[ad_1]

bjdlzx

Worldwide Petroleum (OTCPK:IPCFF) is a Lundin Group firm that’s headquartered in Canada. The corporate has operations in Canada (and it reviews in United States {dollars} until in any other case famous) but in addition in France and Malaysia. As such, this firm is more likely to turn out to be a worldwide operator because it grows.

The Lundin Group of corporations is headed by the Lundin household pursuits. As the web site notes in a number of locations, there isn’t a firm on the head of those pursuits. That makes the group slightly bit atypical. However it seems to work effectively because the group has a incredible status amongst a good variety of buyers.

Every firm that’s a part of (or was previously a part of) the Lundin Group could also be massive or small by itself. However the entire group is impressively massive. This enables an organization like Worldwide Petroleum to have entry to the entire organizational expertise and funds that give an organization like this fairly an edge over the competitors. Buyers in an organization like this achieve a administration depth that’s seldom seen in comparable corporations within the business. It sharply reduces that small firm danger.

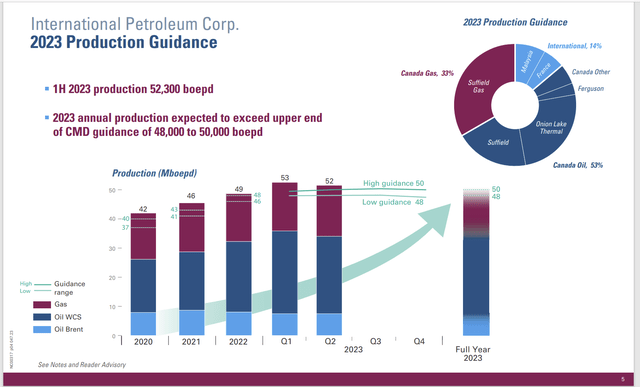

Worldwide Petroleum Manufacturing Development And Present Steering (Worldwide Petroleum Second Quarter 2023, Earnings Convention Name Slides)

Administration has managed to extend manufacturing throughout a time when many within the business have targeted on steadiness sheet restore. This accomplishment has received to be a key a part of evaluating the superior expertise of administration.

It’s particularly noteworthy as a result of this firm has important publicity to heavy oil and thermal oil manufacturing. These merchandise usually have expanded reductions that dry up money flows throughout business downturns. Administration does offset the numerous earnings volatility with low debt. Administration additionally has balanced that heavy oil manufacturing with different merchandise as proven above.

Most of the corporations within the Lundin Group develop opportunistically by acquisitions and mergers. This firm has its justifiable share of acquisitions in its historical past as effectively. The administration expertise limits the chance of overpaying for an acquisition or the chance that an assimilation won’t work out. The administration expertise additionally minimizes the chance of a comparatively massive acquisition.

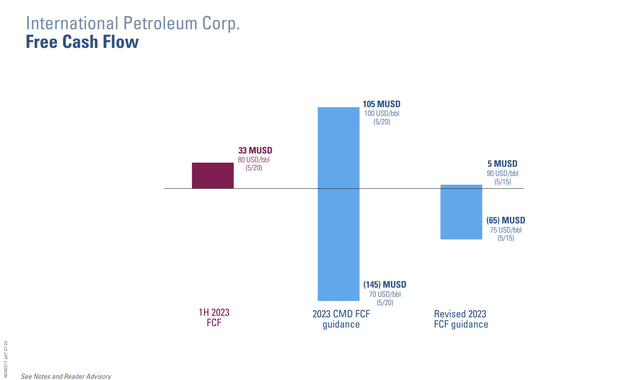

Worldwide Petroleum Free Money Circulation Steering (Worldwide Petroleum Second Quarter 2023, Earnings Convention Name Slides)

This administration will spend cash to realize most firm worth. This can be a development story with the corporate more likely to be bought or merged at a superb worth sooner or later.

Since there are a good variety of opportunistic acquisitions over the previous couple of years, buyers can count on administration to spend cash to optimize operations. That always takes a number of years. Essentially the most cash is after all spent nearer to the time of the acquisition. However there’s usually a reducing amount of cash spent on optimization and assimilation for a number of years afterward.

The primary and fourth quarters are historically the busiest in Canada for capital initiatives. The second quarter (and generally the third quarter) are influenced by Spring Breakup. Exercise is diminished at the moment till Spring Breakup has handed. Due to this fact, free money stream is usually bigger within the second and third quarters.

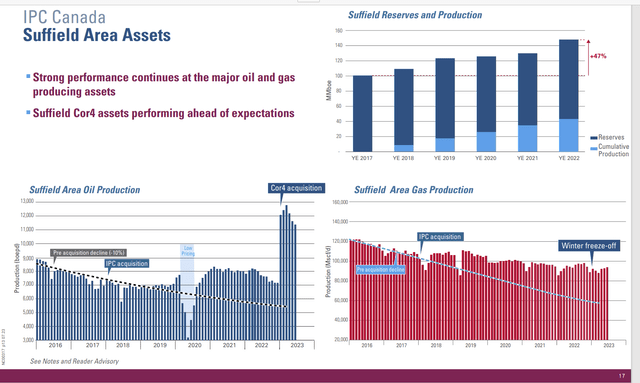

Worldwide Petroleum, Suffield Space Manufacturing Historical past (Worldwide Petroleum Company Earnings Convention Name Presentation Second Quarter 2023)

Most likely probably the most important a part of the corporate’s enterprise is the Suffield Space. The latest acquisition is basically liable for the expansion within the present fiscal 12 months (to this point). That is additionally the realm that’s largely liable for pure gasoline publicity as effectively.

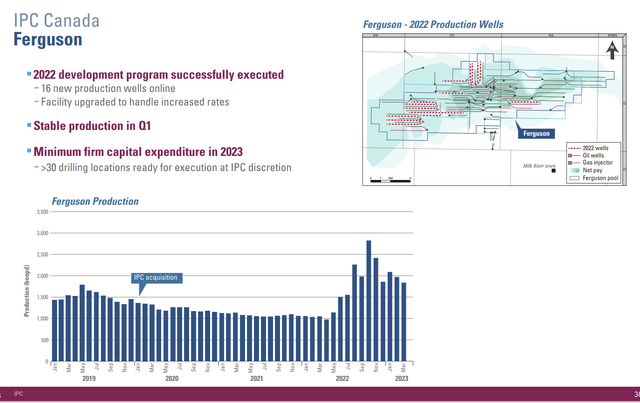

Worldwide Petroleum Ferguson Progress Since The Acquisition Of Granite Oil (Worldwide Petroleum June 2023, Company Presentation)

(Notice: This was the newest slide I may discover on this challenge).

The Ferguson acreage was acquired by the acquisition of Granite Oil. On the In search of Alpha web site, there have been loads of articles about all of the oil on the Ferguson leases (and absolutely the corporate was value excess of it was at present priced). There have been loads of articles elsewhere about these reserves as effectively.

The issue was that Granite was a small firm with restricted sources. Due to this fact, rising manufacturing at an inexpensive price whereas paying shareholders utilizing an earnings mannequin proved to be largely unsustainable.

As has occurred many occasions within the business, the corporate was acquired for a small fraction of all these reserves on account of manufacturing points. The corporate famous earlier within the presentation that the acquisition was practically three years in the past.

But, it lastly seems that Worldwide Petroleum has found out the way to enhance manufacturing on these leases with cheap prices. This can be a very typical instance of this administration buying “issues” after which fixing these issues to the good thing about shareholders. However as this slide demonstrates, it usually takes time to resolve these issues, or the acquired firm administration would have taken care of those points.

Nonetheless, this set of leases is doubtlessly the longer term massive firm publicity to mild oil manufacturing. Since mild oil sells at a premium to heavy oil and thermal oil (and the worth holds up higher throughout business downturns), this acquisition may show to be very worthwhile with appreciable upside).

That is one more instance of the constraints of the reserve report. As many famous, there was loads of potential oil on this space for the scale of Granite Oil. However getting that oil to market proved to be very difficult.

Key Takeaways

Worldwide Petroleum has opportunistically made acquisitions that administration should now make into one rising and worthwhile firm. Administration seems to be effectively on their technique to doing simply that.

This firm has the sources of the Lundin Group of corporations at its disposal. That implies that this firm has much more financially skilled sources to attract upon than many corporations of this dimension. The Lundin Group of corporations has an excellent status with shareholders which can be a bonus.

Funds are comparatively conservative. So, if one other opportunistic acquisition presents itself, the corporate is in a superb place to reap the benefits of that.

Administration will repurchase shares moderately than pay a dividend. That is going to be a development story. So, funding beneficial properties will come from inventory appreciation if administration is profitable. The Lundin Group of corporations usually are constructed after which bought.

This firm is a powerful purchase as it’s comparatively low cost with the Lundin Group of corporations’ benefits. Funds are conservative, and the outlook might be higher than common.

Editor’s Notice: This text discusses a number of securities that don’t commerce on a significant U.S. change. Please pay attention to the dangers related to these shares.

[ad_2]

Source link