devoted, Intermodal, and at last Brokerage.

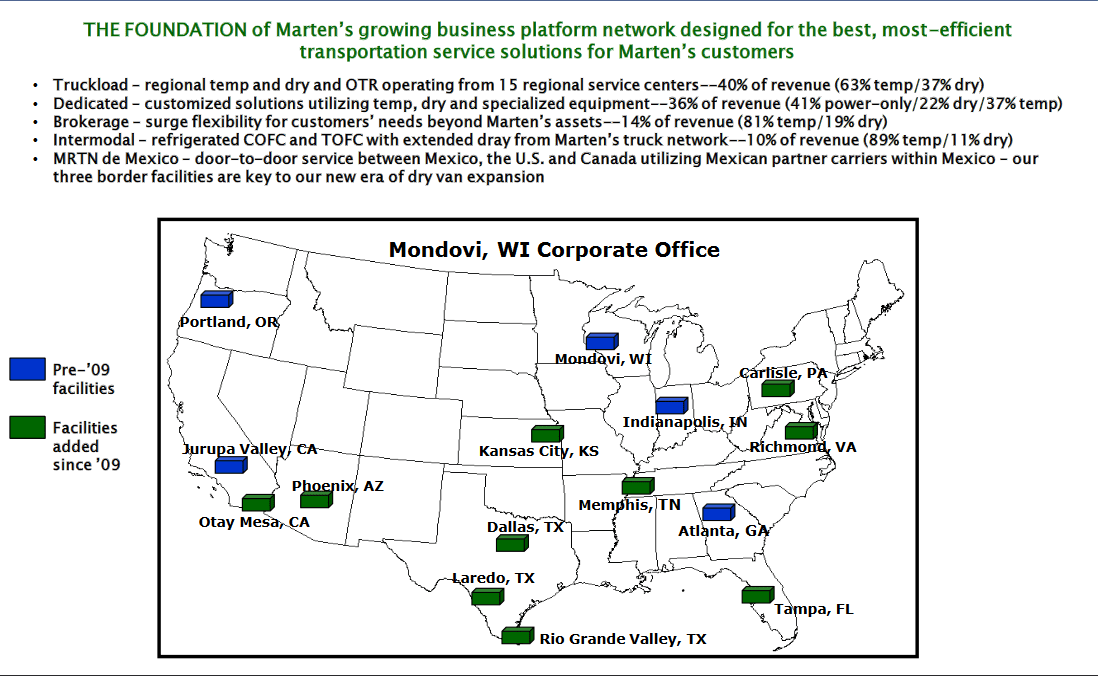

Firm Footprint (Investor Presentation)

The primary phase focuses on the transportation of meals and different client packaged items. These things and shipments are sometimes temperature delicate which is why MRTN is such an excellent candidate right here. MRTN hasn’t but gathered up a big chunk of the potential market share however it appears to be rising proper now a minimum of. The Devoted phase primarily focuses on providing clients the flexibility to have personalized transportation options with dry vans and temperature-controlled trailers. This phase primarily serves particular person clients aside from bigger teams.

When it comes to the phase chargeable for the biggest portion of revenues, it stays the Truckload phase. One can see the influence that increased gas costs have had on the margins by wanting on the common income per tractor per week. In Q1 FY2023 for the Truckload phase, it netted $4.517 while in Q1 FY2022 it was near $5.000. This distinction does make a big influence on the underside line. However as I discussed, this appears to be a short-term headwind and MRTN is near its finest working ratio ever, 88.6% in Q1 FY2023.

Reshoring Brings Demand To Mexico

A number of the vital developments that can have an effect on MRTN would be the reshoring of producing again to the US. Although MRTN does concentrate on temperature-sensitive shipments, they nonetheless ship different issues as nicely, which are not as delicate.

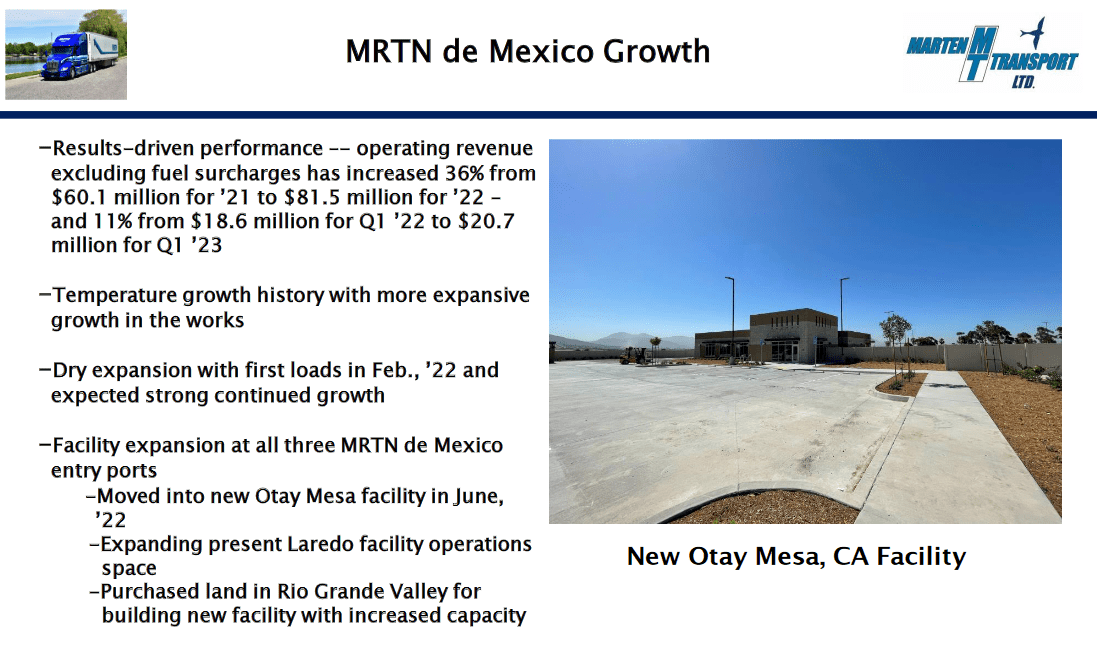

MRTN Growth (Earnings Presentation)

MRTN is increasing into its enterprise extra south and into the Mexican market. The corporate has acquired facility expansions for all three of the MRTN de Mexico entry ports, with the Otay Mesa facility being moved into fairly just lately, on June 22. Manufacturing in Mexico is growing as extra corporations transferring manufacturing again to North America see Mexico as a strong alternative to get each labor kinds and cheaper supplies and merchandise. This will increase the quantity of supply between the 2 international locations, which in fact advantages MRTN. However seeing as MRTN additionally generates a few of its revenues from temperature-sensitive shipments, the quantity of agricultural shipments between the US and Mexico is strongly on the rise and amounted to $44 billion in 2022, the best it has ever been.

Earnings Highlights

When it comes to the final quarter for MRTN, it was a problem for them to efficiently ship robust outcomes once they need to battle with increased gas costs and bills. The underside line of the enterprise did drop on a YoY foundation to $0.28 per share, down from $0.33 a 12 months earlier. This lower needs to be mirrored within the prime line and MRTN grew revenues to almost $300 million for the quarter.

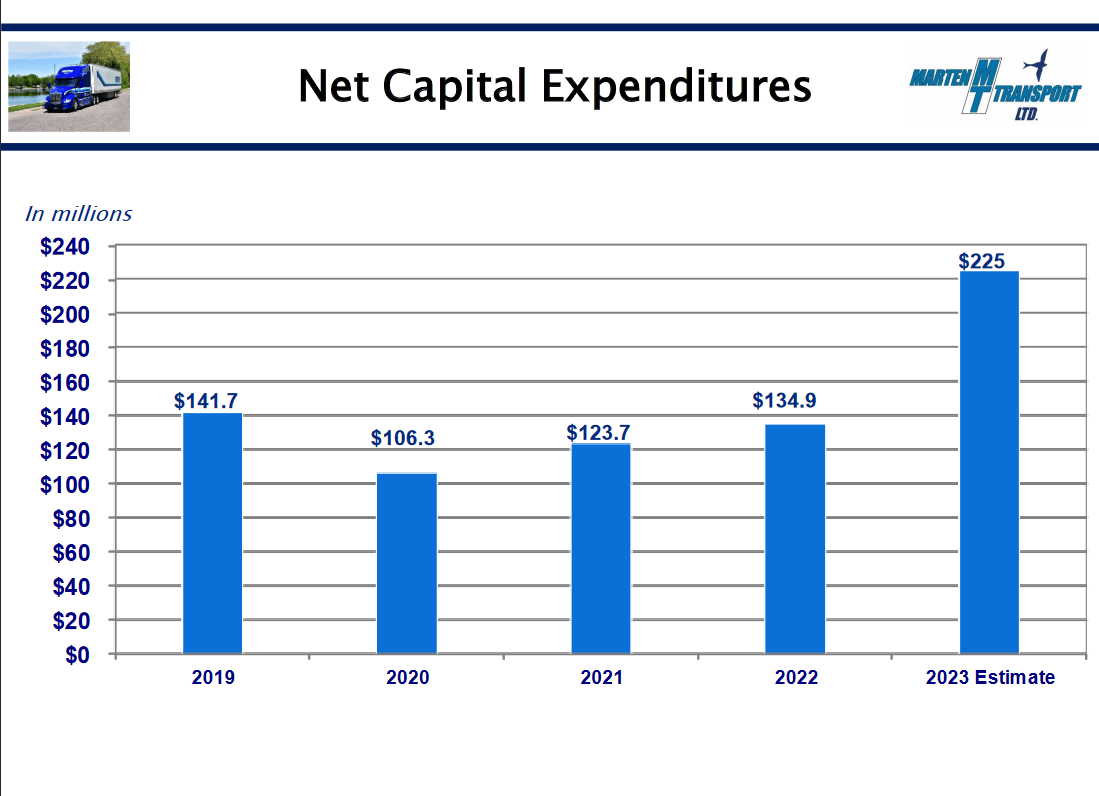

Web Capital Expenditures (Earnings Presentation)

Wanting forward for MRTN they see the web capital expenditures for the enterprise persevering with to climb steadily and in 2023 it is anticipated to be $225 million, a mirrored image that MRTN does see strong development potential forward as they’re diverting ample quantities of money in direction of this. For the approaching quarters, nevertheless, I believe the working ratio will probably be a key level to observe. Seeing an additional lower could be proof that MRTN can effectively battle the higher-cost setting. This could present a strong enterprise mannequin that may develop by means of downturns within the cycle.

Dangers

When it comes to dangers which are going through MRTN proper now the first ones appear to be circulating a decrease exercise in freight shipments. Growing stock ranges amongst clients would create a decrease demand for steady cargo deliveries and orders. If the businesses themselves cannot get their merchandise out the door, they will not see some extent in actively sustaining excessive stock ranges. This would go away the truck fleet of MRTN idle and reduce the ROA that they’ve, which presently sits at 10.76% utilizing the TTM numbers. If the gas costs stay sticky and are not reducing it can imply that MRTN must maybe go on some prices to clients which may create backlash and them searching for alternatives with different rivals.

Last Phrases

Marten Transport proper now I believe that buyers want to concentrate on the large image. If we proceed to see a shift in that manufacturing is returning to the US the demand for MRTN will stay excessive and I count on to see continued development in each the highest and backside line, with the estimation that the gas costs aren’t spiking inflicting the working bills to shoot up. That will create a really tough state of affairs for MRTN however to date they appear to have dealt with the state of affairs because the working ratio sits near all-time lows at 88.6%.

As for the p/e valuation proper now MRTN is beneath its 5-year averages by round 6 – 7% which presents much less of a draw back danger to clients. I believe that investing in MRTN is a guess that continued exercise within the freight shipments market will proceed and that proper now excessive gas costs are short-term ache. I’m ranking MRTN a purchase consequently.

[ad_2]

Source link