[ad_1]

Bitcoin had surged above $30,000 earlier in the course of the previous day however has since noticed a retrace as profit-taking from merchants has spiked.

Bitcoin Revenue-Taking Quantity Is At present Extra Than Twice The Loss-Taking One

Bitcoin confirmed some promising indicators of breaking away from its stagnation earlier in the course of the previous 24-hour interval, because the cryptocurrency’s worth managed to make a pointy restoration in direction of the $30,000 mark. This surge, nevertheless, couldn’t final for too lengthy, because the cryptocurrency has already slipped to the $29,700 stage.

BTC has seen some rise in the course of the previous day | Supply: BTCUSD on TradingView

Thus far, Bitcoin has been in a position to retain quite a lot of the restoration regardless of this pullback, because the asset’s worth continues to be considerably above the $29,000 stage it had been consolidating at previous to this transfer.

From the above chart, it’s seen that the present restoration surge seems to be fairly much like the one seen across the begin of the month. This rally additionally died off on the $30,000 stage and the worth slid off, till it will definitely ended up slumping again to sideways motion across the $29,000 mark.

It will seem that the $30,000 stage was appearing as a serious supply of resistance for the cryptocurrency again then, and evidently its function hasn’t modified this time both.

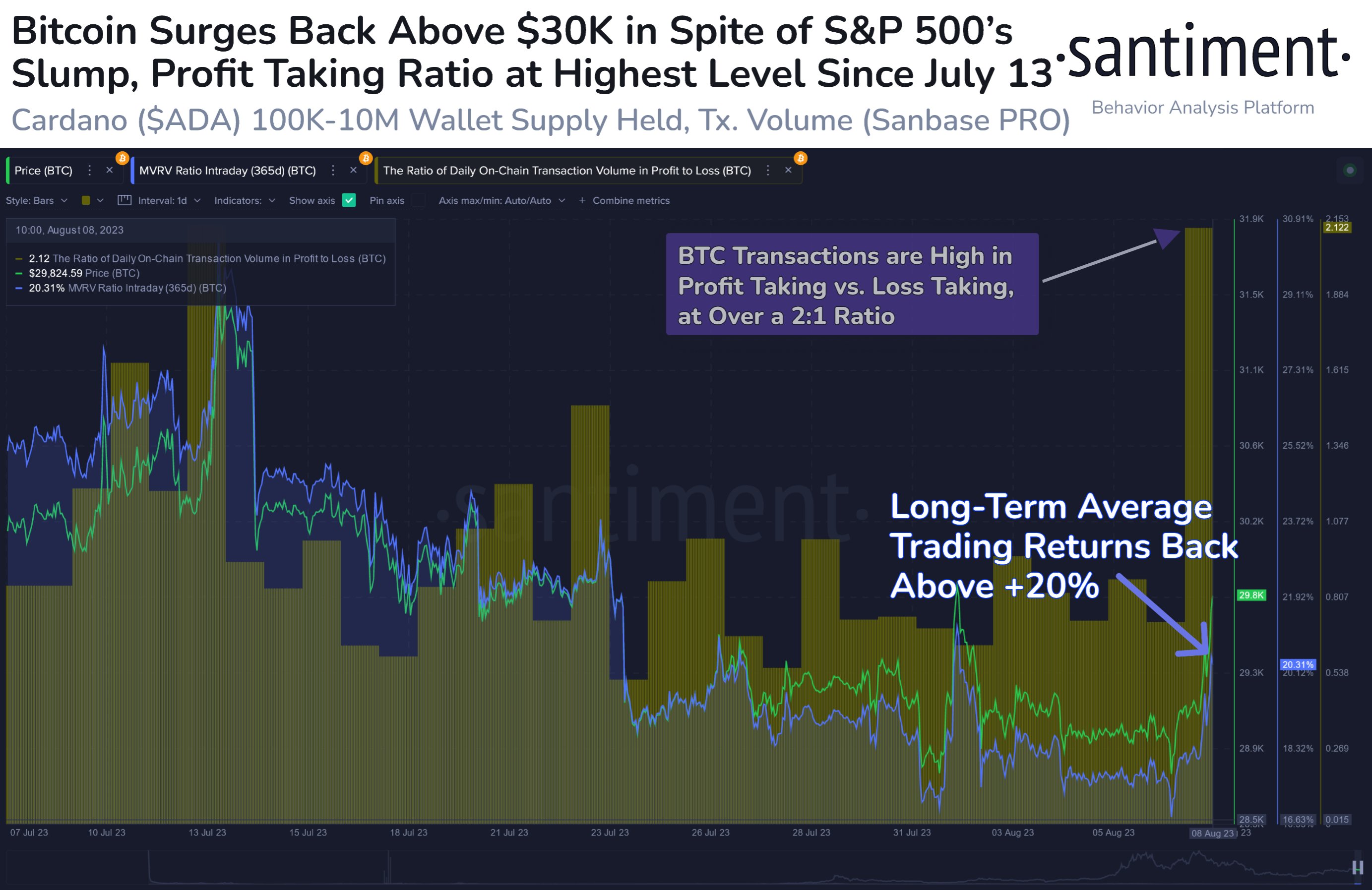

There may be one factor completely different this time, nevertheless, and that’s the stage of profit-taking that the traders are displaying. In line with knowledge from the on-chain analytics agency Santiment, the profit-taking out there has noticed a pointy improve as this rally has occurred.

The worth of the metric appears to have been fairly excessive just lately | Supply: Santiment on X

Within the above graph, the information for the “ratio of each day on-chain transaction quantity in revenue to loss” metric is proven, which retains observe of how the profit-taking quantity within the Bitcoin market compares with the loss-taking quantity proper now.

Clearly, this indicator has surged to some fairly excessive ranges, which means that the revenue realization is much outweighing the loss realization in the intervening time. It’s not unusual for this conduct to be seen throughout rallies, as some traders would wish to rapidly soar on the worthwhile alternative whereas it’s nonetheless there.

This scale of the profit-taking, nevertheless, could also be worrying. On the present stage of the indicator, the profit-taking quantity is greater than double the loss-taking quantity.

As might be seen from the graph, the metric had as an alternative remained comparatively muted when the aforementioned restoration rally of the same scale had taken place earlier within the month.

This distinction in conduct between the 2 Bitcoin worth surges could also be a mirrored image of how the traders have perceived every transfer. Earlier, they could have been extra eager for additional worth rise, so they could not have been too eager on harvesting their income simply but.

This time, nevertheless, the holders could also be pondering that this rise will die out just like the earlier one as effectively, so they’re utilizing the chance to rapidly exit from the market.

Featured picture from Maxim Hopman on Unsplash.com, charts from TradingView.com, Santiment.internet

[ad_2]

Source link