[ad_1]

Listed below are three huge tales from Africa and the worldwide enterprise panorama you (most likely) didn’t miss however ought to bear in mind this week:

Nigeria cuts energy provide to Niger

Within the aftermath of the coup that usurped President Mohamed Bazoum from energy in Niger, Nigeria has suspended its electrical energy provide to its neighbouring nation. Niger is significantly reliant on Nigeria, which serves as its major supply of electrical energy. As a lot as 70% of Niger’s electrical energy provide is hinged on Abuja’s assist.

Earlier than this growth, the Financial Group of West African States (ECOWAS) put sanctions on Niger however has not stated if these embrace electrical energy provides. Along with a one-week ultimatum to revive constitutional order and droop monetary transactions with Niger, ECOWAS decreed the freezing of “all service transactions, together with vitality transactions”.

Nonetheless, there’s one other side to contemplate. The Kainji Dam, which provides most of Nigeria’s hydropower, depends on generators pushed by water movement from the Niger River. This example raises issues about Nigeria’s vitality sustainability if the military-led authorities in Niger had been to take an unprecedented step – blocking the river’s movement from their aspect.

GSK exits Nigeria

After 51 years of operation in Nigeria, GlaxoSmithKline (GSK), a British multinational pharmaceutical and biotechnology firm introduced plans to exit Nigeria final week. The corporate, well-known for its merchandise akin to Augmentin, Neosporin, Panadol, Sensodyne, Advair, Ventolin, and Theraflu, amongst others, is taking this motion after evaluating the choices for shifting to a third-party distribution mannequin for its pharmaceutical merchandise.

Prior to now Recall that the corporate had famous that challenges with accessing foreign exchange had been disrupting the supply of medication in Nigeria. And at some extent, shareholders of the corporate had known as on the board and federal authorities to avoid wasting the corporate from the brink of collapse.

GSK shouldn’t be the one firm with plans to exit Nigeria. A mixed influence of some early reforms in Nigeria has led quite a few firms to withdraw their operations. GSK is solely the newest on this sequence elevating questions concerning the future of companies in Nigeria amidst the financial recalibration.

UK provides £60 million assist to Nigeria

The federal government of the UK has stated it’s providing assist totalling £60 million for agriculture, meals methods and humanitarian actions in Nigeria.

In response to the British authorities, the package deal is hoped to assist greater than 4 million folks develop higher agricultural practices and fight the results of local weather change occasioned by carbon emissions.

Nigeria is at the moment going through financial challenges which have led to a major enhance in inflation, reaching a prohibitive 22.79 per cent. This excessive determine has been primarily pushed by a steep rise in meals costs, inflicting meals inflation to climb to 25.25 per cent. In gentle of the alarming nationwide meals inflation, the federal authorities declared a state of emergency on meals safety The help fund offered by the UK might play a vital position in enhancing the resilience of the nation’s fragile meals system, which stays extremely inclined to the adversarial impacts of local weather change.

ICYMI: Market roundup

The Nigerian Trade Group opened buying and selling on the inventory market on Monday 31 August. The NGX All-Share Index appreciated by 0.22% to shut the week at 65,198.08. The highest gainers had been Sunu Assurances Nigeria PLC (55.00%), Chellarams Plc (32.95%), Abbey Mortgage Financial institution (32.73%), Dangote Sugar Refinery PLC (25.00%), and Skyway Aviation Dealing with Firm PLC (20.82%). The highest decliners had been John Holt plc (-33.18%), OMATEK Ventures Plc (-30.61%), Sovereign Belief Insurance coverage plc (-28.57%), Eterna Plc (-26.74%), and Ikeja Lodge PLC (-18.52%).

The naira closed the week at $1/₦743.07 in opposition to the greenback on the Buyers’ and Exporters‘ window.

Brent crude closed the week at $86.24, whereas US West Texas Intermediate (WTI) crude closed at $82.82.

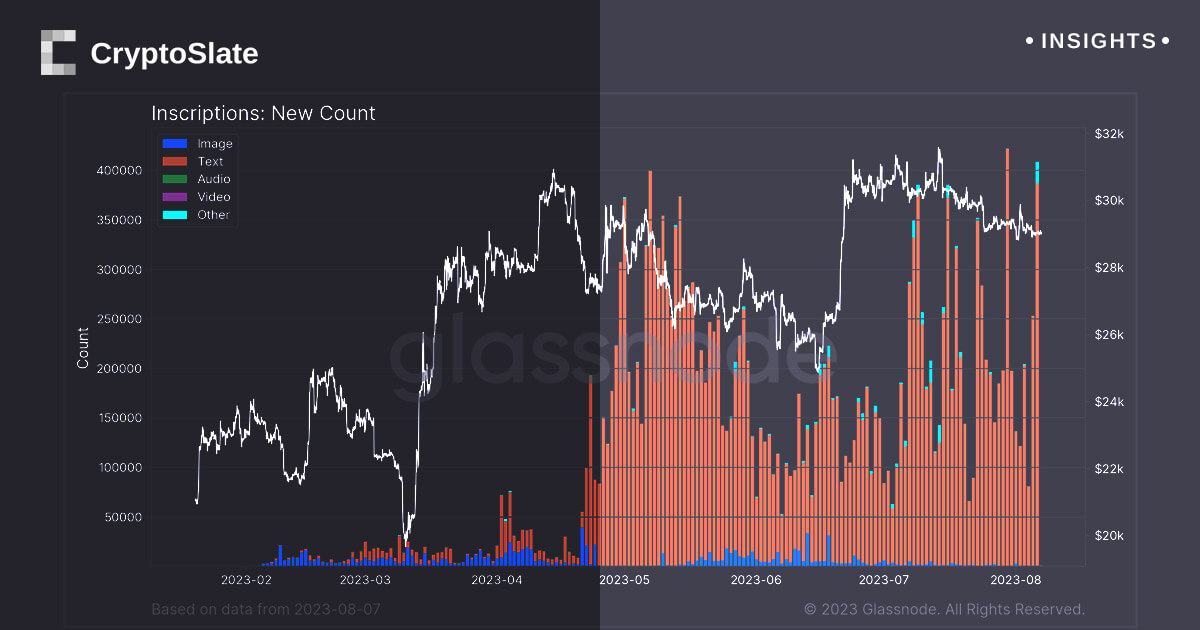

The world cryptocurrency market cap stood at $1.16 trillion, as of 1;34 am Sunday, sixth of August. Bitcoin stood at $29,043, (a 0.99% lower in 7 days), Ethereum stood at $1,834.49 (a 2.40% lower in 7 days) and Binance coin stood at $243.36 (a 0.36% enhance in 7 days).

South African enterprise capital agency, REdimension Capital, has raised over $10 million for its inaugural fund.

Terragon, a cloud analytics and advertising platform, has introduced a $ 9 million Sequence B spherical.

Remedial Well being, a Nigerian startup digitizing pharmacies and bringing effectivity to the pharmaceutical worth chain, has raised USD 12 M Sequence A equity-debt funding.

Emtech, an African supplier of central banking infrastructure introduced a $4 million seed funding.

Traction, the Nigeria-based service provider answer platform, introduced a $6 million seed spherical.

[ad_2]

Source link