[ad_1]

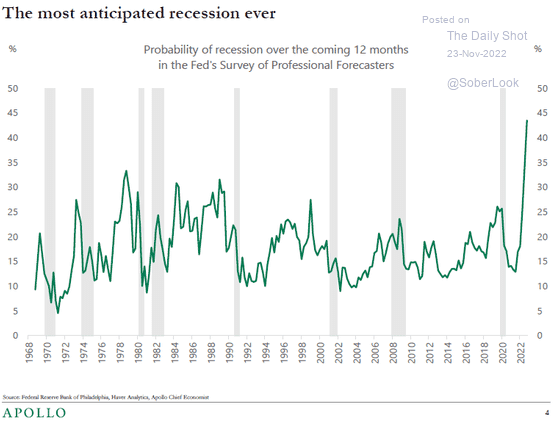

For the reason that starting of 2022, the media has usually warned a recession is coming. As we recommended beforehand, if a recession DID happen, it could be probably the most well-forecasted recession ever on file.

“Whereas the ‘chances’ of a recession in 2023 appear much more important, what bothers us with the recession/onerous touchdown view is that everybody thinks the identical. As Bob Farrell as soon as stated, ‘When all consultants agree, one thing else tends to occur.’”

Most Anticipated Recession Ever

One thing else has certainly occurred. As mentioned in “,” quite a few measures counsel a recession is forthcoming. Nevertheless, that recession has but to disclose itself. Such has led to a fierce debate between the bulls and the bears. The bears contend {that a} recession continues to be coming, whereas the bulls are betting extra closely on a “no touchdown” state of affairs or, as a substitute, avoiding a recession. Even the Federal Reserve is not anticipating a recession.

However how is a “no recession” consequence attainable amid probably the most aggressive fee climbing marketing campaign in historical past, deeply inverted yield curves, and different measures warning of its inevitability?

We discover the reply within the “cash path.”

Observe The Cash

Let’s overview the actions thus far to maintain some consistency within the evaluation.

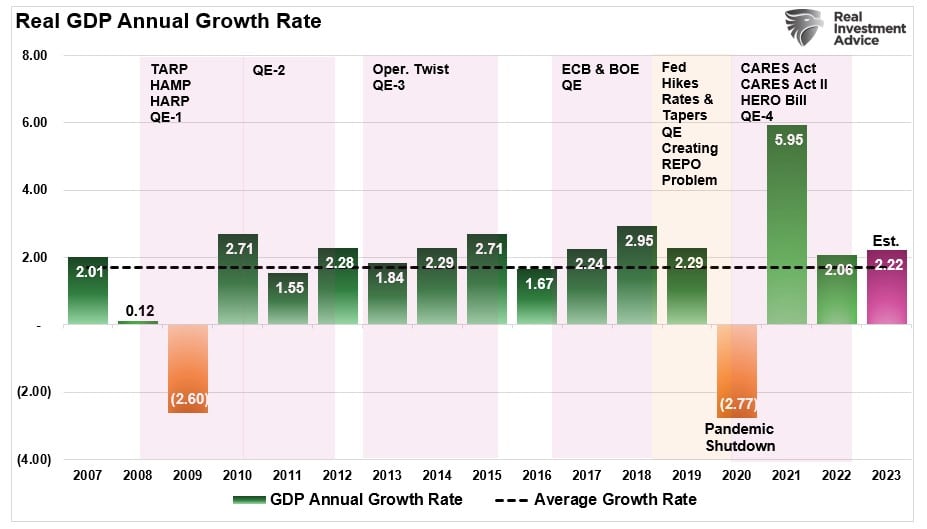

Because the financial system shut down in March 2020 as a result of pandemic, the Federal Reserve flooded the system with liquidity. Concurrently, Congress handed a large fiscal stimulus invoice. That invoice prolonged Unemployment Advantages by $600 weekly and despatched $1200 checks on to households.

Then in December, Congress handed one other $900 billion stimulus invoice. That invoice once more prolonged unemployment advantages at a decreased quantity of $300 per week, plus sending $600 checks to people once more.

To not be outdone, after Biden took workplace, the Administration handed the solely Democrat-supported $1.9 trillion “spend-fest.”

In that invoice, $900 billion went to people via $400 prolonged unemployment advantages and $1400 checks on to households. The remaining $1.1 trillion had little financial worth as bailing out municipalities and funding pet tasks didn’t increase consumption.

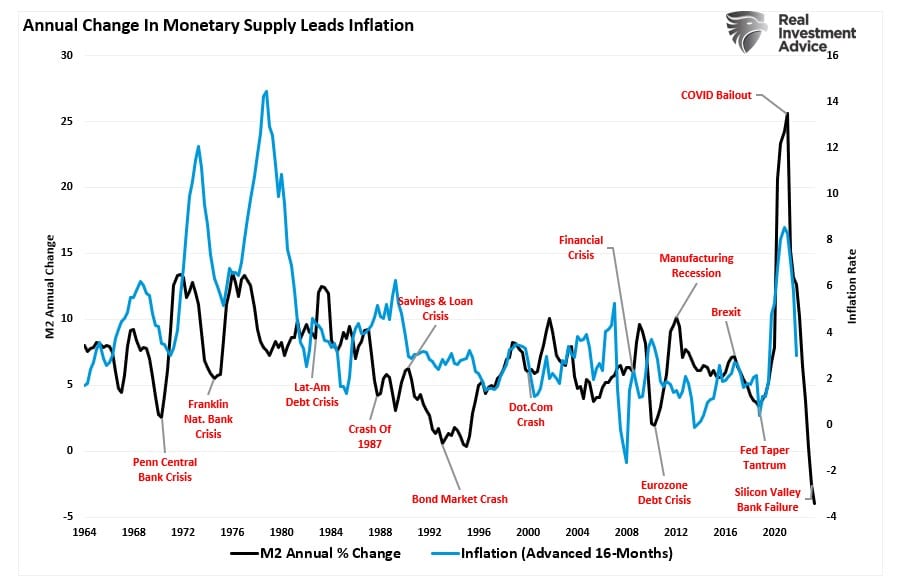

Unsurprisingly, the results of stopping provide by shuttering the financial system and flooding households with cash was, you guessed it, inflation.

M2 As A Proportion Of GDP

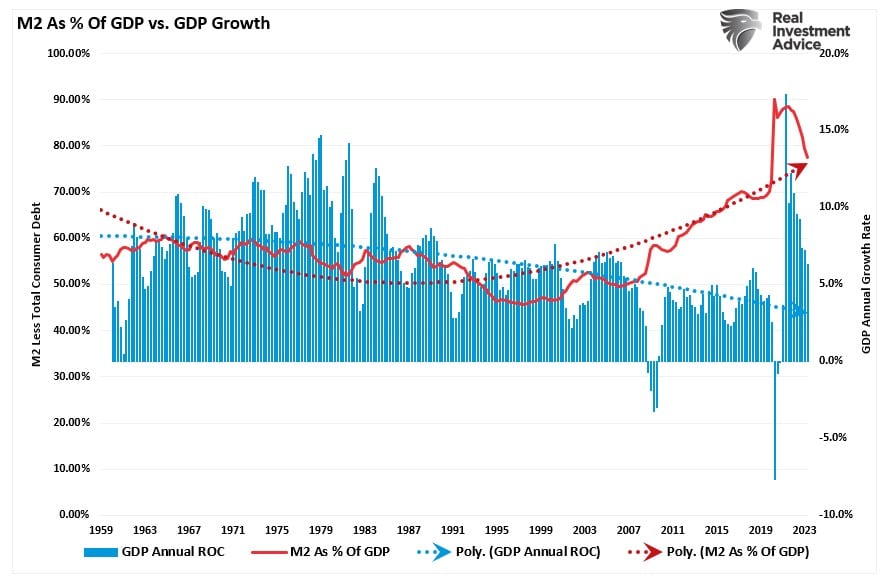

Nevertheless, this surge in cash provide additionally explains why a recession stays so elusive. Whereas the annual fee of change within the cash provide has plunged, which is why inflation is contracting, the cash injected into the financial system continues to be in circulation. We all know this by analyzing the cash provide as a share of the financial system.

Sure, M2 as a share of GDP spiked through the pandemic-driven spending frenzy, however discover that M2 has risen steadily because the “Monetary Disaster.” As proven beneath, such explains why the financial system held up during the last 13 years to numerous financial occasions that ought to have doubtless resulted in a recession. (Primarily based on the expansion charges for the 12 months’s first half, I’ve estimated GDP progress for 2023.)

Avoiding a recession is simpler to know when put into the context of the surge in cash provide derived from continued fiscal and financial inputs.

Nevertheless, as mentioned in “,” the fee is subpar financial progress and decrease requirements of prosperity.

However that, as they are saying, is “historical past.” With all of these Covid-era packages ending, the Fed climbing rates of interest, and lowering their steadiness sheet, how is the financial system nonetheless avoiding the “inevitable recession?”

The Invisible Hand

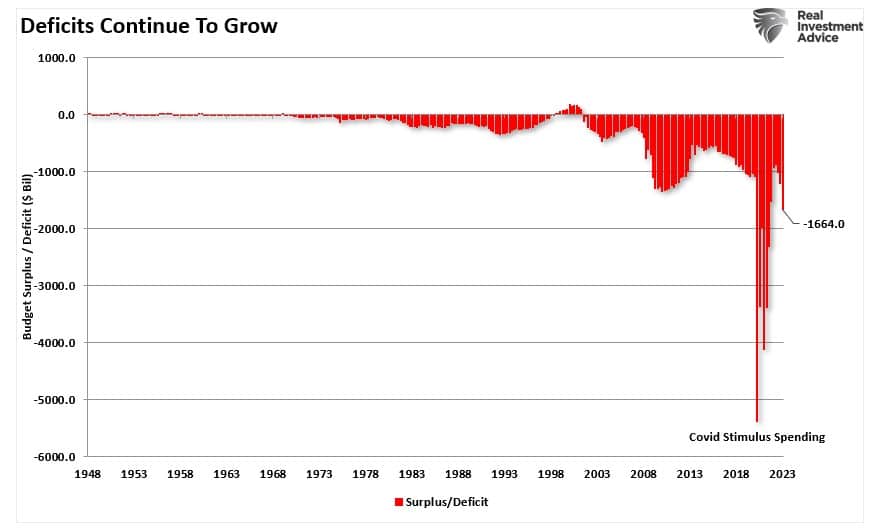

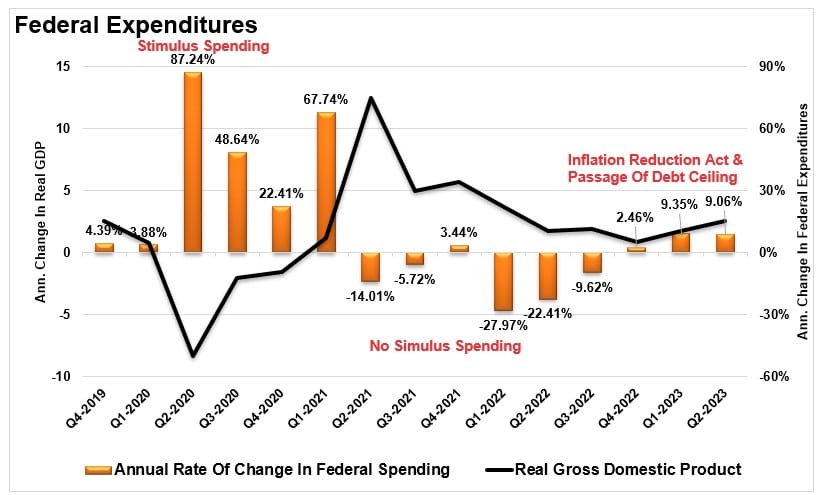

Whereas many economists and analysts anticipate a recession as a result of many traditionally correct indicators, one factor continues to get ignored. That’s the $1.7 Trillion “Inflation Discount Act” handed by the Biden Administration in 2022. Whereas the invoice did go, it has nothing to do with lowering both inflation or the deficit. Whereas the deficit did decline together with inflation, such was a operate of the huge stimulus not being renewed and the normalizing of provide and demand. Secondly was the passage of the latest “debt ceiling” invoice, which routinely will increase spending by 8% every year because of baseline budgeting in Washington. Such is why the deficit continues to swell every year.

Unsurprisingly, contemplating there isn’t any fiscal duty in Washington, D.C., Federal spending continues to rise markedly. That spending continues to maintain the financial system from the broadly anticipated recession.

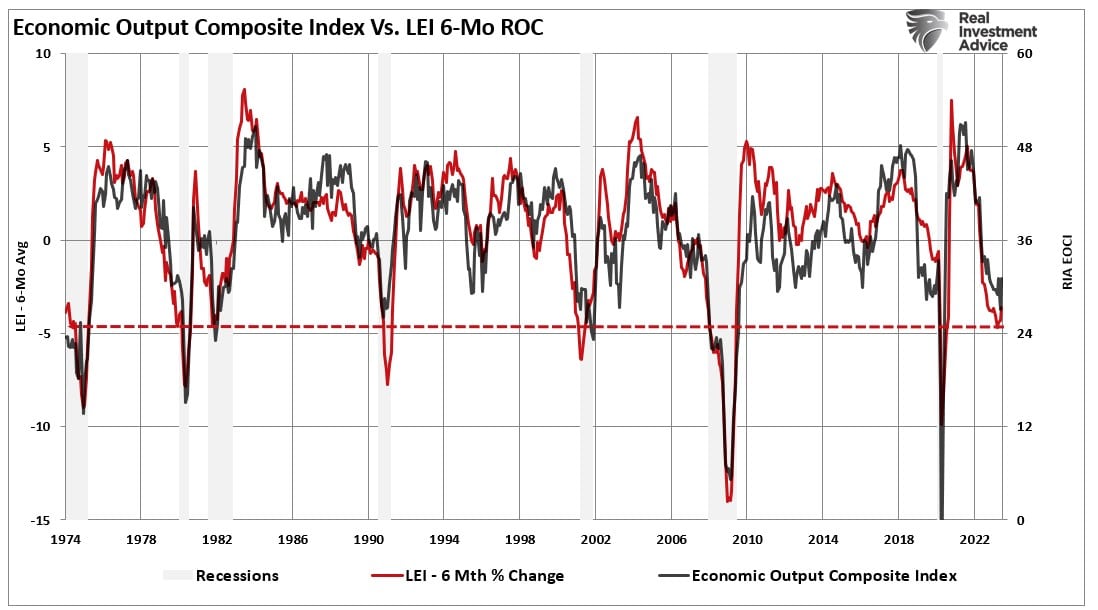

Nevertheless, such could not at all times be the case. As famous above, the huge flood of financial stimulus continues to be working via the system. When mixed with will increase within the deficit, the financial system has managed to take care of some progress. Nevertheless, as mentioned in a latest publish, “,” which has lengthy been a number one recessionary indication.

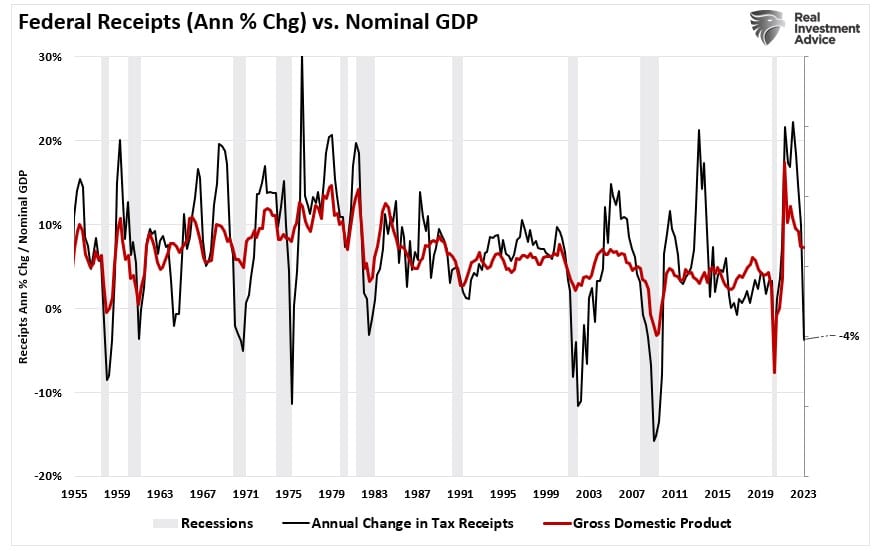

“Discover that whereas Federal expenditures are rising, Federal tax receipts are falling. Such is why the nationwide deficit is rising, which, as famous above, is just the distinction between revenue and expenditures that should be financed via debt.

We’re watching the change in Federal receipts because the Authorities’s revenue is derived from the taxes on each company and particular person incomes. Logic dictates that if incomes are falling, then much less taxes are getting paid. Unsurprisingly, if revenues and incomes decline, such would mirror financial exercise. As proven beneath, there’s a very excessive correlation between the annual change in Federal receipts and financial progress. Traditionally, when the annual change in Federal receipts falls beneath 2% annual progress, such has traditionally preceded financial recessions. Federal receipts’ annual fee of change is at present a destructive 4 p.c (-4%).“

The recessionary onset stays delayed because the Federal authorities continues its spending orgy. Nevertheless, if or when some fiscal sanity returns to Washington, the spending contraction will doubtless set off the recession’s onset.

Nevertheless, till then, the “no recession” view could proceed to help the bullish case.

[ad_2]

Source link