[ad_1]

Kativ

The previous 12 months has seen one of the aggressive fee mountaineering cycles within the Fed’s historical past and has left the funding case for money as robust because it has even been. Durations of excessive rates of interest have tended to happen alongside intervals of robust return prospects for a combined portfolio of shares and bonds as fee hikes drive down valuations. This time round rates of interest are far greater than the long-term returns obtainable on shares and bonds, making a wonderful case for money.

50-50 Basket Of Shares And Bonds Priced For Beneath 2% Annual Returns

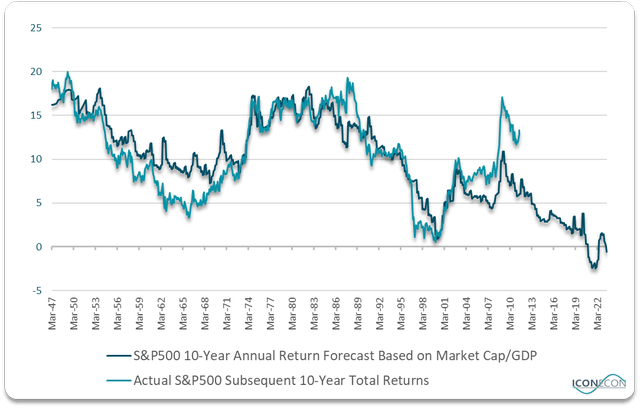

Within the case of 10-year authorities bonds the annual return is mirrored within the yield to maturity of 4%, whereas for shares we are able to solely estimate anticipated returns by taking a look at present valuations and the correlation between valuations and subsequent returns. Relying on the valuation metric one makes use of long-term return estimates can differ wildly, however the metrics with the strongest correlation with precise subsequent returns up to now have been people who strip out the influence of revenue margins that are extremely cyclical and imply reverting.

Bloomberg, Writer’s calculations

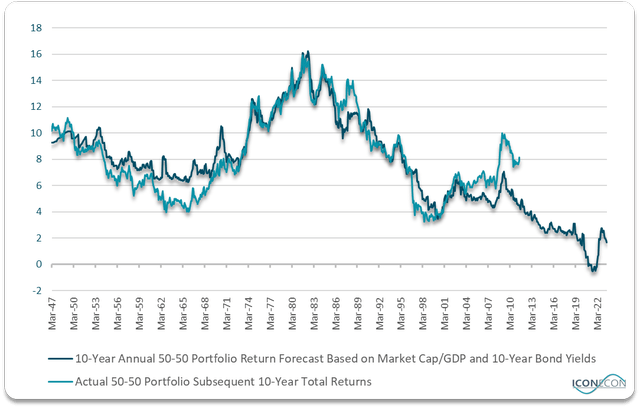

Utilizing the so-called Buffett Indicator, present inventory market capitalization as a share of GDP is now in step with 10-year annual complete nominal returns of -1%. Once we add within the return expectations for bonds, the 50-50 basket is now priced for 10-year complete returns of simply 1.7%, totally 6pp beneath the post-WWII common. Because the chart beneath reveals, there was a really shut correlation between return expectations and precise subsequent returns over this era.

Bloomberg, Writer’s calculations

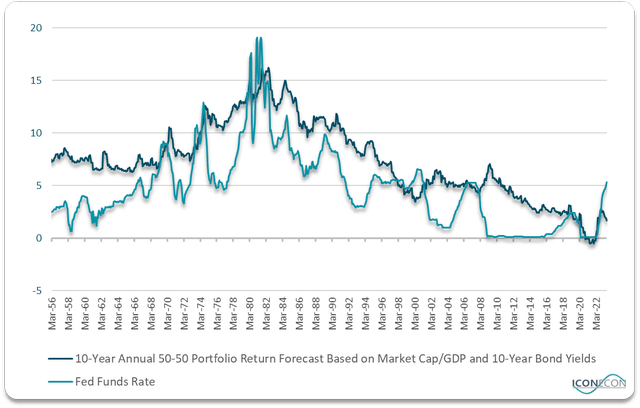

The following chart reveals how this return outlook compares with the Fed Funds fee, with rates of interest now at a file excessive relative to the anticipated return on an equally-weighted stock-bond portfolio. Durations of excessive rates of interest up to now have occurred alongside intervals of excessive potential portfolio returns. This isn’t solely as a result of greater rates of interest drive up 10-year bond yields, but additionally as a result of throughout the Nineteen Seventies and Eighties excessive charges additionally drove down fairness valuations.

Bloomberg, Writer’s calculations

The present interval is a significant anomaly. Excessive rates of interest have pushed up 10-year bond yields however the yield curve stays deeply inverted, whereas the S&P500’s valuations have returned to close file highs. Consequently, money has by no means been extra enticing when in comparison with the return outlook on a stability fairness/bond portfolio.

Financial Coverage Acts With A Lag

Because the Nineties portfolio return expectations have truly been inversely correlated with rates of interest as excessive charges have tended to mirror optimism about inventory market prospects and vice versa. In impact, the inventory market has pushed fee markets, with optimism encouraging the Fed to tighten and pessimism inflicting the Fed to ease.

This creates an issue for the Fed in that it should react aggressively to lean towards the prevailing market sentiment, which might imply that rates of interest are compelled to rise farther from right here, additional strengthening their relative worth case. Financial coverage acts with a lag and whereas traders are embracing a soft-landing view that ought to permit shares to stay elevated, fairness power itself will be certain that the Fed continues to maintain coverage extraordinarily tight, to the good thing about actual returns on money and to the detriment of actual returns on shares.

The Fed’s stability sheet continues to contract which helps to drive down total cash provide, now in its deepest contraction for the reason that Nice Despair. It ought to be no shock due to this fact that 1-year breakeven inflation expectation sit at simply 1.6%, giving money an actual yield of just about 4%. On the similar time, main financial indicators proceed to level to a slowdown, most notable of which is the Convention Board’s Main Financial Indicator index, which at -7.8% y/y in June is in step with a recession by early-2024.

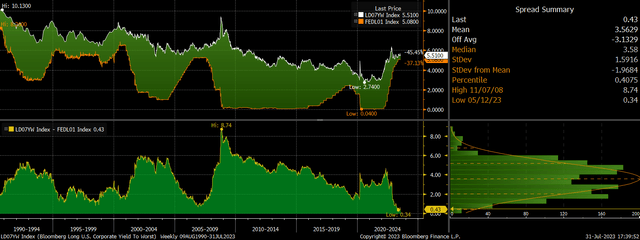

Fed Funds Price Now On A Par With Lengthy-Time period Company Yields

The attractiveness of money is maybe greatest illustrated in comparison towards the yield on company bonds. Danger urge for food is so robust and the yield curve so inverted that the Fed funds fee is now on a par with the yield on long-term US company bonds. Buyers are so satisfied that the Fed will ease and {that a} gentle touchdown will happen that they’re keen to lock within the yield on long-term company bonds regardless of the default danger and period danger even when money presents the identical yield.

Fed Funds Vs Yield On Lengthy-Time period US Company Bonds (Bloomberg)

My sense is that many traders are taking up danger proper now, both in shares or long-term bonds or credit score as they don’t count on excessive charges to stay in place for for much longer and as soon as the Fed begins to ease, danger property will rally. The issue is that rates of interest cuts have by no means truly helped danger property aside from once they have arrived after a crash has already occurred. The 47% complete return decline from 2000-2002, the 55% decline from 2008-2009, and even the 34% Covid crash all occurred alongside financial easing. Sooner or later, the long-term return outlook on shares and bonds will enhance sufficiently to warrant aggressive lengthy positions, however till then money is extremely more likely to outperform.

Editor’s Be aware: This text covers a number of microcap shares. Please pay attention to the dangers related to these shares.

[ad_2]

Source link