[ad_1]

Jack Taylor

Abstract

This publish is to supply an replace on my ideas on Monster Beverage’s (NASDAQ:MNST) latest efficiency and 2Q23 outcomes. I like to recommend a purchase score for MNST as I anticipate earnings progress to stay robust within the low 20% vary, supporting its valuation premium vs. friends.

Funding thesis

The 12.1% improve in income was simply shy of the 12.8% improve anticipated by consensus, nevertheless, natural gross sales is up 14.4%. The corporate’s gross margin elevated by 541 foundation factors to 52.5% because of worth will increase and reduces in delivery and aluminum can prices, amongst different elements. MNST’s 2Q23 EPS of $0.39 was according to consensus expectations.

The main sequential slowdown in Latin America from 1Q23’s 40.4% progress to 2Q23’s 9.4% progress is the “purple” flag I believe must be addressed first this quarter. Because of the troublesome comps attributable to speedy progress because the introduction of COVID, product provide challenges, and distributor stock de-stocking, I consider a three-year stack foundation is one of the best lens by means of which to judge this progress. As such, the sequential progress comps will not be as significant as they appear. What’s extra, the administration’s tone through the name satisfied me there may be nothing basically improper with this slowdown. They appeared assured that the slowdown would finish as inventories are introduced again as much as par, they usually pressured that the model continues to be going robust within the area, as evidenced by its dominance available in the market in lots of international locations. I belief the statements of the administration, particularly given the sturdy efficiency of the US market (which is extra developed). Within the week previous the discharge of the 2Q23 earnings name, the tracked channel progress was 13%, and there was nonetheless a gentle progress of round 10% within the conventional power sector.

“So if I discuss in regards to the power class as such, and we began trying on the one-week knowledge as a result of the neighborhood appears to be like on the one-week knowledge. And the power class continues to be rising in good double-digits, 13% within the final week. So we’re seeing a superb improve within the power class.”

Within the near-term, I anticipate MNST’s progress momentum to keep up its robustness, as indicated by administration’s report of a 13.7% improve in product sales excluding overseas change results and encompassing alcohol manufacturers. The robust efficiency of product sales in July aligns properly with the consensus estimate of a low-teens progress (13.9%) for 3Q23. Given MNST’s monitor document of fostering innovation, I’ve confidence within the firm’s capability to maintain an progressive tradition and lengthen its progress prospects within the years forward.

Illustrating this, in 2Q23, the sale of latest alcohol manufacturers contributed practically 3pts of progress to the U.S. top-line, a exceptional feat particularly contemplating that The Beast Unleashed [TUB] had not but achieved nationwide distribution. With the upcoming nationwide distribution of TUB by the top of FY23, I anticipate additional constructive progress influence. Moreover, Nasty Beast and NOS Zero Sugar, two new merchandise, are anticipated to play a task in MNST’s growth within the close to time period. Significantly with the latter, my confidence is bolstered by MNST’s confirmed success with its Monster Zero Sugar product.

Taking every part into consideration, primarily based on my evaluation of latest outcomes, I’m assured that the corporate is in a good place to maintain exceptional progress by the use of exceptional innovation, advantageous mergers and acquisitions, and the exploration of the high-margin alcohol sector. Regarding the 2Q23, MNST reported yet one more interval of robust income progress, attributed to the constructive influence of worth hikes and a powerful lineup of progressive merchandise which can be performing exceptionally properly.

Valuation

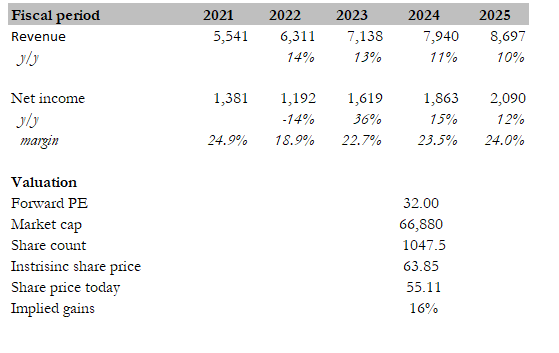

I consider the honest worth for MNST primarily based on my mannequin is $63.85. My mannequin assumptions are that MNST will proceed to see robust and elevated earnings progress within the low-20% vary, supported by low-double-digit top-line progress (in keeping with latest traits) and its capability to innovate merchandise to penetrate adjoining classes (alcohol, tea, and so on.). Margins ought to broaden naturally because the enterprise enjoys excessive incremental margins from penetrating into new verticals because it leverages the identical distribution community.

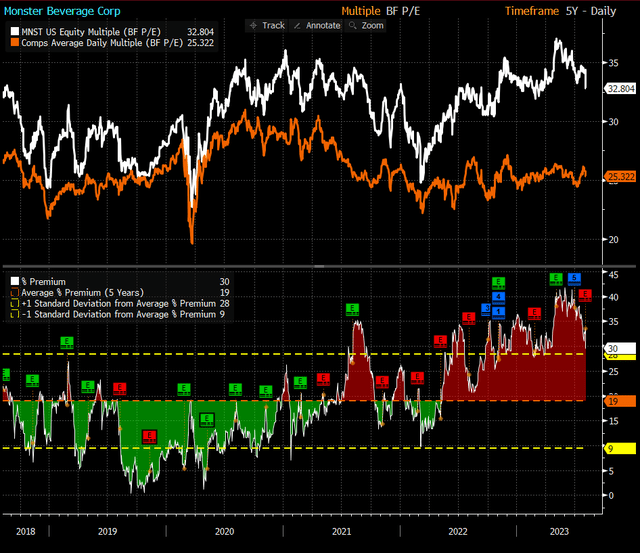

Friends embody: PepsiCo (PEP), Coca-Cola (KO), Celsius (CELH), Keurig Dr Pepper (KDP), and Nationwide Beverage Corp. (FIZZ). The median ahead PE a number of friends are buying and selling at is 25x, the anticipated 1Y income progress price is 5%, and the leverage ratio is 1.2x web debt to EBITDA. I anticipate MNST to proceed buying and selling at a premium to friends given its greater progress price (14% anticipated 1 12 months progress) and its web money place, which provides it ample flexibility to conduct M&A and drive innovation with out worrying about liquidity points.

Personal calculation

Bloomberg

Threat

Given the commodity nature of drinks, my fear comes from elevated competitors from friends immediately rising investments in their very own power manufacturers. I’m constructive that MNST can innovate and market properly to defend its place, however shopper style and choice can change simply and are inconceivable to trace or know prematurely.

Conclusion

To conclude, the upside for MNST is promising, supported by its sturdy earnings progress and absence of debt, warranting the next valuation. The corporate’s 2Q23 outcomes demonstrated regular progress, with robust top-line growth and enhanced margins attributed to strategic pricing actions. Regardless of a brief slowdown in Latin America, administration’s assured outlook signifies a possible rebound, whereas the US market continues to carry out properly. The entry into the alcohol section and innovation additional fortify progress potential. Contemplating the constructive monitor document, I like to recommend a purchase score for MNST.

[ad_2]

Source link