[ad_1]

FrankRamspott/iStock through Getty Photographs

Introduction

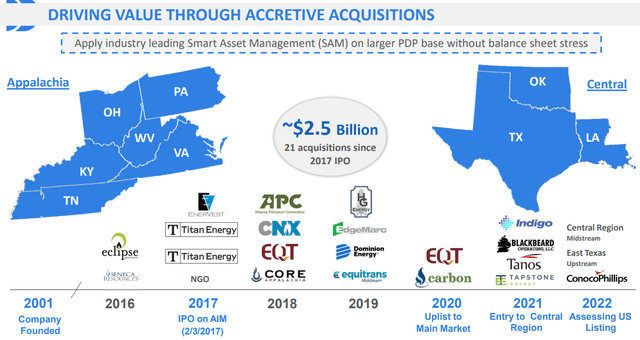

Diversified Vitality (OTCQX:DECPF) is a producer of pure gasoline. The corporate focuses on shopping for outdated and semi-depleted pure gasoline wells off the palms of bigger firms which are not considering investing in them and wish to take the long-term environmental liabilities to desert these wells off their books.

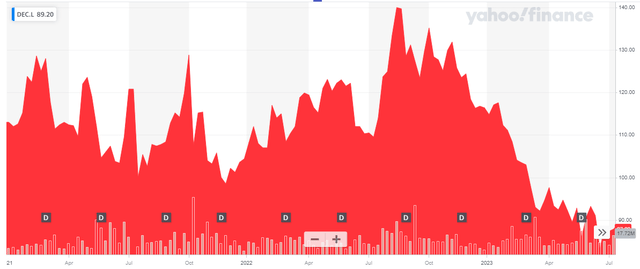

Yahoo Finance

The corporate has its important itemizing on the London Inventory Trade the place it is buying and selling with DEC as ticker image. The typical every day quantity in London is roughly 3 million shares per day, for a complete of two.9M GBP ($3.5M). There are at present 971M shares excellent leading to a market cap of 890M GBP or roughly $1.17B.

Shopping for outdated wells – easy but environment friendly

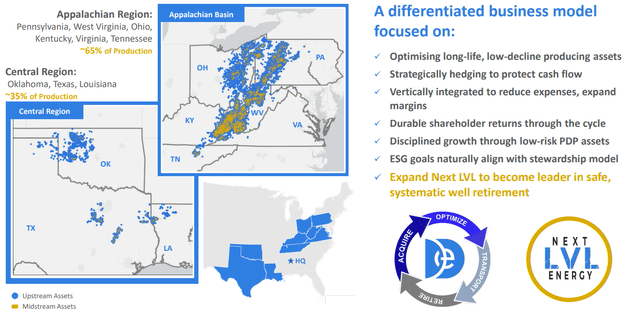

This implies the enterprise mannequin is straightforward. It buys present wells with present manufacturing and present reserves and extends the helpful manufacturing life for so long as potential. The main target is totally on the US the place the corporate focuses on the Appalachian and OK/TX/LA states.

Diversified Vitality Investor Relations

There are benefits and drawbacks to this technique. The primary benefit is clearly shopping for one thing the place you “know” what you might be getting. And what I feel is the largest benefit is the truth that these mature wells have very low decline charges (6%-7%). Which mainly means the corporate is assured of predictable however step by step lowering money flows. Diversified just isn’t actually within the enterprise of drilling new wells (it sometimes does so) however there are alternatives to “clear out” present wells to make sure a greater stream and a short lived increase in manufacturing outcomes.

The primary drawback are the environmental liabilities. Diversified Vitality is the “last cease” for all these pure gasoline wells as DEC must abandon and plug them – it is unrealistic to suppose they may have the ability to promote them to a different social gathering.

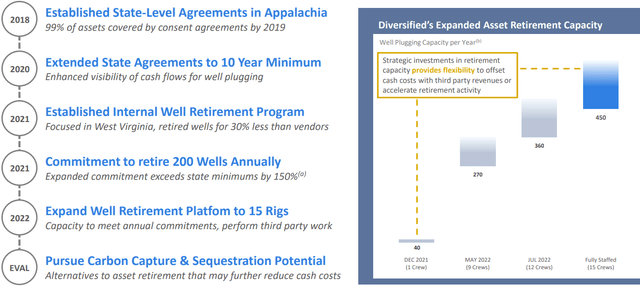

Diversified Vitality Investor Relations

This created some points not within the least when in 2021 Bloomberg fired a number of torpedoes at Diversified Vitality claiming that retaining the pure gasoline wells open causes air pollution. Whereas in principle right, I feel this was a really low-cost shot as a result of A) Diversified is admittedly on high of the present nicely efficiency whereas these wells have been semi-neglected by earlier house owners which targeted on increasing manufacturing and B) Diversified does a superb job in really abandoning and accurately plugging wells.

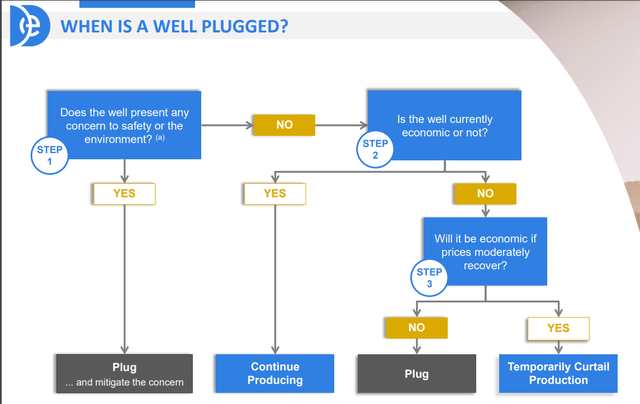

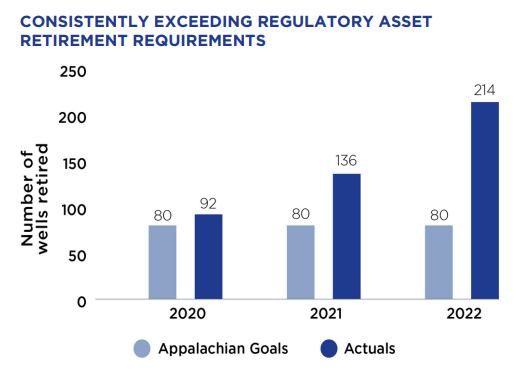

Diversified Vitality Investor Relations

Diversified is definitely abandoning and plugging wells at a sooner price than the respective minimal aims put ahead by the states it is working in, and it’ll proceed to step up its efforts because it now has a capability to plug and abandon virtually 500 wells per 12 months.

Diversified Vitality Investor Relations

Diversified takes the environmental clean-up significantly (you additionally don’t wish to danger getting sued within the US) and gives a presentation solely on its abandonment technique and progress.

Diversified Vitality Investor Relations

So whereas it is a legal responsibility that we must keep watch over, I don’t take into account it to be a serious danger, not even when the natgas value drops to US$2 this 12 months (I’ll clarify the pricing danger within the subsequent part, discussing the hedge e-book).

Diversified Vitality Investor Relations

The hedge e-book brought about extreme complications in 2022, however the money flows remained sturdy

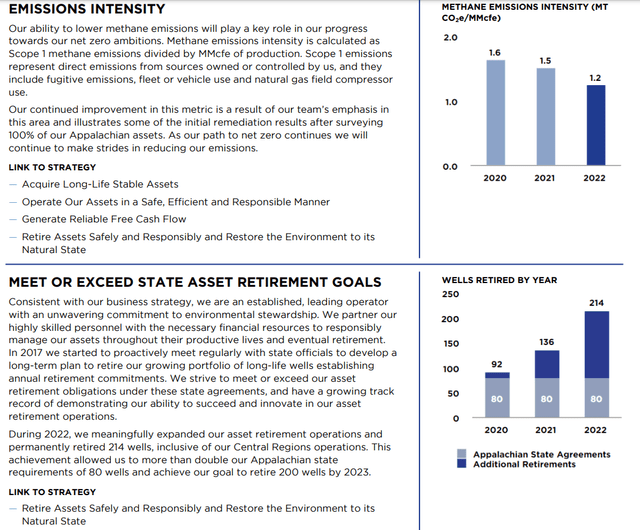

Diversified produced a median of 135,000 barrels of oil-equivalent throughout 2022 of which roughly 86% consisted of pure gasoline. The exit price was nearer to 140,000 boe/day so we should always see one other 12 months of manufacturing will increase in 2023 regardless of having to take care of the pure decline price.

Diversified Vitality Investor Relations

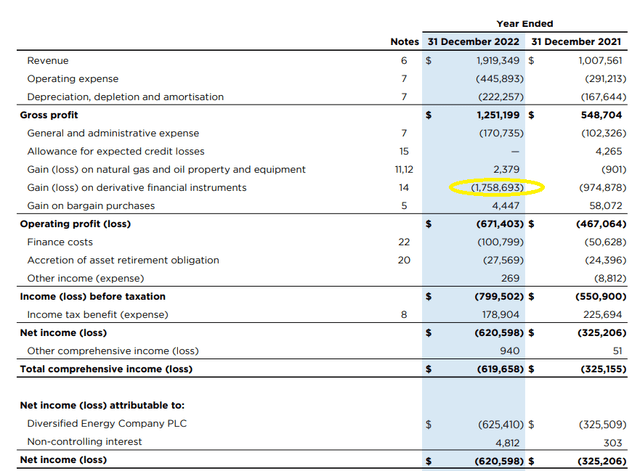

What the picture above additionally reveals you is the common gross sales value of pure gasoline. Diversified has a really intensive hedge e-book which it historically enters into when it purchases an asset (to reduce the monetary danger associated to the acquisition price, working price and cleanup danger) which suggests the corporate had an enormous quantity of hedges under market costs. Not solely did this weigh on the common realized pure gasoline value, it additionally brought about a loss on derivatives of just about $1.8B.

That is also the rationale why I wasn’t instantly satisfied about Diversified. Whereas hedging gives wonderful visibility on future income and money stream, it isn’t exceptional that the counterparties request extra (money) collateral from the hedger. I feel that was the largest danger in 2022 however that danger has now come down significantly because the pure gasoline value has come down (and the danger for the counterparty has decreased). I additionally anticipate Diversified to submit a considerable revenue on its hedge e-book within the present monetary 12 months (if the pure gasoline value stays on the present ranges).

These losses on the hedge e-book are the rationale why we should always take the web loss with a grain of salt. As you may see under, the overwhelming majority of the bills (and the only motive for the web loss) are associated to those hedges.

Diversified Vitality Investor Relations

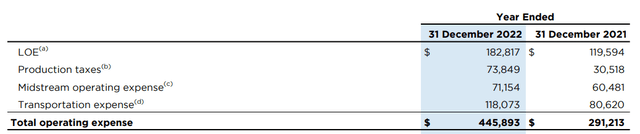

What’s enticing about Diversified is its very sturdy gross revenue. OK, this consists of the pure gasoline value earlier than the affect of the hedges is taken under consideration, however I am nonetheless very happy with the whole working bills of lower than $450M. The “pure” working price is even a lot decrease than that because the second largest working expense is definitely the transportation price.

Diversified Vitality Investor Relations

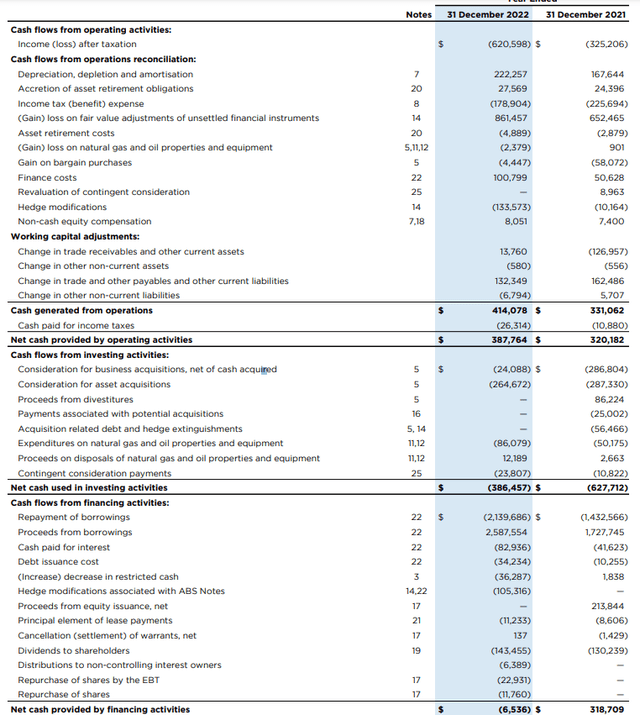

So moderately than specializing in the large internet loss, we should always take a look at the money stream assertion as that gives a greater overview of the scenario. The realized hedging losses (resulting in the realized pure gasoline value of $2.98) are nonetheless recorded however the unrealized losses are filtered out.

The reported working money stream after taxes was $388M (given the hedge e-book efficiency no company tax would have been payable primarily based on the FY 2022 outcomes, however I’m erring on the facet of being cautious right here).

Diversified Vitality Investor Relations

After adjusting the working money stream for adjustments within the working capital (minus $128M), the curiosity funds ($83M) and the lease funds ($11M), the underlying working money stream was $166M.

We see the whole capex was $86M which is a rise of 70% in comparison with FY 2021 and I do anticipate the longer term capex to lower once more. The sustaining capex is someplace within the $40-60M vary on an annual foundation which suggests the underlying free money stream was $116M. That being stated, have in mind Diversified additionally spent $133M on hedge modifications. These are usually not repurchases of present hedges however actually simply shaking them up a bit of bit by buying longer-term put choices to fulfill the wants and necessities of recent asset-backed debt.

As it is a non-recurring merchandise, one would have a robust case to argue this shouldn’t be included within the normalized free money stream calculation. A view I agree with as the percentages of seeing these modifications on an annual foundation are fairly low. This implies the underlying sustaining free money stream is roughly $250M, nonetheless utilizing the common realized pure gasoline value of $2.98 as start line. There have been 829M shares excellent, leading to a sustaining free money stream of $0.30 per share. Utilizing an GBP/USD trade price of 1.22 USD per GBP, the FCF per share expressed in pence got here in at 24-25 pence.

The $0.30 per share in sustaining free money stream (excluding debt amortization) additionally means the present dividend of $0.04375 per quarter ($0.175 per share per 12 months) is totally lined. This implies the present dividend yield is sort of 15% which is definitely working in opposition to the corporate within the present funding local weather (a 15% dividend yield certainly have to be unsustainable, proper?’). One necessary factor to take into accounts right here: Though Diversified is a British firm with a list in London, it is topic to the US tax code as all of its operations are within the US. This implies the dividend withholding tax would be the ordinary 15% for non-US residents which are in a position to make use of the double taxation treaty.

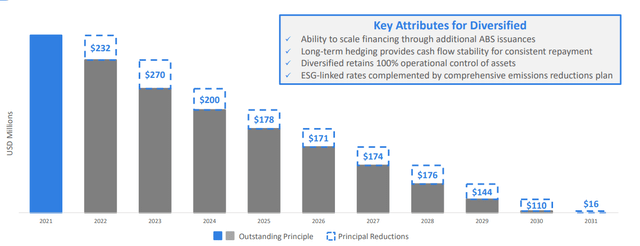

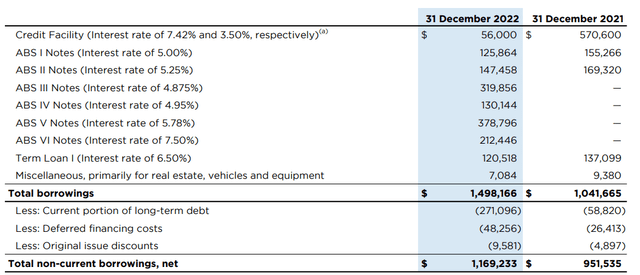

There’s one concern with the excessive dividend funds: Though the web free money stream undoubtedly covers the present dividend, we additionally ought to preserve the debt construction in thoughts. As of the top of December, Diversified had a complete internet monetary debt (excluding leases and asset retirement obligations) of $1.43B. Whereas that’s excessive, there are two necessary components right here. To start with, the debt is self-amortizing.

Diversified Vitality Investor Relations

As you may see within the picture above, the debt is self-amortizing as Diversified continues to make annual repayments of the principal quantity. Be aware: The picture above is for illustrative functions solely as Diversified has the choice to “throttle” the reimbursement tempo. For 2023 we see the corporate plans to repay $270M in principal of the debt which suggests to maintain the dividend and have the ability to afford the deliberate debt reimbursement, Diversified must generate $410M in free money stream. That’s primarily based on the year-end 2022 scenario. Subsequent to the top of 2022, Diversified introduced a capital elevate (priced at 107 pence, so greater than 15% above the present share value) to 971M shares. This implies the money wants to keep up the dividend have elevated to $165M and the whole money outflow for this 12 months (together with the debt reimbursement) will likely be $435-440M.

That capital elevate was carried out in reference to one other acquisition. An acquisition which is able to additional improve the consolidated manufacturing price by greater than 10% whereas producing $107M in extra EBITDA within the course of utilizing January strip costs. So a value-accretive transfer however the acquired asset will want some “managing” primarily based on the present residual reserve life index. A $25M capex program is budgeted for 2023 to complete some almost-completed wells.

Going again to the debt scenario on the stability sheet. Will probably be a reduction to see nearly all of the debt has mounted rates of interest and labeled as asset-backed securities. This additionally means Diversified will proceed to borrow cash in opposition to property and PV10values of these property. That maybe received’t work rather well with Henry Hub spot costs under $2.50, however given the self-amortizing schedule of the prevailing debt, there isn’t actually a have to refinance the debt so long as Diversified is ready to step by step scale back its debt. And if it repays $270M this 12 months, it is going to see its curiosity bills lower by in extra of $10M.

Diversified Vitality Investor Relations

All of the ABS notes have a authorized maturity date in 2037 and past however have an preliminary amortization interval which sees the debt being paid off by 2030. However by having a authorized maturity date that’s a lot additional out sooner or later, Diversified could have some flexibility to scale its funds and repayments.

And at last, there is a risk Diversified will have the ability to proceed to promote non-core property like earlier this week when it offered non-producing acreage for US$16M. Whereas US$16M isn’t an entire lot within the better scheme of issues, it is going to for certain make issues simpler for the corporate. One other small sale was accomplished in June, which additionally helped the corporate to understand US$40M in proceeds. Mixed, this $66M takes care of a few quarter of this 12 months’s debt repayments.

A take a look at the hedges for 2023 and past

In any case, the primary query this 12 months is clearly “will it have the ability to generate $450M in free money stream this 12 months?” as that’s the whole amount of money it must comfortably cowl the dividend in addition to the scheduled repayments of the principal of the prevailing debt.

We all know the corporate generated $300M in working money stream in FY 2022 primarily based on a median manufacturing price of 135,000 boe/day and a realized pure gasoline value of $2.98. We all know this 12 months’s manufacturing will are available at 158,000 boe/day. Let’s be conservative and use 155,000/day (the Q1 exit price was 145,000 boe/day, and the sale of the three,000 boe/day in June can even put stress on the full-year goal). That’s a 15% improve vs. 2022 which is able to already end in a $50M OpCF uplift to $350M.

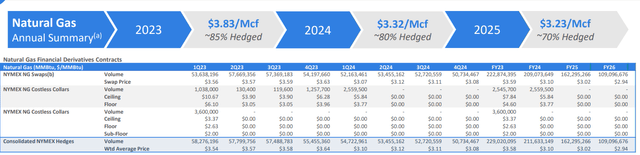

What’s now maybe much more fascinating and necessary is the hedge e-book for 2023. Whereas Diversified had fairly a number of hedges at low costs in 2022, the corporate took benefit of the upper pure gasoline costs in 2022 to begin hedging the next proportion of the 2023 and 2024 manufacturing at larger costs.

I’d usually seek advice from the year-end hedge e-book, however Diversified has lately been fairly lively, ensuing within the following breakdown (as of the top of FY 2022).

Diversified Vitality Investor Relations

For FY 2023, the corporate hedged a complete of 230M MMbtu (to not be confused with Mcf) of pure gasoline at a median value of $3.57 (that certainly is about 20% larger than the common realized value in FY 2022). That is 85% of the anticipated manufacturing which suggests the corporate is uncovered to the spot value for simply 15% of its manufacturing (be aware: the corporate continues to replace its hedge e-book so we’ll doubtless see new numbers as soon as the H1 outcomes will likely be revealed). Even when we’d use a median natgas value of $2.50 for the spot value this 12 months (I feel it is going to are available larger as I anticipate larger pure gasoline costs within the second half of this 12 months; the common value for supply within the last quarter of this 12 months is at present roughly $3.10), the common realized value could be round $3.42, a rise of 15% vs. 2022. This would supply an extra uplift of roughly $131M pre-tax and about $100M after-tax to the working money stream (all different working bills will clearly stay unchanged so we have to improve the income by 15% and never simply the working money stream). On this simulation, Diversified Vitality will certainly generate about $450M in working money stream and about $400M in free money stream.

That might not be enough to cowl the anticipated dividend + debt reimbursement schedule however have in mind the $2.50 market value is maybe a bit conservative and have in mind Diversified offered simply over $50M value of property on a year-to-date foundation. Ought to the ahead curve be right, a full-year value of $2.75-2.90 seems affordable. This nonetheless makes it tight however let’s not overlook 2023 is the ultimate 12 months of a moderately excessive principal reimbursement. The amortization schedule sees the principal quantity drop by $70M in 2024 adopted by one other lower in 2025. So mainly Diversified solely wants the $435M this 12 months. The money wants subsequent 12 months will lower to $355M (together with additionally diminished curiosity expense).

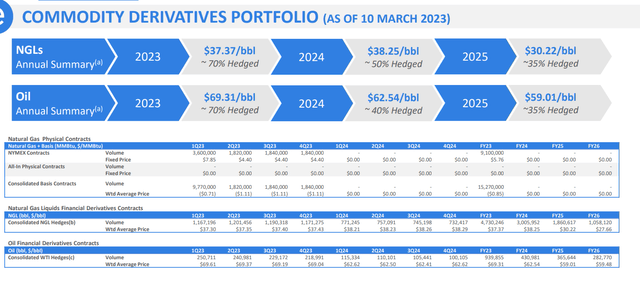

And one factor I haven’t mentioned but: For FY 2023, Diversified has already hedged 4.7 million barrels of NGL at $37.3. That’s 90% larger than its 2022 hedges (at $19.84/barrel!) and though that is solely a small portion of the manufacturing, this beautiful a lot ensures an extra 80M bump within the internet income and in extra of $50M in extra after-tax free money stream. This may doubtless be the swing consider figuring out whether or not or not Diversified can cowl its money outflow plans. At this level and primarily based on the present market costs and together with the proceeds from the asset gross sales, I’m leaning towards “sure.”

Diversified Vitality Investor Relations

Funding thesis

I’m scratching my head after I see Diversified’s share value efficiency. When the pure gasoline value was transferring up, traders have been (accurately) pointing on the hedge e-book as a motive why the share value barely moved. However now these hedges are proving to be very invaluable, the market is now pointing on the low pure gasoline value on the markets as a motive to keep away from Diversified and that is not sensible as the common realized value of Diversified this 12 months will

Personally I’m not too thrilled in regards to the excessive dividend because it’s clear the market doesn’t admire it. If Diversified would suggest a 50% minimize and pledges to make use of the remaining money to cut back its internet debt (or maybe purchase again some shares) I’d be 100% in favor of that plan.

Diversified Vitality just isn’t a “purchase and maintain endlessly” firm. However I do suppose the market is misinterpreting the corporate’s skill to generate constructive free money stream. Whereas the mix of dividend plus debt reimbursement could also be tight this 12 months, it is going to solely be tight this 12 months and a median pure gasoline value of US$3-3.25 ought to be enough to cowl all money wants from 2024 on (together with the 15% dividend). I anticipate the market to understand this someday over the following 12-24 months, and that is also the time horizon for this funding. I anticipate to understand a complete return of 20%-25% per 12 months over the following two 12 months interval. To realize that, the share value realistically solely wants to extend to 115-120 pence because the overly beneficiant dividend already takes care of a return of 15% per 12 months.

I’ve a considerable lengthy place in Diversified Vitality.

Editor’s Be aware: This text discusses a number of securities that don’t commerce on a serious U.S. trade. Please concentrate on the dangers related to these shares.

[ad_2]

Source link