[ad_1]

TERADAT SANTIVIVUT

Report QT and large charge hikes no downside: Company Bond Market Misery Index drops to lowest stage since earlier than the Fed began tightening.

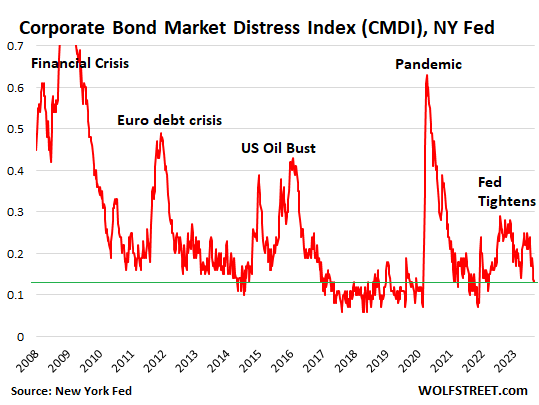

The New York Fed’s replace on Wednesday of its weekly Company Bond Market Misery Index (CMDI) exhibits simply how a lot liquidity there may be nonetheless sloshing round from years of mega QE, and the way yield-chasing has resurged this 12 months, regardless of the Fed’s mountaineering its coverage charges to the very best ranges in 22 years and regardless of the largest QT ever.

This index of misery within the company bond market, after spiking early within the tightening cycle, fell to 0.13 over the previous two weeks, the bottom stage since earlier than this tightening cycle started:

“The index identifies as ‘misery’ durations throughout which numerous particular person measures of market functioning point out deteriorating circumstances in each the first and the secondary markets for company bonds,” the New York Fed says.

“Company bond market functioning seems wholesome. The tip-of-month market-level CMDI is under its historic twentieth percentile,” the New York Fed says.

“Market functioning in each the high-yield and investment-grade sectors improved throughout the course of August,” the New York Fed says.

In different phrases, after some preliminary wavering, the company bond market has simply adjusted to the a lot tighter financial insurance policies and returned to la-la-land.

One purpose to trace misery is to see how far the Fed can go together with its tightening earlier than it does some actual harm to the company bond market. And the index exhibits that in comparison with the opposite moments of injury – even the lesser ones of the Euro debt disaster and the US Oil Bust – there hasn’t been any harm. The index is now again in its historic consolation zone.

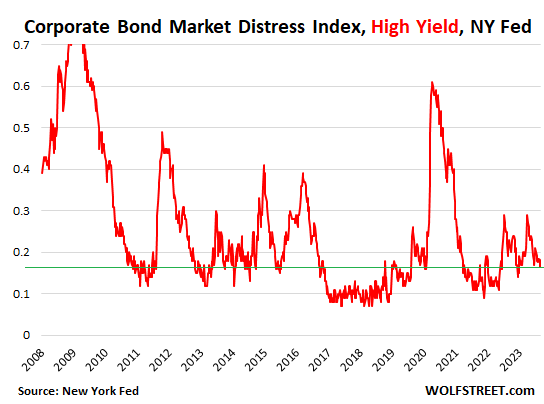

Even the junk bond market stays in its consolation zone. The New York Fed additionally offers the sub-indices for misery within the funding grade phase and within the junk-rated (excessive yield) phase of the company bond market.

The Excessive Yield CMDI tracks junk bonds which can be rated BB+ and under however above CCC/C, so not together with the low finish of the junk bond market (right here is my desk of company bond credit score rankings by rankings company).

This Excessive Yield CMDI fell to 0.16 this at present, and after the 2 temporary spikes has returned to its consolation zone:

To cope with the worst inflation in 40 years, the Fed has tried to “tighten” monetary circumstances with charge hikes and QT. Tighter monetary circumstances would make borrowing for firms and shoppers tougher to get and costlier, and would create a little bit extra misery amongst debtors, particularly these with weaker credit score, comparable to junk-rated firms, and would subsequently cut back funding and demand within the financial system and thereby take away some inflationary pressures. So the speculation goes.

Throughout this tightening cycle, the New York Fed got here up with the CMDI to trace the consequences of this tightening on the company bond market. It enhances an entire slew of indices trying to measure monetary stress, however is particularly addressing misery within the company bond market.

And at first, the consequences have been as promised: In late 2021, when the Fed began speaking about tapering, charge hikes, and QT, monetary misery within the company bond market started to rise from traditionally low ranges, in anticipation of what would possibly come.

By November 2022, with charge hikes and QT in full swing, the CMDI had risen to 0.28, the very best stage since November 2020, when it was coming down from the lockdown shock.

However since then, it has wobbled decrease, exhibiting that there’s now much less misery within the company bond market than earlier than the Fed even began tightening.

The CMDI contains major market measures from the Mergent Mounted Earnings Securities Database (FISD), comparable to issuance volumes, major market pricing, and issuer traits.

It contains secondary market measures, comparable to buying and selling knowledge from TRACE, and measures that mirror central tendencies and different elements of the distributions, of quantity, liquidity, nontraded bonds, spreads, and default-adjusted spreads. And it contains quoted costs from ICE Financial institution of America to trace the differential secondary market circumstances for traded and non-traded bonds.

Unique Publish

Editor’s Word: The abstract bullets for this text have been chosen by Looking for Alpha editors.

[ad_2]

Source link