[ad_1]

US greenback has damaged out forward of Powell’s speech

In the meantime, EUR/USD is eyeing a pattern reversal

USD/JPY’s rally has fizzled out

All through the primary half of the week, the maintained relative stability. Nevertheless, as US financial knowledge started to exhibit indicators of decline, the buck shifted decrease.

Wednesday launched notable volatility to the FX market, primarily triggered by disappointing PMI knowledge within the US. Nonetheless, the greenback’s decline was considerably offset by even weaker PMI knowledge rising from each the Eurozone and the UK.

Thursday ushered in a extra optimistic outlook. Unexpectedly robust functions, totaling 230K, and a 0.5% improve in for July supplied insights into the economic system’s resilience. These constructive indicators bolstered the greenback’s energy.

Now, because the week nears its conclusion, the forex has regained momentum and initiated an ascent in anticipation of a hawkish by Jerome Powell on the .

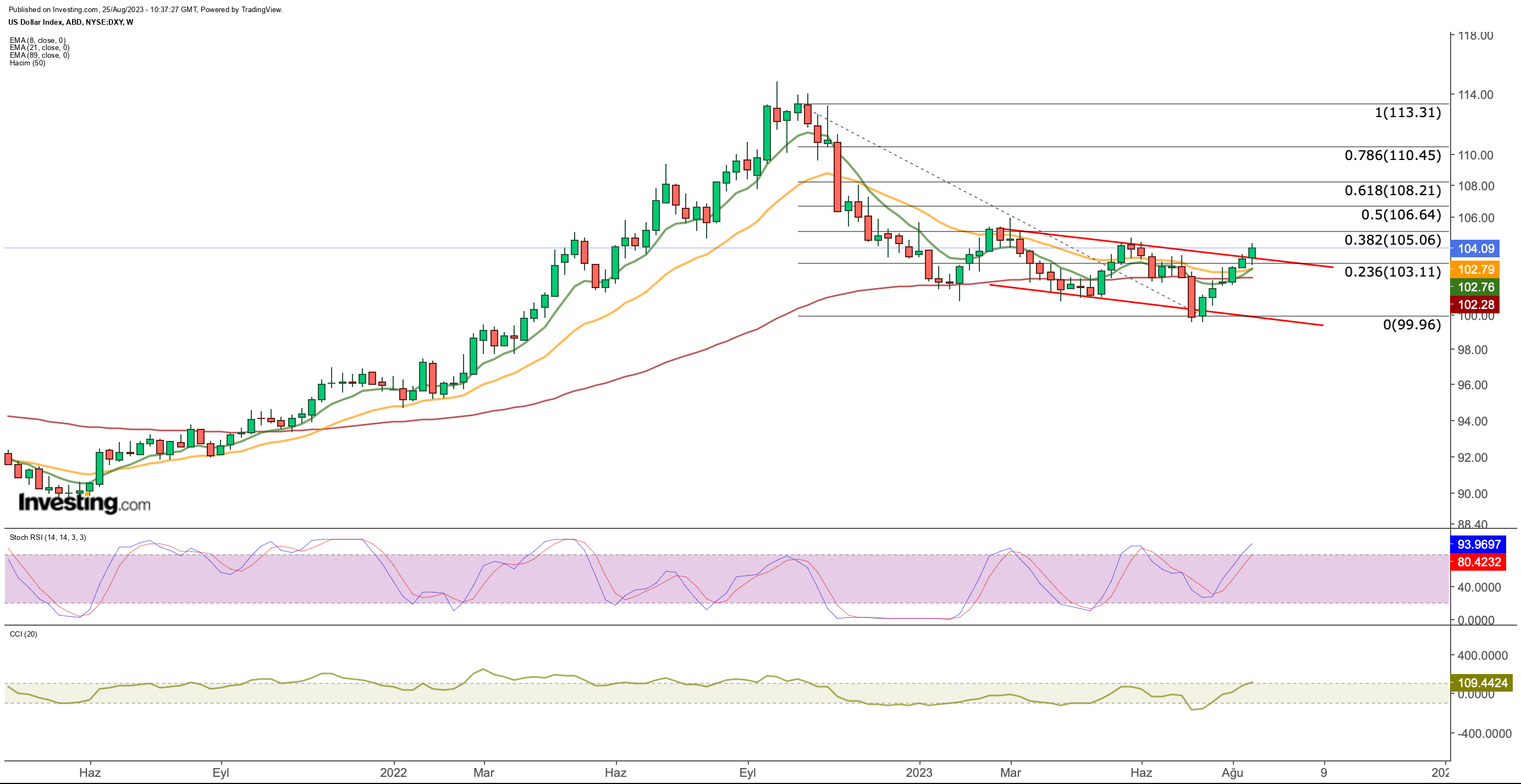

Greenback Index Technical Image

All through the week, the DXY (Greenback Index) primarily traded inside a good vary of 103.3 to 103.5. Nevertheless, this vary was damaged yesterday because the DXY surged into the 104 territory.

This motion, pushed by an uptick in demand for the greenback, is advancing towards the height noticed in Could. Notably, the index seems poised to breach the descending channel.

Contemplating the downtrend of the DXY that has been in place since October 2022, there stays a sound chance, from a technical perspective, for an uptrend in direction of the 108 stage, which is located above the Fib 0.382 worth at 105.

A number of technical elements help this potential rise. The DXY has been utilizing the 8-day Exponential Shifting Common (EMA) as dynamic help, and each the 8-day and 21-day EMA values have crossed above the 3-month EMA worth over the previous few months. This mix of shifting averages means that the greenback’s energy may persist.

Moreover, a big issue influencing the present bullish outlook is the approaching by Federal Reserve (Fed) President Powell at at this time’s occasion. The upward motion of the DXY might be interpreted as traders pricing in a hawkish stance from Powell.

Nevertheless, if Powell’s assertion signifies a dedication to tackling inflation and emphasizes the significance of knowledge in upcoming intervals, it may doubtlessly set off a reversal within the greenback.

EUR/USD

Regardless of repeated makes an attempt all through the week, the pair was unable to interrupt free from its short-term downtrend. Finally, the pair succumbed to the mixed stress of constructive knowledge in regards to the US economic system and Powell’s speech. Because of this, EUR/USD dropped beneath the essential 1.08 threshold.

The importance of this weekly closure beneath the vital level can’t be understated. This level aligns with the Fib 0.786 stage within the corrective motion that corresponds to the rise noticed from Could to July. The breach of this stage has the potential to disrupt the pair’s momentum throughout the year-long uptrend it had skilled.

From a technical standpoint, a breach beneath the $1.08 stage may doubtlessly result in a corrective transfer in direction of the Could help at $1.06. Ought to the pair descend additional beneath this level, the downward momentum may persist, doubtlessly extending the decline into the vary of 1.03 to 1.05.

The potential of a pattern reversal seems to hinge on the tone of Powell’s speech, with a extra dovish stance presumably prompting this shift. Such a dovish stance may function a basis for EUR/USD to anchor across the $1.08 help, doubtlessly permitting the pair to stay within the present channel.

USD/JPY

The pair has been lingering close to its highest level of 2023 for the previous week. Apparently, the greenback’s strengthening in opposition to the yen appears to have stopped across the 146 mark.

What provides significance to this case is that these present ranges align with these the place the Financial institution of Japan (BoJ) beforehand intervened within the USD/JPY change charge again in September of the prior 12 months. It is comprehensible that traders are approaching this juncture with warning, which clarifies the presence of resistance on the 146 stage.

Amid ongoing market hypothesis relating to the potential intervention by the Financial institution of Japan (BoJ) within the USD/JPY, the central financial institution has chosen to keep up its silence. Market analysts concur {that a} additional strengthening of the greenback in opposition to the yen wouldn’t bode effectively for Japan’s economic system.

Whereas Japan has intentionally abstained from elevating rates of interest to safeguard its economic system, the persistently weak yen nonetheless exerts a damaging impression on imports.

Though no definitive motion has been taken by Japanese authorities up to now, the tempo of the USD/JPY pair’s ascent main as much as the upcoming financial coverage assembly in September may immediate the BoJ to contemplate a sudden intervention.

Ought to such intervention happen, it is notable that the pivotal juncture stays on the 146 yen stage. Ought to the pair surpass this stage, there is a potential for USD/JPY to progress in direction of the 150 vary, which constitutes the higher boundary of its established buying and selling channel.

Within the occasion of potential intervention, it is believable to witness USD/JPY breaching the decrease channel restrict, subsequently shifting towards the 130 stage.

USD/TRY

The forex pair skilled a big decline following the Central Financial institution of the Republic of Turkey’s (CBRT) choice to lift the coverage charge to 25%, surpassing market expectations.

In a speedy transfer, USD/TRY plummeted by over 5% to succeed in 25.28 yesterday, retracing again to cost ranges noticed in June. It is value noting that the CBRT had initially taken a tightening stance in June once they raised the coverage charge to fifteen%.

This transfer marked the primary rate of interest hike in a span of twenty-two months. Nevertheless, the speed improve fell in need of the anticipated 21% stage.

This divergence from the market’s expectations in June relating to the coverage charge had penalties. Particularly, the Turkish lira continued to lose worth in opposition to the US greenback, resulting in a notable surge within the USD/TRY pair’s worth from 23.5 to 26.

Although the speed hike in July additionally did not meet expectations, the communication relating to a tightened coverage and the central financial institution’s stance in direction of attaining the year-end inflation goal of 58% contributed to sustaining the US greenback at a mean of 27 Turkish Lira (TRY).

The latest rate of interest adjustment, coupled with the assertive dedication to an inflation-focused strategy within the choice assertion, proved efficient. This has led the market to contemplate the Turkish lira as a doubtlessly enticing choice for yield, making it a candidate for carry commerce methods. This shift may doubtlessly reverse the extended depreciation pattern of the Turkish lira.

Anticipating the Central Financial institution of the Republic of Turkey’s (CBRT) continued rate of interest hikes within the upcoming intervals appears possible, and such strikes may function efficient instruments within the ongoing battle in opposition to inflation.

From a technical perspective, if a corrective motion initiates from present ranges, it is believable that USD/TRY may retrace to the vary of 19 to 21 TRY. On this course of, the primary line of help is anticipated round 23.2 TRY.

***

Discover All of the Data you Want on InvestingPro!

Disclaimer: The writer doesn’t personal any of those shares. This content material, which is ready for purely instructional functions, can’t be thought of as funding recommendation.

[ad_2]

Source link